Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

“Everything that happens once can never happen again. But everything that happens twice will surely happen a third time.” - The Alchemist

Last November, OpenAI shocked the world when it unveiled its new user-friendly LLM-based chatbot: ChatGPT.

“Artificial intelligence,” which was, for decades, a fringe topic of discussion for scientists, sci-fi enthusiasts, and others that can be collectively referred to as “nerds,” went mainstream overnight.

The reason? ChatGPT was the first piece of AI that a normal person could knowingly interact with, and it was incredible. I remember sitting in the back of a business school class last January tinkering with ChatGPT for hours, asking it all sorts of questions and prompts.

“Tell me an abbreviated history of Ghenghis Khan.”

“Give me 10 synonyms for the word peculiar.”

“Name 8 investors who made a huge profit by betting against the housing market in 2008.”

While ChatGPT wasn’t perfect, it was good. Really good. And I wasn’t the only one who thought so. As its popularity surged, ChatGPT headlines began dominating internet media:

By last April, the consensus was that ChatGPT, and AI as a whole, was going to permanently alter how everyone did everything. Every internal memo was going to be outsourced to the chatbots. AI was going to replace any job that could be automated. Writers and musicians were toast. Google was as good as dead, and so were Excel and PowerPoint! Maybe that’s why Microsoft invested $10B into OpenAI.

There was no point in learning to code (or write, or do basic arithmetic, for that matter), because LLMs could do it for you. University professors were screwed, as students would simply outsource every bit of their homework to the robot in their pocket.

