Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

Peter Lynch is one of the greatest fund managers in history. Known for owning thousands of stocks at once, Lynch ran Fidelity's Magellan Fund from 1977 to 1990. In that time frame, he averaged an astounding 29.2% return per year, more than double the S&P 500. Lynch only underperformed the S&P for two years during his tenure.

Given his performance, you would think that investors in his fund made a killing.

But they didn't. In fact, Lynch estimates that the average Magellan investor made only 7% a year, seriously underperforming the S&P 500 during that time. How is that possible?

Because timing is everything.

No one was interested in Lynch's Magellan Fund when it was performing poorly, but Magellan was the hottest fund on Wall Street after it crushed the S&P for a few years. This led to investors selling or avoiding the fund during periods of underperformance, while they piled in after it had outperformed for an extended period.

Buy high, sell low appeared to be the norm.

In hindsight, it seems absurd that investors would repeatedly make these ill-timed decisions, but this cycle has played out for centuries in markets. It is still happening right now, as you read this.

Let's dive in.

Cathie's ARKK

Ark Invest CEO Cathie Wood has been one of the hottest names in finance in the 2020s. Over the last five years, her flagship fund, ARKK, has averaged 26.7% returns. Those are incredible numbers, nearly doubling the S&P's 14.8%. Cathie even outperformed the tech-heavy QQQ, which averaged 24.0% during that time frame.

No one outperforms forever though, and different investing styles periodically go out of fashion. We call these shifts in market favorability "cycles". When a stock, sector, or fund is down bad, we think it's gone for good. No one wants to buy something that is crashing. When a stock, sector, or fund is up big, we get overconfident. We're making bank.

Between 2014 and 2019, few people had heard of ARKK. But something changed in 2020: Tesla went nuts. And guess who had a massive position in Tesla? Cathie Wood's ARKK. As the market rebounded from the covid crash, growth stocks as a whole exploded. Many 5x'd and even 10x'd from their lows.

And guess who had massive stakes in many of these growth stocks?

Cathie Wood's ARKK. So Cathie starts getting more TV time because her funds are doing so well. And suddenly everyone is talking about S-curves, technology shifts, EVs, AI, genomics, and the hottest ETF in the world: ARKK.

Now that everyone and their mother is talking about ARKK, billions of dollars flood in the ETF. By the end of January 2021, the 30 day trailing inflows were $4B!!! Tesla and Roku and Square and every other tech stock that you could think of were up 500%+ from their covid lows. EVs were taking over, value investing was dead, and you could never pay too much for cutting edge technology.

Everyone wanted to board Cathie's ARKK.

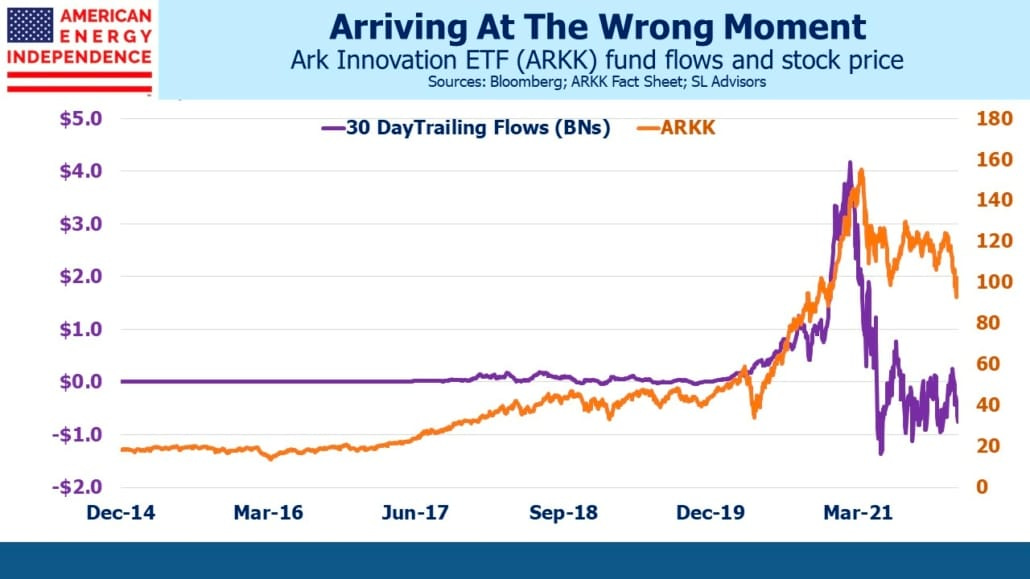

Until the market shifted. The graph below from SL Advisors shows ARKK's inflows relative to ARKK's price. This is 30 day trailing flows, so real-time flows likely peaked at the same time as ARKK's price.

