Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

Decentralized currency. Pyramid scheme. Inflation hedge. Roulette wheel. Future of finance. Get rich quick scheme.

Bitcoin is the world’s most controversial asset. Everyone has an opinion about this cryptocurrency, and it can be difficult to separate fact from fiction. What is Bitcoin, what isn’t Bitcoin, and why does it matter? This one should be fun.

Origin Story

In late 2008, a programmer with the pseudonym Satoshi Nakamoto published his manifesto, Bitcoin: A Peer-to-Peer Electronic Cash System, online. This paper outlined methods of using a peer-to-peer network to generate what was described as "a system for electronic transactions without relying on trust". A few months later, the Bitcoin network came into existence when Nakamoto mined the first Bitcoin block. This block came inscribed with a cryptic message:

The Times Jan/03/2009 Chancellor on brink of second bailout for banks.

See, Bitcoin was created in the wake of the financial crisis. Distrust in financial institutions ran high as trillions of dollars were lost due to the shady actions of banks and regulators. While Main Street went bankrupt, Wall Street was bailed out by the government. Bitcoin offered the perfect foil to institutional corruption.

Bitcoin’s first adopters were active members of online forums. In 2010, Laszlo Hanyecz completed the first commercial Bitcoin transaction when he bought two Papa John’s pizzas for 10,000 BTC (that would be $310,000,000 today, for those keeping score back home). Bitcoin then gained attention as the primary medium of exchange on black market site “The Silk Road”. Bitcoin has since outgrown its questionable roots, and today the cryptocurrency is a $600B asset supported by a variety of institutions.

What makes Bitcoin special? Two characteristics: decentralization and scarcity.

Decentralization

There is no central bank that controls the issuance or movement of Bitcoin. The cryptocurrency is mined (a process that involves using computers to solve complex puzzles to “unlock” Bitcoins”) by individuals and tracked on the blockchain.

Bitcoin Mining Operation, China

Blockchain is a fancy term for an online ledger. As Bitcoins are either A) mined or B) exchanged between parties, these transactions are recorded on blocks within the blockchain. Each “block” contains both a timestamp of the transaction and a piece of the previous block, and they form a chain. Hence “blockchain”. This blockchain structure prevents fraud, as no block can be manipulated without changing all of its predecessors. Additionally, the transaction logs establish ownership of each coin. Ownership is easily verifiable, and the coins can’t be counterfeited.

Scarcity

Only 21 million Bitcoins will ever exist, period. Satoshi Nakamoto designed Bitcoin so that the number of coins awarded to miners will be reduced by 50% every few years. ½ of all Bitcoins that will ever exist were mined in the first four years, but it will take 120 years to mine the rest. We now have an electronic asset with no central authority and a limited number of units. The anti-dollar.

Bitcoin vs. the US Dollar

Now let’s compare Bitcoin to the US Dollar. Bitcoin’s price has exploded over the last decade:

Meanwhile, the purchasing power of the US dollar has declined by more than 90% since 1950:

While Bitcoin is a decentralized, scarce asset, the dollar is not. Since the Great Financial Crisis, the Federal Reserve has “printed” trillions of dollars by buying bonds. The supply of US dollars isn’t fixed, and it has increased exponentially over time. Econ 101 says that when supply goes up, price tends to go down. Remember my article last week about inflation killing your savings account? The same phenomenon is at play here. Dollar supply increases, prices increase, inflation occurs, and your dollar loses a little bit of value. Bitcoin’s supply is fixed, meaning that in theory, it shouldn’t devalue over time. The perfect inflation hedge.

Decentralized currency. Scarce asset. Inflation hedge.

Bitcoin is the best story in finance.

Unfortunately, it’s just that: a good story. Bitcoin supporters tout a million reasons why Bitcoin is going to take over the world, but this cryptocurrency has a dirty secret. Since its inception, Bitcoin’s only real use has been enriching everyone who bought in early. Buyer beware.

“Decentralized”

Bitcoin transactions might be decentralized, but Bitcoin ownership isn’t. 40% of all Bitcoins ($250 billion) are held by 2500 people, and only 50,000 or so coins trade each day. That is very low volume setting the price for a massive asset, and a few trades can create massive price moves. This is a market largely controlled by a small minority of investors, and many of their livelihoods are tied to the price of Bitcoin. If you became a millionaire by getting in Bitcoin early, what would you do to keep the price up?

Construct a narrative that the government is hurting citizens by devaluing the dollar?

Portray Bitcoin as the best inflation hedge in a world with too much money?

Pay celebrities and media members alike to promote Bitcoin?

