Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

In Spring 2023, four big tech companies: Alphabet (Google), Meta, Microsoft, and Amazon mentioned “AI” 186 times. This was up from just 36 times one year prior.

What happened? Well, it all started with this cool new chatbot called “ChatGPT.” Released by OpenAI in November 2022, ChatGPT set the world on fire, wowing users with its comprehensive, human-like responses to detailed questions and prompts.

ChatGPT helps software engineers code, writes better history essays than most college students, and composes Shakespearean rap songs about the efficient market hypothesis in a matter of seconds.

It’s incredible.

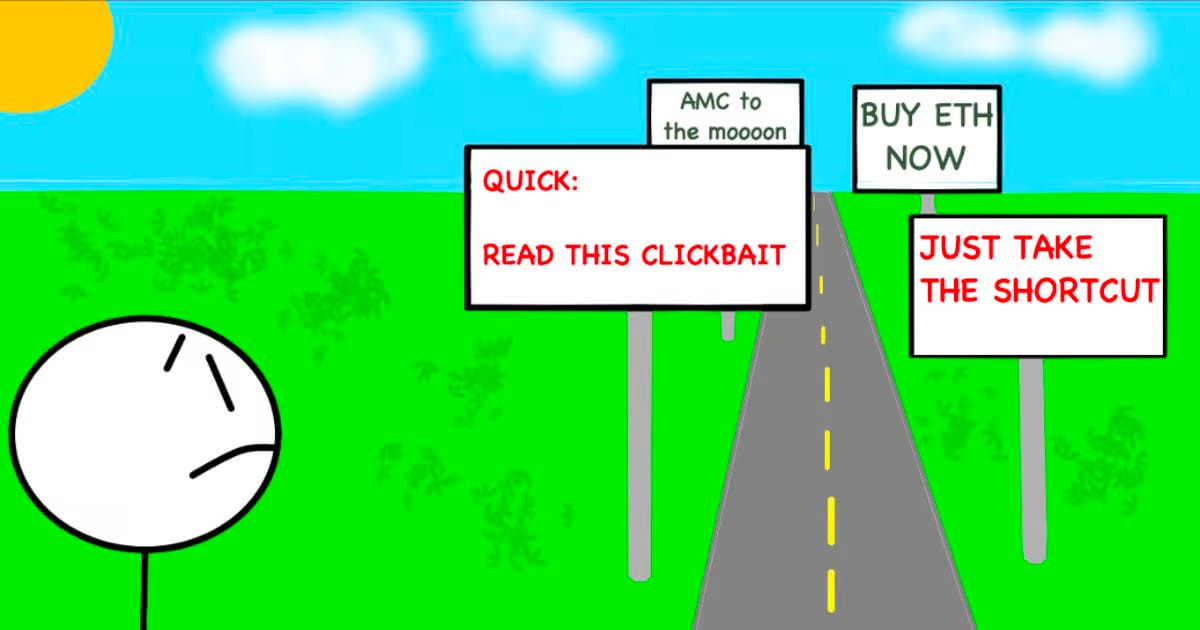

So obviously, in the wake of Chat-GPT, everyone pivoted to AI. Startups that previously focused on web3 and crypto are now creating AI solutions. Newsletters that covered various tech trends are now providing updates on the latest news in the AI sector. Venture firms are pouring billions into hot AI startups that have yet to release products. “Influencers” on Twitter, Linkedin, and even TikTok won’t stop talking about AI, AI, AI. “Here’s how AI is going to change your life!” “10 AI hacks that you have to know.”

It’s an AI gold rush, but gold rushes have always favored early entrants. 300,000 prospectors flocked to California for the original “gold rush” in the 1840s and 50s, but few actually struck it rich. We have seen this dynamic play out time and time again in financial markets as well.

In 2020, you could have made money by “investing” in all sorts of things. I had a good nine-month run in the SPAC market when that sector was flying. Folks who were early to NFTs saw life-changing returns. The prices of several growth stocks increased by 10-20x in under a year.

But then everyone from Paul Ryan to Shaquille O’Neal launched a SPAC, the market got saturated, prices stopped rocketing, and many of those deals failed. Spending $10k to buy a picture of a rock is fine if you can flip it for $100k. Spending $100k to buy a picture of a rock is fine if you can flip it for $500k. But the guy who spent $500k for the picture of the rock? He’s out of luck. Growth stocks like Zoom saw their stock prices go nuclear when their revenues increased by 500% in a single year, but those stocks fell back to earth once investors realized those growth rates weren’t sustainable.

Every single “hot” trend eventually went cold.

If you got in early, you made bank. If you got in late, you got smoked. The only way to win the “trend” game is by being early. Once it’s in the mainstream news, you’re too late.

OpenAI was founded in November 2015, my freshman year of college, and they launched their first generation GPT large language model in 2018. They received a $1 billion investment from Microsoft in July 2019, the year they transitioned from being a non-profit to a “capped” for-profit, and they released the complete version of GPT-2 four months later.

While OpenAI sparked the current wave of AI excitement last fall, Chat-GPT wasn’t some overnight sensation. It was the result of seven years and billions of dollars of research. But everyone wants to capitalize off of a third party’s success.

Similar to the California gold rush of the 1840s, the early entrants in this AI craze might hit home runs, but everyone else is likely to strike out. OpenAI has been working on Chat-GPT for seven years. Companies like Meta and Google have probably been experimenting with AI behind closed doors for years as well.

Most of these recent AI startup pivots?

They are simply “wrappers” built on top of Chat-GPT or another large language model, just one update away from being obsolete. Sure, a few of these startups will raise insane funding. Maybe someone sells their AI newsletter before this mania dies out. But for every trend-chasing success story, there will be a dozen failures because each gold rush only remains relevant for so long.

There’s an opportunity cost associated with chasing hot topics like this. Betting your entire business or personal brand on AI distracts from your ability to build something with real staying power. And the second that the zeitgeist changes? It’s back to square one.

Don’t get me wrong, AI is cool. I regularly use Chat-GPT with my own work. But going all in is a dangerous game. AI might change the world, but it won’t change human behavior.

- Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!

Jack's Picks

Morgan Housel wrote a good piece on how optimism compounds over time.

Katie Gattin Tassin discussed whether or not the middle class is shrinking, and why.

I started reading Anthony Bourdain’s (RIP) book Kitchen Confidential, and it’s freaking awesome.

I thought y’all would enjoy this shitpost I wrote about BlackRock on Twitter.