As you can see, most of the money came in after ARKK had nearly tripled in price. What was the result of these massive inflows at peak valuations? Most investors in ARKK have lost money, even though the ETF has outperformed both the NASDAQ and S&P over the last five years.

Right now, the cumulative P&L for ARKK investors is negative, despite the ETF being up 220% in the last five years. No one had heard of ARKK until Tesla and tech stocks began taking off. The performance of these stocks in 2020 appeared to validate ARKK's analysis, and capital inflows 10x'd as a result.

But this was the worst possible time to buy, as valuations were stretched further than any point in ARKK's history. Valuations were insane. ARKK had large positions in several small-cap stocks that would be difficult to unwind without tanking prices. And half of these companies weren't even making money.

To quote myself:

When valuations are sky-high, execution has to be perfect for you to breakeven. And if growth slows down at all? Have fun staying poor. When valuations are at rock-bottom, every little thing that goes right can make you money.

Jack Raines

The riskiest time to invest was after ARKK had proven itself to be a winner in 2020.

Yet that's what most investors did. We tend to make proactive moves at reactive times, to our own detriment. More on this idea later.

The Jim Cramer Effect

One of my favorite themes on FinTwit (Finance Twitter) lately has been the collective decision to fade literally every single one of Jim Cramer's recommendations. Someone made an anonymous Twitter account that tracks stocks' performances after Cramer recommends them, and it is freaking hysterical.

Scroll through that account when you have some free time. It is a goldmine. So what gives? Cramer is an entertainer first and investor second. He is trying to sell views for CNBC, not outperform the market. In a piece that I wrote two weeks ago, Volatile Times, I used a graphic to demonstrate how information moves through financial markets these days.

As you can see, television is the final frontier. By the time Cramer is talking about anything, it has already been absorbed by all other market participants. If it seems like Cramer is bullish on stuff that already went up, or bearish on stuff that already went down, it's because he is. That is a feature, not a flaw. On the information train, Cramer, and everyone else in "mainstream financial media", is the information caboose.

But these information cabooses amplify the effect of heavy buying and selling at inopportune times. Because they give Cathie Wood air time once ARKK is up 300%. They let Bill Ackman cry on TV and say "Hell is coming" the week that markets bottomed in 2020. They talk about a 0 revenue electric pickup truck start up going public at $100B valuation.

And this is the first time that a lot of their audiences are hearing about ARKK. Or the market crash. Or Rivian.

Not knowing any better, the audiences then buy the top of tech, sell the bottom of indexes, and back up the electric pick up truck for Rivian shares.

In summary:

A stock increases 100%

Early investors make bank

Mainstream media picks up on the story after the big move

Mainstream media covers the stock as if the move hasn't happened yet

Media audiences buys at the worst possible time

Audience gets dumped on after piling it at the peak

This happens over and over and over again.

Bad Fortune Cookies

The Dunning-Kruger effect states that we tend to overestimate our skills and abilities. Nowhere is this more obvious than financial markets. Market participants who hit it big one time often believe that they are superior investors to the field, leading to them underperforming later.

Hayman Capital's Kyle Bass is famous for making 212% in 2007 thanks to a well-timed short bet on the US mortgage crisis. But his success on one black swan bet led to him looking for black swans everywhere, most of which never came true.

From 2008 to 2015, Bass averaged a modest 1.56% while the S&P 500 ripped into a decade-long bull market. Investors who make their names shorting disasters rarely do well in sustained bull markets.

In July 2020, Cathie Wood made a bold claim that oil was headed back to $12 a barrel.

Sure, EVs are the future of the auto market. But what has happened to the price of oil since that tweet?

It has more than doubled. For those wondering, ARKK is down close to 10% since that tweet.

But Cathie made billions betting on Tesla and the EV revolution. There's no way she was going to flip her opinion on oil.

Cathie's picks were home runs 2020. But it was unlikely that her portfolio companies would continue to produce outsized returns after their 500% melt ups. However, her home run bets gave Ark confidence in their assessments. Billions of dollars in fresh inflows confirmed that market participants supported her ideas. And all of these factors created one powerful confirmation bias cocktail.

So all of this money flows in at the top, because Cathie is a genius. ARKK doubles down on their ideas after most of the easy money has been made, because, again, they were geniuses. Then markets shift. Everyone who bought the top got wrecked.

Being really right is a double-edged sword, because it makes you even more confident in your abilities. And you are inclined to lean even harder into your current beliefs. But markets are dynamic, and strategies that outperform today will likely underperform at some point down the road. At the end of the day, Valuation Matters.

