Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

I'm going to tell you a story in reverse. We'll start with the conclusion, then see how we got there.

The conclusion:

I met one of my favorite writers, Morgan Housel, last week at Collaborative Fund's office in New York City. Meeting other writers is cool. Meeting the guy who wrote the best-selling finance book of the last two years is really cool. Chatting with the guy who wrote the best-selling finance book of the last two years about a dozen things, many of which had nothing at all to do with neither writing nor finance is really, really cool.

If you asked me, "How did y'all meet?" I would say that we connected on Twitter and decided to link up when Morgan was in NYC. But that's not really the truth. Not the whole truth, anyway. The truth is this meeting never should have happened. The circumstances that led to our meeting were largely a fluke.

Now for the "how we arrived here" part. Stick with me.

April 2019

In 2019, my senior year of college, several top business schools offered deferred enrollment options for their full-time MBA programs. In the normal business school cycle, prospective students would work ~2+ years before applying to business school. This deferred enrollment option rearranged the process: you could now apply as a college senior, and, if accepted, you would then work 2-5 years before starting graduate school.

I love my alma mater, Mercer University, but a degree from a decent regional university in Georgia wasn't going to wow any top-tier employers. An MBA from Columbia, Harvard, or Booth (Chicago's business school) would.

As a 22 year-old who had no idea what he wanted to do with his life, pursuing an MBA from a top-10 program seemed like a no-brainer step to improve my career prospects.

So I studied for the GMAT for months, I applied to the seven best business schools that offered these deferred enrollment programs, and I landed interviews with Booth and Columbia.

After researching the two schools, Booth was my preferred choice. The campus was beautiful, the school was ranked higher at the time, Chicago seemed like a fun town, and I was dating a girl from Milwaukee (only a 1:30 drive from Chicago) who wanted to move home at some point. A lot of variables aligned, and, assuming I was accepted, Booth was a no brainer. So in April, I flew to Chicago for my interview.

Visiting Booth School of Business, April 2019. Not a huge fan of the tie.

My interview went well, except for one small road bump: I was the only applicant in my class who didn't yet have a full-time job lined up after graduation.

While I was graduating in May, I had decided to return to Mercer to play one last season of football the next fall. This wouldn't have been a huge deal, except these deferred enrollment programs required December graduates to apply the following spring (in this case, May 2020).

As a spring 2019 grad that would still be taking classes in fall 2019, I was in a weird position, and I was worried that Booth would cancel my application and make me reapply the following year if they knew I was staying at Mercer for one more semester. I wanted to go ahead and secure a grad school seat now, so I kept my fall plans a secret in my interview.

I did have a finance internship with GEICO that summer, so when future plans came up in my interview, I discussed my internship and explained that it would lead to a full-time offer at the conclusion of the summer.

Conflict avoided, or so I thought.

Two weeks later, I flew to New York to interview at Columbia. I was planning to tell the same story to disguise my actual fall 2019 plans, until I checked my email when my flight touched down at JFK.

"Dear Jack Raines, this year's class of Booth Scholars was very competitive, and unfortunately you were not accepted in the 2019 cohort. We hope Booth stays on the forefront of your mind, and you consider reapplying in the future."

My dreams of using a top MBA program to catapult me from a probable career in mid-tier corporate finance to the aristocracy of investment banking and MBB management consulting were collapsing before my eyes.

"Shit," I thought. "What if I don't get into Columbia either? Do I need to change my story? I only have 24 hours til my interview."

In my taxi to the hotel, I realized where I screwed up.

My only edge as a candidate was my student-athlete story: a walk-on defensive end that earned a scholarship and became a team captain and starter his senior year. By disguising my plans for Fall 2019, I forfeited my edge and virtually guaranteed a rejection letter.

Being honest in my Booth interview certainly wouldn't have cemented my admission; it was a competitive class after all. I may have still lost out to the other candidates, and the school could have made me reapply in 2020. Who knows.

But when 200 kids have the same GMAT scores and academic backgrounds, the candidate who is doing a summer internship with an insurance company is going to lose out to the dozens of others fielding full-time offers from McKinsey, Bain, and Goldman unless he has an edge.

So when the Columbia admissions officer asked about my plans, I told the truth.

"I'm in a unique spot where I'm graduating this semester, but I have the opportunity to play football again next fall. I joined the team as a walk-on, and after suffering a concussion, multiple torn ligaments, and a fractured hip, I'm finally going to be a starter and a team captain. This has been a goal of mine since I was a freshman in high school, and I have to see it through. I know this doesn't fit the traditional timeline for this program, but I hope the admissions committee will still consider my application."

Two weeks later, I received the following email:

"Congratulations! We are excited to welcome you to Columbia Business School!"

March 2020

After finishing school in December and landing a job in February, I spent five days working on a corporate finance team in UPS's Atlanta office before the pandemic sentenced everyone to an indefinite purgatory of laboring remotely from our homes. Like pretty much everyone else now confined to their apartments, I got bored. When I got bored, I started trading stocks. Why not, right? The most volatile market in history, and I didn't have anything else to do.

