Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

I’m going to tell you about an annoying trend, then an amazing business blueprint, then what happens when an annoying trend tries to emulate an amazing business model.

An Annoying Trend

As a terminally online writer who pays his bills each month by, among other things, publishing newsletter pieces on the internet, I’m pretty tuned in to the ebbs and flows of social media trends and content cycles.

A year or two ago, savvy Twitter (RIP) users realized that “threads,” or chains of tweet replies, were an excellent method for garnering engagement on the blue bird site. In an effort to build the biggest audiences possible as quickly as possible, Twitter’s most shameless users started “threading” anything and everything in the pursuit of internet eyeballs.

While threads were a great mechanism for telling long-form text-based stories on a short-form platform, many of these users weren’t publishing anything compelling. In fact, much of the content wasn’t even particularly interesting.

Wikipedia articles about Psychology 101 topics were reclassified as Mental Models before being deconstructed over the course of 25 tweets. 15-tweet chains of “10 Google Chrome hacks that you HAVE TO KNOW” flooded our timelines.

Naturally, at the conclusion of these engagement-baiting posts, the posters would include a link, usually to a newsletter, where they would, you guessed it, send subscribers a weekly email with 10 more productivity hacks that they “have to know.”

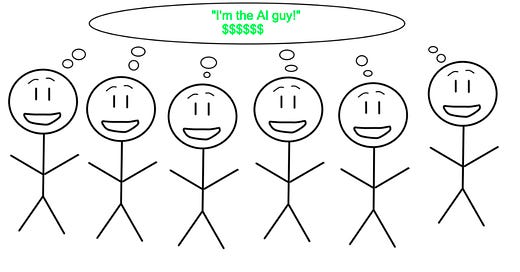

And then, as the thread bois grew more and more cringe, a fun new technology called AI took the internet by storm. In the blink of an eye, last week’s productivity gurus were at the forefront of the AI movement, and these self-proclaimed “AI guys” were telling the world “10 ChatGPT prompts that you HAVE TO KNOW” in an effort to funnel everyone to their, you guessed it, AI newsletters.

An Amazing Business Blueprint

As college students at the University of Michigan, Austin Rief and Alex Lieberman launched a little newsletter project that would later become the behemoth known as Morning Brew.

Lieberman (left) and Rief (right)

Morning Brew, a free, daily business newsletter that boasts millions of readers, was such as success that in October 2020, Insider purchased a controlling stake at a $75M valuation. Just four months later, Hubspot acquired a similar newsletter, The Hustle, for approximately $27M.

After the success of these two newsletters, a blueprint began to emerge:

Build a free daily newsletter around a relevant topic (business, finance, etc.)

Once the newsletter reaches a critical mass, monetize the content through advertisements

Continue to grow and monetize this newsletter until you can sell it for $_______

Don’t get it twisted: there is nothing easy about building a large, successful newsletter. Producing quality content, especially on a regular cadence, is hard. Growing your audience is hard. Selling ads is hard.

But the blueprint was there.

In early 2022, entrepreneurs Shaan Puri (who cohosts the My First Million podcast with Hustle founder Sam Parr) and Ben Levy launched The Morning Brew of crypto, The Milk Road.

Shaan and Ben’s Twitter (X? idk) avatars

They did an excellent job of covering the biggest stories in crypto each day, and the popularity of their newsletter exploded. A combination of word-of-mouth marketing, paid social media ads, and an in-house referral system helped them accumulate 250,000 readers in less than a year, and the duo sold their creation for millions by the end of 2022.

Shaan and Ben speed-ran the newsletter blueprint, and they crushed it.

And now everyone and their mother is trying to do the same thing with AI.

An Unfortunate Combination

The Milk Road showed just how quickly this newsletter blueprint could create a million-dollar business, but one important detail often gets overlooked in this whole process: The Milk Road wasn’t just a crypto newsletter. It was the crypto newsletter.

No one else was producing anywhere near the same volume and quality of crypto content as them. The Milk Road team had established an effective monopoly on daily text-based crypto news, and they reaped the rewards of their efforts.

Now one year later in the AI bubble, everyone and their mother is trying to run the same playbook.

Every “productivity influencer” who had figured out how to extract email addresses from their Twitter and Linkedin followers turned their email lists into AI newsletters that list a variety of AI product releases and AI startup launches and other AI headlines. I have seen, I don’t know, at least a dozen “large” accounts that couldn’t spell AI in 2022 now promoting their AI newsletters daily.

And all of their newsletters look exactly the same.

The goal, of course, is to scale and eventually sell the AI newsletter. And you know what? It’s going to work for someone. Someone is going to build an AI newsletter read by hundreds of thousands of subscribers, and they are going to sell it for an ungodly sum of money. And that’s awesome.

But many, many more people are going to invest hundreds of hours in trying to build the exact same newsletter, just to lose.

A few days ago, I listened to Tim Ferriss’ recent podcast with investor Bill Gurley. Normally, Tim spends a couple of hours interviewing guests about their careers and life stories. In this particular episode, the format was reversed, and Bill actually interviewed Tim.

At one point, Gurley asked Ferriss how he had managed to succeed in the podcast game. Tim replied, “It’s not enough to be a good interviewer. I really think you need to seek to be a category of one. It’s a lot easier to be the only than it is to be the best when you have millions of podcasts to compete against. So spend a lot of time thinking about positioning.”

I like that term: category of one.

Everyone is obsessed with being the best, but you can only have one “best,” regardless of the number of competitors.

In the newsletter game, The Milk Road was a category of one. The AI market, however, is a category of one too many, and all of these newsletters are producing the same content for the same general group of readers. They can’t all win, the numbers just don’t work.

Of course, this “category of one” idea isn’t just a content thing, it’s a life thing.

Do you know how many people applied for Blackstone’s 2023 analyst class? 62,000.

Do you know how many applicants were hired by Blackstone? 169. That’s good for a 0.27% acceptance rate (meanwhile, Harvard University currently boasts a 3.2% acceptance rate).

Do you think that you’re going to out-model, out-quant, and out-finance 61,831 out of 62,000 applicants? Probably not. But you just might win the prize by playing another game entirely.

People don’t read Tim Ferriss’s books or listen to his podcast because he’s the greatest entrepreneur, investor, traveler, productivity hacker, or anything else (though you could accurately label him as any one of these things). People consume his content because he’s freaking Tim Ferriss.

Tim’s unique combination of many different things has made him a category of one, he is effectively his own monopoly.

The key to winning your game, whatever it is, is to either be the first or be the only, and it’s far easier to be the only. A compelling life story can overcome a subpar standardized test score. Stick figure drawings can distinguish a finance blog. Maybe long-form opinion pieces could differentiate a saturated market of AI listicle newsletters. You get the idea.

Figure out what your category of one is, that thing that makes you unique, and leverage it.

- Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!

Jack's Picks

One of the most frustrating aspects of investing is staying up-to-date with the latest information. Koyfin solved this problem by providing investors with a comprehensive data platform that includes detailed company financial metrics, sector-specific stock performance, active portfolio tracking, and more. The best part? Young Money readers get 15% off their first year. Upgrade your investing toolbox with Koyfin.*

Three days ago on Exec Sum, I published a deep dive explaining how Gridline is disrupting the alternative asset market. Check it out here.

I thought this article on the phenomenon of “end of life dreams” was fascinating, if not a bit morbid.

Rob Henderson shared an interesting piece that covered the state of the dating market in the US today.

I joined Josh Brown, Michael Batnick, and Sam Ro for the funniest podcast episode of my life (covering everything from AI stocks to Linkedin satire) in last week’s edition of The Compound and Friends.