Was Cathie a genius investor who foresaw a tech shift, or did she happen to be in the right place at the right time during a high-beta bull market after the covid crash?

The truth is probably somewhere in the middle.

Proactive Steps at Reactive Times

It seems obvious: buy low, sell high. But our behavior shows that we keep doing the opposite, over and over again. Why? Because volatile moves are accompanied by powerful stories.

Price always drives narrative, at first anyway. As Peloton skyrocketed, it was obviously the next $100B company. Cult-like following. Brand appeal similar to Apple and Tesla. Growing like crazy. The fundamentals were just good enough to support the story.

As long as it kept growing. But then *shocker* people returned to gyms. Demand for at-home fitness dropped, and Peloton's growth slowed.

Suddenly, the "next Apple" became a future 0. Of course Peloton would crash! They just taped an iPad to a bike! It was so obvious! What a fraudulent company!

Oh it was so obvious? Then why did it get so expensive in the first place? Why did so few people make money shorting it? Because good stories are powerful tailwinds until they aren't.

The entire way up, critics grew louder and louder. "Growth isn't sustainable." "At-home fitness is a covid fad." "Valuation is too high." But it didn't matter. The story of the at-home fitness revolution overpowered any possible criticism.

Meanwhile, neutral investors on the sideline wanted to take a position, but they thought it was too risky. Because of the bear arguments. But the price kept ticking up. And the FOMO grew stronger and stronger.

"Am I too late to get in?" "I should have bought a month ago." "I'll buy on the pullback."

That pullback never comes, the bears grow exhausted, and the only argument left is that Peloton is obviously the next $100B company. Cult-like following. Brand appeal similar to Apple and Tesla. Growing like crazy. The fundamentals were just good enough to support the story.

Finally these neutral investors take a position at $100+ per share. But the positive returns had already happened, and now this unprofitable company with covid tailwinds is trading at a dangerous price/sales multiple.

This brings me back to a point that I mentioned earlier: These investors made a proactive move at a reactive time.

Here are some other proactive moves at reactive times:

ARKK received billions of inflows at its peak, after a 300%+ melt up

Over half of all Bitcoin investors made there first BTC purchase in the last 12 months, after it became a $1T asset

Thousands of investors sold their stocks after the quickest 30%+ drawdown in history

See, the right move would have been to buy Peloton early. Or sell/avoid the stock after it 5x'd and the world was opening back up. But most investors took the sustained price increase as a nod of confidence that it was safe to invest. The time that feels safest, when everyone is positive that Peloton is a great stock, is when you should proceed with caution. Most of the easy money has been made, and any execution issues could crush the stock.

Then earnings slowed, and the stock crashed. Finally, all of the critics are right. But they got too exhausted on the way up to make money shorting on the way down. And those neutral buyers who purchased shares at $100+? Well they are in denial. Because Peloton is the next $100B company after all.

So what happens next? Eventually the bulls will grow exhausted and sell for a massive loss. Another proactive move at a reactive time. Next, Peloton probably reaccelerates its growth and fixes its margins, and the stock rebounds.

Stories are loudest at the top and bottom. "See, obviously I was right, the stock 10x'd!" or "See, obviously I was right, the stock is down 80%!"

These stories can stick around a lot longer than you would expect. Investors actually thought 80x sales for tech companies was fair, because it worked for two years. EV companies were trading at 100x multiples to their traditional auto counterparts because Tesla, duh. Value stocks were dead, because tech is the future. And everyone who missed the biggest part of the move buys into these stories at the worst possible time.

Cathie saying "oil is dead" was actually a great buying opportunity for oil. But most investors followed her into tech land. Because she had just made 100%, while oil was down 45%.

And now? In the middle of an EV and tech revolution? ExxonMobile has outperformed pretty much any other large cap stock.

Oil was dead, until it wasn't. EV stocks could only go up, until they didn't. The time to take caution is when a narrative goes mainstream, but we rarely do that. If we did, that narrative wouldn't be mainstream in the first place.

If everyone knew to buy the dip, there would be no dip. If everyone knew a stock had topped, they would sell and it would never reach that peak. Investing sounds easy in theory, but it is so damn hard in real time. Stocks make wild moves when stories overpower fundamentals, but the stories are so good that we never notice until after the fact.

In five years, will the recent Meta dip look like a generational buy? Or will it look like the worst falling knife of 2022? I have no idea.

All I know is that 95% of people will miss the move, most will buy the highs or sell the lows, and it will look all too obvious in hindsight.

Happy Monday, let's go lose some money.

- Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!