March 2021

This whole trading stocks thing worked: one year later I was up 6,000% and had made approximately $400,000. I had gotten pretty good trading SPACs, and I was wondering if someone would pay me to write about them.

I googled "how to make money writing about stocks" and saw that Seeking Alpha would pay $100 - $150 per premium article, so I made an account and started writing. I could put together a good piece in 2-3 hours that needed minimal revisions. Not a bad gig to make extra drinking money on the weekends.

July 2021

My company wanted me back in the office soon, but I wanted to travel for a year before moving to New York for business school. These two choices were at odds with each other, so I put in my two weeks notice and bought a one-way ticket to Barcelona. However, I wanted to make some money while I was abroad. How did I plan to do that?

Writing.

My total writing "experience" was 15 or so pieces on Seeking Alpha and a couple of chapters for this book idea of mine, The Inefficient Market Hypothesis. So I applied to a number of remote writing roles, from staff writer at Morning Brew to a part-time gig at Collaborative Fund where, you guessed it, Morgan Housel worked.

Worried that my resume would get overlooked, I decided to bypass the regular application portal by sending examples of my work directly to Housel, Morning Brew's CEO Austin Rief, and others who worked at companies where I had applied.

A few weeks had passed, and I wasn't getting any offers. I was caught in the classic chicken or egg dilemma: you need writing experience to get a writing job, but how do you get writing experience without having a writing job?

Around this time, I noticed that a lot of people were publishing their own blogs/newsletters on a site called Substack.

So I thought to myself, "Screw it, I'll just start a blog, write a couple of times a week for a few months, and then reapply once I have a bigger portfolio of work. I made a Substack called Young Money (only God knows where that name came from), I started writing away.

August 2021

A couple of weeks before flying to Barcelona, I saw that the popular meme page "Litquidity" had a newsletter, Exec Sum, which had ~100,000 readers.

I sensed opportunity!

I messaged Litquidity on Twitter and said, "Yo, I like your content and your newsletter. I want to help with Exec Sum. Let me know if you're interested. I write a finance blog called "Young Money" if you want to check out some of my stuff."

November 2021

Litquidity hired me, and I became the editor (?) of his newsletter (a role I still hold). Through this gig, I learned how the economics of the newsletter biz work, and I saw that if you have a big, engaged audience, you can make a lot of money through sponsored advertisements.

And then I thought to myself, "Maybe this blog shouldn't be a stepping stone to get a job. Maybe this blog can be the job."

All I needed was a big audience, right?

December 2021

I was still planning to start business school next fall, and I had to email Columbia with an employment update by December 5th in order to start school the following August. One stipulation for students in the deferred enrollment cohort is that we needed 2-5 years of relevant pre-MBA experience, and we had to inform Columbia of our experience when we submitted our intention to matriculate.

Thanks to my extra semester playing football in 2019 and my decision to quit my job in August to travel, I had only worked 18 months. Meanwhile, hostel hopping in Europe while writing a blog and sort-of working for a finance meme page's newsletter wasn't exactly "relevant pre-MBA experience".

So I was ~6 months shy of hitting that 2-5 year relevant experience requirement (depending on what you call relevant experience) when I submitted my information. I didn't think much about this issue until two weeks later, when I received a phone call before dinner while I was in Sevilla, Spain.

*ring ring*

"Is this Jack Raines?"

"Yes?"

"This is ______ from Columbia Business School, we had some concerns with your.... experience."

What ensued was a 45 minute conversation that consisted of Columbia saying I needed more *relevant* experience, and me saying that what I was doing now was most definitely more *relevant* than staring at spreadsheets and moving my mouse to appear online like I had done for the last 18 months.

And let's be real, pretty much anyone working fully remote was doing the same thing.

The call ended with Columbia saying I probably needed another year of "relevant experience" before I could start, but they were willing to hear out my one request: an opportunity to send them an email clearly outlining how and why my current situation was, in fact, very relevant to my MBA journey and post-MBA goals.

Considering that business school in Fall 2022 was an integral part of my life plan and I had made $0 from writing at this point, I really, really needed to start at Columbia in the fall.

And boy oh boy that email I sent CBS admissions was, without a doubt, the finest 2500 words that I have ever written. The result:

It worked. Shout out to the admissions committee for reconsidering my application.

May 2022

I came back to the States from Europe in December, then headed to Argentina for a few months. Young Money had grown big enough that it was generating revenue through ads, and everything with Litquidity was going swimmingly. I had sorta, kinda turned a blog into a business.

Not only was I getting more readers, I was building a network of writers, operators, investors, and other interesting folks through my blog.

And I was still having a blast traveling. Exploring Europe and South America. Visiting friends from DC to Austin. And this thought crept up in my mind, "Do I even need business school?"

I mean, yeah, I had already gotten in. But the initial plan was travel for a year, then get my MBA, the work in consulting or IB or whatever. And I didn't want to do the latter anymore. I just wanted to write, and write, and write. And I had figured out how to make money writing.

I could write from a beachside shack in Australia, a hostel in Thailand, and an Airbnb in Amsterdam. Did I really want to jettison myself to one location for two years?

