Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

I have a simple investing process that I like to call “index and chill.” It goes something like this: First, I invest in an S&P 500 index fund. Second, I chill. Simple, no?

The reason that I “index and chill” is as follows. Two years ago, I experienced the pinnacle 23-year-old male rite of passage: a successful day trading run that led me to believe I would be the next Druckenmiller, and an ensuing unsuccessful run where I nearly blew all of the money that I made.

I started with $6,000, for those curious.

In the aftermath of this ridiculous rollercoaster, I had six realizations:

The circumstances under which I made so much money so quickly would likely never exist again.

The likelihood that I find another opportunity to make a lot of money in a short period of time was low.

The likelihood that I blow the rest of this money looking for another opportunity to make a lot of money in a short period of time was high.

I was still up like 2,000% from my initial investment in a little over a year.

I had enough money in my tax-free (yes, I was day trading a Roth IRA. Peak degeneracy) account that it would, over 40 years of compounding, be worth millions.

The time that I would spend trading could instead be spent doing stuff that… I don’t know… I actually liked?

So on August 17th, 2021, I threw all of my money into an index fund and never looked back. That was, without a doubt, the best financial decision that I’ve ever made. And no, it wasn’t because diversification guaranteed me outsized returns. Quite the opposite, actually. It guaranteed that my portfolio would have market returns, which historically average 9%, indefinitely.

But this decision wasn’t made to maximize my financial returns. It was made to offload a financial responsibility. The countless hours that I had previously spent researching and tracking stocks could now be spent doing something, anything, more interesting than looking at some lines on some screens.

You could say I sacrificed control for optionality. But optionality is a peculiar thing. We’ll get to that in a minute.

Last month, I was scrolling through Twitter (as I do) when this Will Manidis tweet made me take a second to reflect.

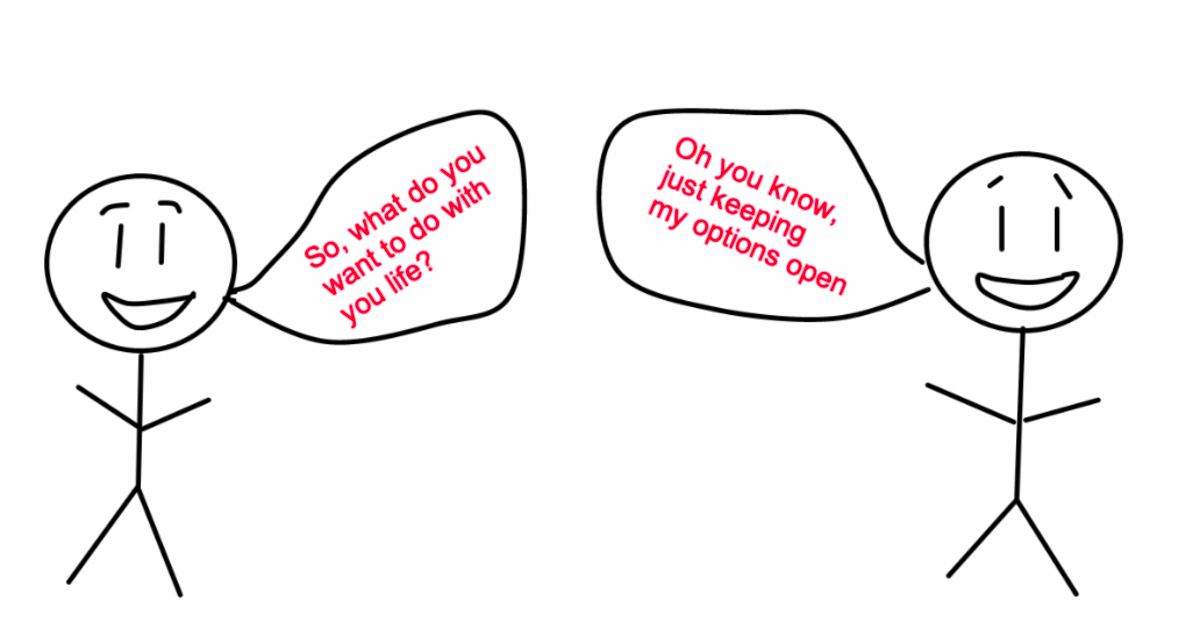

“The most disturbing trend is the amount of people treating life like an index fund.”

It’s funny that he used “index fund” to describe how so many people live their lives.