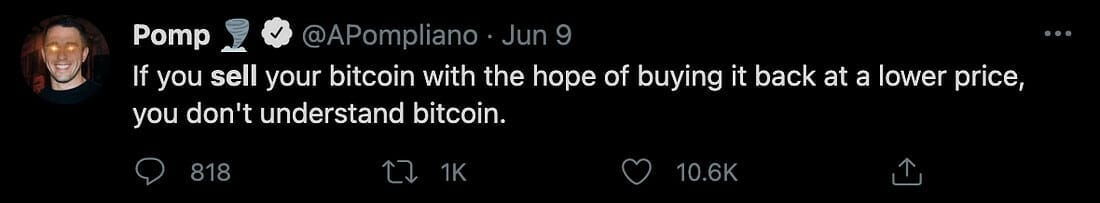

Discourage selling and demean anyone with an opposing opinion?

You got it. What is the end result of these efforts? New investors like you and me buy Bitcoin, keeping the dream alive.

Scarce Currencies Don’t Work

Besides decentralization, Bitcoin’s defining trait is scarcity. A scarce currency should hold its value, but that’s not how money works. Today, the US Dollar is backed by nothing but faith in Uncle Sam. This might seem sketch, considering every dollar was backed by gold 100 years ago. We called this the Gold Standard. Ironically the Gold Standard, the OG scarce currency, was a catalyst for the Great Depression.

Investors grew nervous as the stock market began declining in the late 1920s, and many turned to cash. Hysteria grew, and many Americans began to fear that banks would run out of cash. This became a self-fulfilling prophecy as the mad dash to withdraw cash caused banks to run out of reserves. In the modern era, the Federal Reserve can increase the money supply to ease tensions. Under the Gold Standard? We were screwed. 100,000 gold nuggets were not just going to appear in Washington D.C., and there was no method to “create” a larger money supply. The central bank tried raising interest rates to encourage investors to deposit money in banks, but it didn’t help. It did, however, make it more expensive for the already struggling businesses to secure new loans. What happens next? Mass business failures and a collapse of the US economy.

Currencies are mediums of exchange: you use them to buy, sell, and invest in other assets. Imagine the dollar was a store of value. Every time investors got scared, they would hoard cash. This cash is no longer flowing from person to person, and commerce slows to a halt. It would never work. Additionally, economies and populations are constantly growing. You need a dynamic currency to deal with a dynamic economy. The US Dollar devalues over time by design, and that is a good thing. It’s not supposed to be an investment, it’s a medium of exchange. Fine art is a store of value, but it could never be a currency. The US Dollar is a currency, but it can’t be a store of value. “Bitcoin’s scarcity makes it valuable” may be true, but it also means that Bitcoin can never be a global currency. You can’t have it both ways.

“Inflation Hedge”

Maybe the US Dollar has declined by 90% in the last 71 years, but Bitcoin is down more than 50% in three months:

Is Bitcoin volatile? Sure. Has it increased in value dramatically over the last decade? Absolutely. But the world’s greatest inflation hedge losing 50% of its value during the fastest inflationary period of the 21st century is hysterical. Bitcoin was never an inflation hedge. It was just a speculative asset.

Corruption Is only Cool if We’re Doing It

From Soulja Boy and Kim K tweeting out support for different cryptocurrencies, to media figures promoting Bitcoin, there is a wave of celebrities endorsing Bitcoin and the broader crypto movement. Why? Money. Some of the scams are obvious. When a C-list celebrity makes an Instagram post about a crypto that you’ve never heard of, it’s an obvious red flag. What about when professional athletes announce that they’re taking their salaries in Bitcoin, or a politician says that Bitcoin is a safer alternative to the US Dollar?

There is a lucrative market for influencers who are willing to take a cut to promote different cryptocurrencies, and many do. Before assuming they know something that you don’t, ask why they would be speaking out about crypto in the first place.

The Truth about Bitcoin

Bitcoin is supposed to be a decentralized, scarce cryptocurrency that can protect investors from inflation. In reality Bitcoin ownership is anything but decentralized, scarce currencies don’t work on large scales, and Bitcoin has gotten bodied during a period of high inflation. My biggest issue with Bitcoin isn’t that I think it’s a poor investment. People are free to invest as they wish. My issue is the predatory nature of the Bitcoin movement.

Early investors have made millions on Bitcoin, but thanks to low trading volume it’s near impossible to unload a large position in the cryptocurrency without dumping the price. How do you keep the price elevated? You have to bring new money in. How do you do that? Convince naive retail investors that if they buy Bitcoin, they’ll get rich too. Tell them that the US Dollar is destined to fail, and Bitcoin is the only way to preserve their savings. Never let reality get in the way of a good story.

Is the US Dollar backed by anything more than faith in the US Government? Nope. But what is Bitcoin backed by other than a group of early investors and desperate promotors?

There Is Only One Reason to Invest

To make money. Period. You don’t invest to join a movement. You don’t invest to take a stand against the system. You invest to make money. When an investment begins to look like a religion, you should be cautious. Why do all of these narratives about Bitcoin exist? Because someone invested in Bitcoin for the right reason: to make money. The problem is they need to find a new buyer, and they hope that it’s you.

- Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!

i wonder if he will ever revisit this.