Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

In March 2019, a 23-year-old Aussie named Ash Barty took the Tennis World by storm when she defeated three top-ten players, including Petra Kvitová and Karolína Plíšková, en route to a Miami Open victory.

Two months later, she defeated Markéta Vondroušová in the French Open finals, dropping just four games in the final match. Barty became the first Aussie to win the tournament since 1973, and by the end of June, she was the top-ranked player in the world.

After an 11-month tennis hiatus stemming from the Covid-19 pandemic, Barty returned to the courts, rattling off a series of wins in the Yarra Valley Classic, the Miami Open, the Stuttgart Open, and ultimately Wimbledon in 2021, and she continued her dominance with an Australian Open victory in January 2022.

At just 25 years old, Barty was the face of tennis. She had taken the torch from Serena Williams, spending 114 consecutive weeks (and 121 weeks total) ranked as the best player in the world through March 2022.

In an emotional interview with her friend and former doubles partner Casey Dellacqua, Barty said, "It’s the first time I’ve actually said it out loud, and yeah, it’s hard to say. But I’m so happy, and I’m so ready, and I just know at the moment in my heart, for me as a person, this is right. I know I’ve done this before, but in a very different feeling. And I’m so grateful to everything that tennis has given me; it’s given me all of my dreams, plus more. But I know that the time is right now for me to step away and chase other dreams, and yeah, to put the racquets down.”

You rarely see this in sports, athletes leaving the game at their peak.

Jordan retired as the undisputed GOAT before playing two more forgettable seasons with the Wizards. Tom Brady, despite winning more Super Bowls than any other franchise in the history of the game, sacrificed his marriage to start off 6-7 with the Bucs in his age-45 season. Shaquille O'Neal, basketball's most dominant center ever, averaged 24 points per game over his career. In his 19th season, he struggled up and down the court for the Boston Celtics, averaging just 9 points per game across 37 appearances.

In a sports world that seduces its biggest stars with dreams of more titles, more points, more records, and more accolades, Ash Barty was the rare champion who walked away enough.

23 months ago, a viral tweet from Jason DeBolt appeared on my timeline. DeBolt, a then-39-year-old software engineer that worked for Amazon Web Services, had announced that he was "retiring from the corporate world" after his portfolio of 14,850 Tesla shares reached $11,944,889 in value.

Starting with a $19,000 investment in March 2013, DeBolt poured a total of $300,000 into the electric vehicle manufacturer over the next 6 years. By January 2021, these total contributions had 40x'd to a $12,000,000 portfolio.

Jason won the game. But he decided to keep playing.

Tesla's stock price continued to climb over the next year, increasing from a split-adjusted $272 on January 7, 2021 to $400 per share just 10 months later. Tesla was worth $1.23T, and DeBolt's stake reached approximately $18,200,000. "To the moon," as they say.

However, since peaking a year ago, Tesla's stock has plummeted from $400 to $180, taking DeBolt's portfolio with it.

Last week, the self-proclaimed "All in Tesla investor since 2013" was down $11M from his peak a year ago, and down $4M from that initial tweet in January 2021. Instead of cashing out his winnings, which are still around $8M, DeBolt is considering selling his house to buy even more shares.

I don't think Jason, or anyone else for that matter, could have top ticked and sold Tesla at ~$400 a share in November. However, had he liquidated Tesla and bought, say, an S&P 500 index fund the day that he quit his job, he would be up another $400,000 right now, instead of down $4,000,000 over the last two years.

It seems insane, risking millions that you can't afford to lose to (hopefully) make millions more that you don't even need. But Jason is far from alone.

Over the last year, we have seen countless "fortunes" disappear as the prices of growth stocks, cryptocurrencies, and other speculative assets have collapsed.

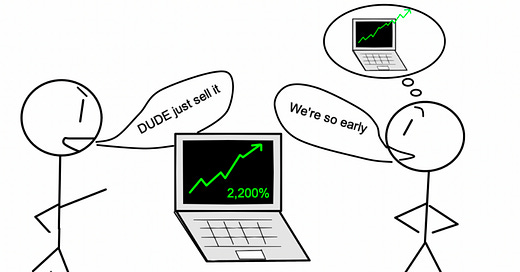

My first thought when reading these stories is "Why didn't you sell??" But the truth is that anyone who would have sold wouldn't have held this long in the first place.

To quote myself from back in February:

How do you tell someone that 50x sales is an outrageous valuation, when they got rich by ignoring valuations for the entirely of their investing careers?What they thought was well-researched alpha was actually a factor bet on growth and tech. When market trends reverse, no amount of research will save a poorly positioned portfolio. But no one who thought it was just a factor bet held til the Feb 2021 highs, and no one who truly believed in their growth stock research ever thought that they should sell...

Tesla's growth has been incredible over the last decade, and Musk deserves credit as the greatest entrepreneur of this generation. But most of the gains in Tesla's stock came from valuation expansion, not company growth.

Yet many investors viewed Tesla as the odds-on bet for EV adoption, and they got paid as a result. What happens if your Tesla bet was right for the wrong reasons, and valuations contract? What happens if you never sold, because $1T is still too cheap for the greatest EV company of all time?

Me, 10 months ago

If you held bitcoin from $1,000 to $60,000, or Tesla from $20 to $400, you weren't suddenly going to think that your asset of choice was overvalued. You weren't betting on bitcoin to hit $70,000. You were betting on it to replace our current financial system, or at least to continue appreciating through inflation. Valuation expansion wasn't going to scare you away from Tesla, especially not before robo-taxis and full self-driving turned the EV manufacturer into a $10T enterprise.

If you had listened to the critics a year ago, you would have missed out on millions. Why the hell would you sell now, just as you are beginning to be proven right? Sure, your portfolio is worth $10M. But the euphoria from having your conviction proven right? That's priceless. And this same conviction that minted so many rags-to-riches stories keeps these investors from selling, sending them back to their rags.

Wealth created through speculative means is rarely secured by rational actions. Most speculators continue speculating, until, like the athletes past their prime, they quietly exit the scene with a mere fraction of their earlier successes.

Ash Barty's are rare in sports, but they are even rarer in financial markets.

- Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!