As I mentioned a second ago, index funds are a great option for your finances because they free you from the opportunity cost associated with a time-consuming, actively managed portfolio. No longer worrying about your investments, you have that much more time to go pursue more important stuff in life. Indexing your wealth provides optionality.

But when this pursuit of optionality expands from our portfolios to our lives and ambitions, we run into problems.

Mihir Desai is a professor at both Harvard Business School and Harvard Law School, putting him in contact with more high-achieving young folks than pretty much anyone. Five years ago, Dr. Desai wrote about The Trouble with Optionality in The Crimson.

To quote Dr. Desai’s piece:

This emphasis on creating optionality can backfire in surprising ways. Instead of enabling young people to take on risks and make choices, acquiring options becomes habitual. You can never create enough option value—and the longer you spend acquiring options, the harder it is to stop.

The Yale undergraduate goes to work at McKinsey for two years, then comes to Harvard Business School, then graduates and goes to work Goldman Sachs and leaves after several years to work at Blackstone. Optionality abounds!

This individual has merely acquired stamps of approval and has acquired safety net upon safety net. These safety nets don’t end up enabling big risk-taking—individuals just become habitual acquirers of safety nets. The comfort of a high-paying job at a prestigious firm surrounded by smart people is simply too much to give up. When that happens, the dreams that those options were meant to enable slowly recede into the background. For a few, those destinations are in fact their dreams come true—but for every one of those, there are ten entrepreneurs, artists, and restaurateurs that get trapped in those institutions.

We spend most of our formative years putting optionality on a pedestal while giving little thought to why we want optionality in the first place.

In high school you play three sports, take some foreign language classes, and run for student government so you can get into the best college possible, where you study something you’re not all that interested in to get an internship you probably don’t care all that much about to secure a job you’re not going to like to differentiate your graduate school application for the top 10 MBA/Law/whatever program where you’ll jump through hoops to land an even more prestigious internship to land another job that will pay you a lot of money to do something you hate so you can pivot to—

DO YOU SEE WHERE I’M GOING WITH THIS?

Nothing is done for the sake of the thing itself, everything is just a stepping stone for whatever comes next. And, like the donkey chasing the carrot on a stick, we convince ourselves that we are just a couple of steps away from pursuing some dream of ours that we never seem to reach.

Optionality for the sake of optionality. It’s a sick, twisted game when you sit back and think about it, because there will always be another option. Until there’s not.

The great irony of pursuing infinite optionality is that sooner or later it starts working against you, actually limiting your options as time goes on. And therein lies the difference between pursuing optionality in your finances and in your life.

Money can compound forever, and indexing your portfolio ensures that its value will appreciate over time. In this case, time works in your favor.

But your life, unlike your money, has an expiration date, and some opportunities don’t come around twice. You can spend 40 years of your career constantly chasing “the next step,” just to look back and realize you never pursued a single job that you actually liked. Your resume-filler activities occupied valuable time that could have been spent exploring your interests. The business you wanted to start, the girl you wanted to ask out, the trip you wanted to go on, the skill that you wanted to develop, or whatever other thing you wanted to do but “the timing was never right?” Sorry, those opportunities have come and gone.

Optionality is only as valuable as the things that it allows you to commit to, and if you never commit to something, that optionality dies with you, worthless, unable to be redeemed.

I saw it in undergrad, and I see it in business school. I think it’s the curse of young people in 2023 that they feel so pressured to win “the game” that they never bother to see if “the game” is worth playing in the first place.

Don’t get me wrong, patience is a virtue, and delayed gratification is a competitive advantage. But the idea that every period of our life should just be some stepping stone for an ever-present “next stage” is a recipe for disaster.

The truth is, it takes time to build anything significant. It takes years to build a company from scratch, raise a loving family, or master a difficult skill. Like hitting all of the sample tables in a mall food court, optionality allows you to quickly skim the surface of all sorts of experiences, but your experiences end right there: on the surface. Sooner or later you have to call your shot and dive in.

Index funds are a beautiful thing because they grant you the freedom to pursue your ambitions to their fullest. But if your life becomes an index fund in and of itself, then what’s the point?

- Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!

Jack's Picks

Derek Thompson wrote about America's curious obsession with "Workaholism," and how that trend might finally be changing after the pandemic.

A couple of weeks ago, I linked up with Rational VC’s Cyrus and Iman in London to chat all things writing, shitposting, opportunity costs, and more. Check out the episode here.

I am once again linking Mihir Desai’s excellent piece on optionality.