Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

In case you missed the big economic news last week, the Federal Reserve announced that for the first time since March 2022, they are temporarily pausing rate hikes. The reason? Inflation finally appears to be rolling over.

These results shouldn’t be shocking. After all, the Federal Reserve is run by some of the brightest minds in politics and finance, and one of their chief responsibilities is to “Set monetary policy to promote maximum employment and stable prices in the U.S. economy.”

Given the circumstances of the past three years, I would say they’ve done a pretty good job. And yet, according to the internet, the Fed has done everything they could to destroy the US economy and send us into the worst downward spiral since the Great Depression.

Let me list some critiques and predictions that I’ve read about the Federal Reserve since Jerome Powell fired up the “money printer” in March 2020.

As the global economy ground to a halt in the early days of the coronavirus pandemic, the Federal Reserve made the decision to slash interest rates and fire up “quantitative easing” to ensure that financial markets could continue functioning properly. Critics thought that this money printing was foolish and unnecessary, and on March 28th, 2020, Forbes told me that Donald Trump and the Fed were destroying the US dollar.

Since then, the US Dollar Index is up 2.60% vs foreign currencies.

In March 2022, The Washington Post told me that the Fed was leading us off a cliff to stagflation and hyperinflation, and in June 2022, economist and former US Secretary of the Treasury Larry Summers said that we would need “five years of unemployment above 5% to contain inflation.”

One year later, it appears that Summers’ speech actually top-ticked inflation, stagflation is nowhere in sight, and the US unemployment rate still sits near all-time-lows at 3.7%.

In November 2022, another Forbes piece explained why Fed interest rate increases would fail to bring inflation down, and in December 2022, BlackRock said the Fed’s actions would likely cause a stock selloff in 2023. Here we are halfway through 2023, and the S&P 500 is actually up more than 10% YTD.

In fact, despite conventional wisdom stating that increasing interest rates would tank the market, the S&P 500 is now trading at the same level that it was when the Fed announced its rate hikes 15 months ago, despite interest rates climbing from 0.25% to 5% in that time.

So let’s see where we now stand, more than three years after that first decision to cut interest rates:

The S&P 500 is up 56% since March 2020

The US unemployment rate remains near its lowest level in history

Inflation appears to have peaked a year ago

Interest rates are more in-line with their historical norms

Yes, there were a few unfortunate casualties of the interest rate hikes. SPACs are probably dead, or at least SPACs that took half-baked PowerPoint presentations public at $4B valuations (speaking of which, does anyone know if Nikola Motors is still on pace for $1.4B in revenue this year? asking for a friend). NFTs have seen better days, conspiracy theorists who believe that GameStop and AMC are being artificially suppressed by Citadel Securities, George Soros, and the Rothschild family are down horrendous, and the venture capital industry is no longer subsidizing my Gen-Z lifestyle by funding grocery delivery startups and ride-sharing apps with negative unit economics.

But all-in-all, I’d say the outcome was a net positive. The data speaks for itself.

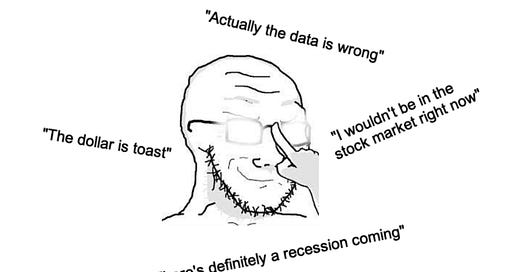

And yet, if you tuned into CNBC, Fox, or CNN or scrolled through Twitter, TikTok, or Reddit at any point over the last three years, you would think that the Fed was irresponsible, short-sighted, and likely to wreck the global financial system.

Why is perception so different from reality? I have some thoughts.

1) Pessimism is seductive.

No one cares if the market is up 8% this year and we’re all gainfully employed. That’s boring. Monotonous. Pessimism is seductive because it introduces risk and excitement to the mundane. Pessimism drives storylines, and occasionally, when one of those stories becomes reality, it’s a hit.

Why do you think Michael Lewis’s The Big Short spent 28 weeks on The New York Times’s best-seller list and the film adaptation made $133M on a $50M budget? It was the story of the “pessimist,” Michael Burry, making hundreds of millions of dollars when his prediction about a US housing market collapse came true. And everyone wants to be the next Burry.

Plus, no one remembers the pessimist’s false predictions. If you hit it big once, you’re a genius forever. Kyle Bass has underperformed the market since 2008, but he is still making TV appearances because he made one correct prediction the year the original iPhone was revealed.

2) Politics and economics are fascinating and frustrating because causality is near-impossible to prove and anyone can find “data” that supports their preconceived notions.

Like candidates on The Bachelor, economic pundits often expound on “their truth” instead of looking at the world around them objectively because they can always, always, find data that supports their worldview. If you want to believe the world is going to shit, there is some study, data point, or chart that will tell you the world is going to shit.

3) Two opinions are perennially in vogue: the government is bad/irresponsible/ruining everything, and Wall Street is bad/irresponsible/ruining everything.

Don’t believe me? Look at how many people think that BlackRock is a Marvel villain orchestrating wars and funding climate disasters simply because they don’t understand how index funds work.

Sitting at the intersection of finance and politics, the Fed is capitalism’s most convenient scapegoat, and hating the Fed allows you to kill two birds with one stone.

So now let’s bring it all together.

Pessimism sounds like prudent advice, it’s pretty much impossible to disprove pessimistic economic worldviews, and it will literally always be popular to talk shit about the higher powers in finance and government.

Given this information, why wouldn’t you say the Fed is ruining the world? It’s a recipe for instant engagement.

But engaging doesn’t = true. I would like to propose a thought experiment:

Imagine that the internet didn’t exist, you couldn’t watch the news, and you had to go about your normal day-to-day life. Would you think anything was wrong? I doubt it. Odds are that you and pretty much everyone you know has a job, your portfolios are doing just fine, and most of your fears, or at least your financial/economic fears, stem from external sources.

Maybe the Fed did alright, after all. Shout out to Jerome Powell, the hero we needed but didn’t deserve.

- Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!

Jack's Picks

If you work in tech, your finances are probably confusing. When should you exercise? You’ve got money, but where should you put it? What about tax strategies? Compound is personalized wealth management for people in tech — it’s how people at Stripe, Discord, OpenAI, and more make smarter decisions about their money. Check it out here.*

My man Quinn Emmett wrote a detailed piece on societal progress (colorful vocabulary included, which I believe we need more of in the content world).

Isa Adney wrote an excellent profile on one of my favorite writers (and internet friends) Lawrence Yeo.

I enjoyed this episode of the Founders podcast that covered the Rothschild, Morgan, Toyoda, and Rockefeller families.