But I also knew that moving to New York was the right move from both a professional and personal standpoint. An MBA from Columbia would establish more credibility, especially with people who aren't so internet savvy, and business school would provide a friend group of 100s of folks around my age doing super interesting stuff. Moving to New York was a no brainer, but I was dangerously close to saying "screw it" and continuing the nomadic lifestyle.

After weighing my options for a month, I decided to go back to school.

October 2022

Which brings us to present day, where I met my favorite writer in New York City last week.

You're probably wondering, “So what was the point of this ridiculously long monologue about the last two years of your life?"

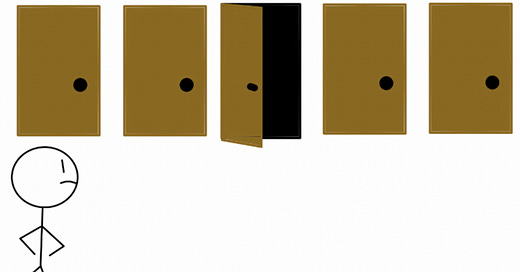

It illustrates an important, but oft-overlooked concept: There were a million small, seemingly inconsequential steps over the last two years that, had they gone differently, would have prevented this meeting from ever occurring.

If I never apply to business school, or if I get accepted to Booth, or if I get rejected by Columbia as well, or if Columbia doesn't let me matriculate this fall, or if I decide I don't need business school, I don't move to New York this fall. If I don't move to New York this fall, I don't meet Morgan.

If Covid doesn't happen, I don't work remote. If I don't work remote, I don't start trading stocks. If I don't start trading stocks, I don't start writing about stocks. If I don't start writing about stocks, I don't apply for writing jobs. If someone hires me for a writing job, I don't have a blog. If I don't have a blog, I never connect with Litquidity. If I don't connect with Litquidity, I don't double down on the blog. If I don't double down on the blog, I don't meet Morgan.

When we look back on the past, the paths to our current realities seem so obvious. We can easily trace the steps that led from where we were to where we are today.

But we rarely think about the worlds that didn't happen, because we can't see them. The thing is, our reality of things that did happen doesn't exist in a vacuum. The stuff that did happen, the paths that did come true, they weren't preordained. All of the stuff that didn't happen played an important role in shaping the things that did.

Change one thing in the past, and the present is unrecognizable.

There are different alternate realities where I'm in business school in Chicago, or living in Charleston/Austin/DC with friends, or writing a blog from some hostel in Thailand. There's a world where this blog never happens, and I'm prepping for IB and consulting interviews in New York right now.

And this applies to much more than two writers grabbing coffee together on a Tuesday in Manhattan.

Between the peak of the Dot Com bubble and December 2000, Apple's stock fell ~82%, from a split-adjusted $1.20 to $0.21. Fast forward 20+ years and Apple is now up more than 100x from its Dot Com peak, and ~600x from its bottom.

Many investors use Apple's performance as an example of why you should adopt a long-term mindset.

"You have to tolerate the declines to earn the rewards."

But what if one action, one decision, one seemingly inconsequential thing goes differently? What if Apple doesn't release the iPod in 2001, or the iPhone in 2007? The company likely never recovers, or it may go bust in the Great Financial Crisis.

Let's go back another 10 years. What if Steve Jobs never came back in the 90s, or what if Microsoft didn't invest $150M in a cash-poor Apple to cool down anti-trust whispers from the government? Apple doesn't exist today.

Amazon is another company that faced a steep decline after the Dot Com crash before rebounding to become one of the world's most valuable companies. But the Ecommerce giant only exists today because they raised $672M in convertible bonds mere weeks before the market crashed. If they had waited even a month, Amazon likely faces insolvency, and Jeff Bezos is probably working for a hedge fund in 2022.

Every single success story is the sum of thousands of things that didn't happen. The avoidance of an infinite number of realities that would have ended in failure.

Picking stocks is hard because you are inherently betting on future variables that haven't yet materialized. For you to succeed, you have to be right about future events that don't yet exist, future decisions that haven't yet been made, and future innovations that have not yet been discovered.

It's easy to look back now and think, "Obviously I should have invested in Apple 20 years ago." But 20 years ago, it was anything but obvious.

In 2000, you had no way of knowing the iPod and iPhone were going to exist, let alone revolutionize the world. Amazon Web Services and Prime were barely ideas, and the Ecommerce site was still focused on physical books. Did you really want to invest in a dying computer manufacturer and an online bookstore while the tech market was imploding in 2000? Did you really wanna to put your chips in *that* basket?

A better interview in Chicago in April 2019, and my meeting with Morgan never happens. A slower fundraise in 2000, and Amazon is another Dot Com fatality. A less charitable Bill Gates in the 90s, and the iPhone never exists.

Every single thing that looks obvious in hindsight was one roll of the dice away from never happening at all.

- Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!

Jack's Picks

After facing a 78% drawdown from her fund's peak, Ark Invest's Cathie Wood penned a public letter to the Federal Reserve asking them to stop raising interest rates. No, this isn't satire. This actually happened. Check it out here.

The New York Times had a great piece on all of the issues with California's failed bullet train project. Check it out here.