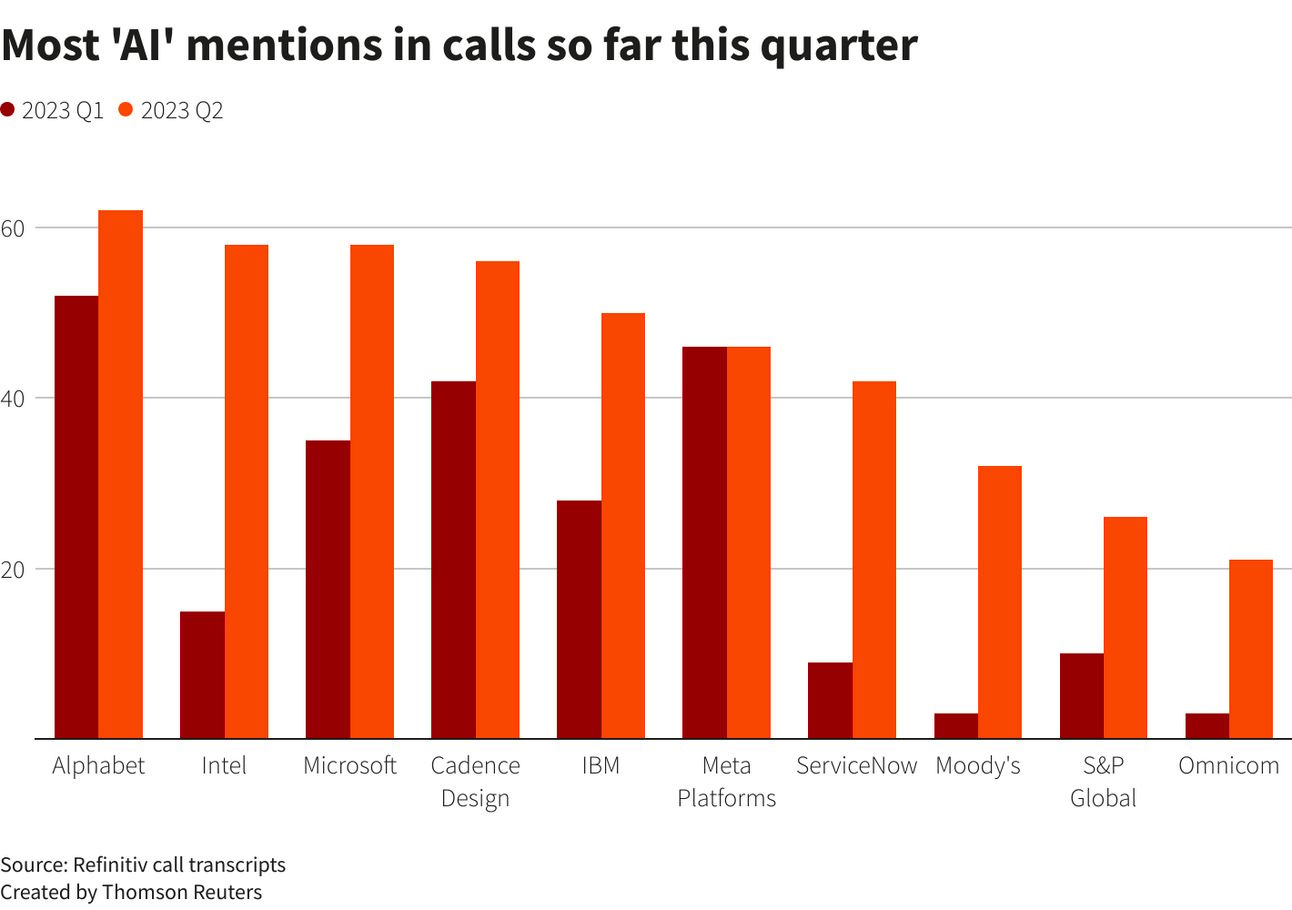

Fortune 500 executives caught AI fever, and “artificial intelligence” quickly overtook “inflation” as the favored corporate speak buzzword in earnings calls:

And everyone from Microsoft to McKinsey & Co wanted a piece of the AI pie. Did you really think America’s most prestigious consulting firm was going to miss out on billing a client $50M for developing an “AI implementation strategy?”

Startup founders pivoted their companies’ focus to AI en masse, and venture capitalists, desperate to find the next OpenAI, were signing off on multi-million dollar term sheets for idea-stage companies.

And then the funniest thing happened: people got bored.

According to analytics firm Similarweb, ChatGPT traffic was down 3.2% in August, after declining 10% in both June and July.

While ChatGPT will probably experience a resurgence this fall as students return to the classroom and expedite their homework via chatbot, it seems like talks of AI disrupting/replacing anything and everything have cooled down.

Don’t get me wrong, I’m bullish on AI as a technology, and I have personally had a lot of fun playing with ChatGPT, Dall-E, and other AI platforms, but the initial euphoria was a bit much.

In the tech/VC corner of the internet where I often find myself, the explosive growth and subsequent plateau/decline of AI’s role in the broader cultural zeitgeist is the nth rendition of a market hype cycle that has included SPACs, crypto, and Web3, and that hype cycle goes something like this:

1) A new technology comes out, and it looks promising.

2) The first companies in this new field make/raise a ton of money.

3) Those who invested in these first companies also make a ton of money and look like geniuses.

4) Everyone who heard about this first wave and missed the boat starts looking for ways to get in. Startup founders change the direction company, and investors adjust their funds’ strategies.

5) The general public hears about this new technology, and the hype cycle hits its crescendo when completely unrelated parties crack under pressure and join the fun. (Applebee’s launching an NFT project is a good example).

6) People get bored, the momentum dies down, and the attention goes elsewhere.

Rinse, repeat.

This cyclicality exists everywhere.

The same investors who fell in love with Elizabeth Holmes seven years ago were fawning over Sam Bankman-Fried in 2021, because everyone wants to give their money to the next wunderkind startup founder.

Do you remember that scene from The Big Short where Steve Carrell is shocked that a stripper has taken out mortgages on five different properties? We witnessed the same phenomenon over the last three years as countless people who had previously never invested in real estate took out mortgages and loans at record-low interest rates to purchase apartments and self-storage units to lease as “passive income.” This “passive income” strategy was all the rave on TikTok and Instagram until these new landlords had to deal with delinquent tenants, unit vacancies, and cities like New York cracking down on short-term rentals.

In 1998, every 20-something with a degree from a top-25 school chose tech startups over banking and consulting… until their stock options were wiped out and that cycle reversed. 22 years later, we watched this same labor cycle play out again.

Everything. Is. Cyclical.

Especially the things that are destined to “change the world.”

I swear, it feels like our memories get shorter and shorter as the internet and media force these cycles to play out faster and faster, and we run an increased risk of making the same mistakes time and time again because we are so quick to forget what just occurred.

My advice? If you do manage to find one of those rare things that isn’t cyclical, never let it go. And if you have to play the cycle game, know when you’re going to exit.

- Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!

Jack's Picks

The worst thing about traveling? Unpacking a bag full of wrinkled, disheveled clothes. Thankfully, my Halfday travel bag solved this problem with a built-in garment compartment for my jackets, button-ups, and dress shoes, and it folds and zips into a duffel bag where I can store my casual clothes as well. If you want a travel duffel that doesn’t suck, check out Halfday! (Plus, all Young Money readers get 20% off 🤝)

Katie Gatti Tassin discussed the role that narratives played in the rise and fall of crypto over the last market cycle.

Sieva Kozinsky shared a detailed, step-by-step breakdown of how his team purchased a motorcycle rental company in Hawaii and immediately increased its cash flow.

I went down a “blimps” rabbit hole last week. Did you know that we used to have transatlantic blimp travel from Europe to the US? In fact, you could take a blimp from Germany to Brazil. If you nerd out on weird stuff like I do, start with the Hindenburg Wikipedia page.