Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

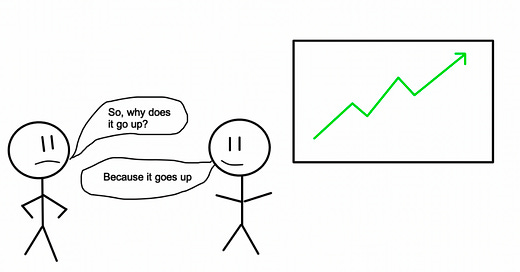

Most of the strongest-held beliefs in the world of finance have the same origin story, and that story goes something like this:

Something happens once, and few people notice. Then it happens again, garnering more witnesses. Once it happens a third time, a pattern emerges, and observers expect it to happen a fourth time. By the fifth, sixth, and seventh iterations, researchers begin studying this pattern, hoping to predict future occurrences. By the 10th iteration, everyone agrees that the trend is bound to continue.

A few examples of these beliefs:

“You should invest early and often in the S&P 500” (because the market has, on average, increased by 10% per year over the last century).

“Bonds are far less risky than equities” (because historically, bonds have been far less volatile, and they provide fixed interest payments).

“Treasuries are risk-free” (because they’re backed by the US government).

“Buying a home is a guaranteed path to building wealth over time” (because home prices have gradually climbed for decades).

“Becoming a software engineer/lawyer/doctor is a low-risk path to becoming rich” (because this was true for the last generation and the generation before that).

The list goes on and on.

The longer that one of these ideas remains true, the more that we believe it will continue to remain true. And if an idea persists long enough, we treat it as a law, and we begin to make decisions based on these laws. But it’s important to remember that these “laws” are only underpinned by two things: observations of patterns and assumptions that these patterns will continue. Dependence on these assumptions can be dangerous.

Take the idea that “treasuries are risk-free.”

Investors can purchase T-Bills and treasury notes with different maturities, such as 3 months, 1 year, 10 years, etc. These treasuries make fixed interest payments, and their default risk is essentially 0 due to their backing by the US government.

And yet, Silicon Valley Bank went bust by investing in “risk-free” treasuries.

SVB made its name by working with startups that were overlooked by other lenders, and this client base proved to be quite fruitful as the venture-backed startup market exploded in the 2010s. By 2021, SVB held billions of dollars in deposits from well-funded startups, and they wanted to put those deposits to work generating some yield.

The problem was that the Federal Reserve had cut rates to near-zero in 2020, and treasuries were yielding next-to-nothing. That being said, long-dated notes had slightly higher yields than their short-dated counterparts, (10-year treasuries were yielding 1.62% in March 2021, while 3-month T-Bills were paying 0.02% at that time) so SVB invested heavily in the 10-year bonds.

And then the Fed raised rates. And then they raised them again. And again. And again. And again. Two years later, 3-month T-Bills were yielding 5% (and 10-year notes had jumped to 4%). Increased interest rates sent the prices of existing bonds down, and longer-dated bonds were especially sensitive to these changes.

To illustrate why this happened: imagine that you purchased a 10-year note yielding 1.6% interest in 2021, and two years later you could purchase the same note, now yielding 4%, or a shorter-dated note yielding 5%. 2% yield locked in for another 8 years is no longer an attractive opportunity, and the price of those bonds would decline to reflect this new reality.

SVB locked in generationally low interest rates at the worst possible time. This alone wouldn’t have been a problem, as the bank could have either held the bonds through their maturity or slowly offloaded them, but a cooling venture market forced their hand.

Startup funding slowed to a crawl in 2022 and 2023, and many of SVB’s customers needed their cash. This came to a head when clients collectively withdrew $41B in a single day. To meet these deposit needs, SVB had to firesale its “risk-free” bonds on the market for steep losses, and the bank couldn’t recover.

Two more stories.

The first modern private pension fund was established in 1950 by General Motors. The allure of guaranteed retirement benefits attracted America’s blue-collar workers, and in the years that followed, Ford, General Electric, UPS, and other large employers unveiled similar programs.

The pension formula was simple: Workers spend a certain number of years with a company, and that company provides them with a certain amount of money each year in retirement. The issue, once again, was assumptions. In the 1950s, the life expectancy in America was 68 years. In 2024, that number has increased to 79.25 years, but folks are still retiring around the same age. Input years have remained the same, output years have increased by a decade. The numbers don’t compute.

Pension funds around the country are now seriously underfunded, and companies are having to slash pension benefits for current and future employees to cover their current liabilities. If you took a job with GE 10 years ago expecting those pension benefits to continue forever, you got screwed.

From the birth of the personal computer to when I graduated from college in 2019, the computer science degree —> software developer pipeline was the lowest-risk path to a lucrative career. Software was eating the world, and as computers grew more complex, the need for software engineers exploded. “CS graduates get paid” was a law.

And then the script flipped.

No-code tools emerged, reducing the skill set needed to perform highly technical work, and AI tools have expanded the volume of code that current programmers can write. Software engineers are still important, but the trend of exponential headcount growth has been disrupted, leaving engineers worried about their future career prospects.

So, which of our current beliefs could be proven wrong?

I have asked myself this question about home prices and US stocks.

Home prices only went up, up, up for our parents and grandparents, but our predecessors benefited from two tailwinds: interest rates that had (until last year) steadily declined since the 1980s, and a population that increased by 120 million people.

What will happen if interest rates increase or remain constant? What if our population is flat for a decade, reducing new housing demand?

The stock market has climbed by ~9% annually since the inception of the S&P 500 in 1928, but how long is 100 years, really? What if big tech companies plateau, reduced birthrates impact longer-term profitability and growth (companies need customers!), or our national debt finally affects our standing in the global economy? There’s no guarantee that the future will mirror the past.

Don’t get me wrong, I’m bullish on America, and my money is invested accordingly. But it’s important to know which assumptions underpin the stories that we tell ourselves about our money.

- Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!

Jack's Picks

Writing online has been, without a doubt, my most valuable pursuit over the last two years, and 1 question that I often receive from aspiring writers is, “How do I get started?” My friend David Perell runs a writing school called Write of Passage that teaches people to create a range of opportunities for themselves by sharing ideas on the internet. Many of his alumni have landed book deals, job offers, and more after graduating from his program. David's writing school is hosting a free workshop that allows you to experience their writing Bootcamp. If you’re interested, you can sign up for the workshop using my affiliate link.

Last week I found this 2020 podcast interview between Tim Ferriss and Michael Lewis, and I thought it was electric. (I bought three of Lewis’s books after listening)

Nick Maggiulli wrote a scathing review of Tony Robbins latest “investing” book.