Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

What Is FIRE?

FIRE 🔥🔥: Financial Independence/Retire Early. It’s a movement that has gained a lot of traction over the last decade, and its popularity exploded after the COVID-19 pandemic began. This shouldn’t come as a surprise. A lot of people are unhappy with their jobs, so they look to retire and get on with their post-work lives as quickly as possible.

FIRE consists of the following game plan:

You work ____ years to make _____ money. These values vary depending on individual retirement goals and salaries.

Invest every extra penny in SPY or a similar broad index fund, so the value of your investment appreciates over time (on average, 9% annually).

Set an annual withdrawal amount that you will need to live off of for the rest of your life.

When your total capital reaches a threshold where the annual withdrawal amount is 4% of the total balance, quit your job and live off of your investment returns.

If you invest aggressively and have a fairly lucrative job, you can easily reach FIRE in your early to mid-30s and never “work” again. Sounds pretty FIRE, right?

I’m not too sure. Let’s dive in.

Not-so-FIRE Misconceptions

First, I believe the FIRE movement can be a great strategy for helping people achieve their life goals. At the very least, it helps people invest. However, no one talks about what comes after you make the money, as well as the opportunity cost of investing every extra dollar.

I’ve spent some time browsing the financial independence subreddit page, and there is a lot of great content there to help people reach their financial goals. However, many users also perpetuate two toxic ideas:

Work is a horrible thing that must be endured until it can be escaped for good.

FIRE is the end goal. The conversation stops there.

I’m going to break these ideas down a bit.

Work Sucks, Right?

It’s true, a lot of people hate working. That doesn’t mean work itself is horrible. It might mean your job sucks though. A lot of people like their jobs. My roommate Chase works 80 hours a week in commercial real estate, and he lives for that stuff. Realistically he’ll be able to retire at 30 if he wants, but there’s no way that happens because he enjoys it too much.

Another one of my friends, Nick, works for Dick’s Sporting Goods in Pittsburgh. He gets to travel all over the country expanding product lines and opening super stores in new cities. He loves his job and team.

Another one of my friends, Conrad, started his own sports-media company. He probably works 80-100 hours a week on this company, and he wouldn’t have it any other way.

Plenty of jobs suck. Work itself doesn’t suck. A ton of people find their jobs satisfying and fulfilling. If you find yourself in a state of existential dread every Sunday because of work in the morning, consider taking another job before taking a personal vendetta against the labor force itself.

Financial Independence Is a Step, Not the Goal

Here’s the real kicker that people miss. If the final goal is financial independence, you’re probably going to be disappointed when you get there. Sure, it’ll be sweet, sweet victory at first. But we are goal-oriented people. Say you spend your 20s and early 30s dedicating all of your efforts to “escaping the corporate grind.” After a decade, you make it. You won! No longer a slave to corporate America. Or at least that’s how it’s presented.

And then what?

You’re a 33 year old millionaire who never has to work again. Now what?

Sip mojitos on the beach for the rest of your life?

Chase waterfalls?

Play golf every day?

The problem with setting FIRE as your end goal is that you may lack purpose once you hit that target. Ernie Zelinkski wrote in his book How to Retire Happy, Wild, and Free:

“Regardless of how talented you are and how successful you are in the workplace, there is some danger that you will not be as happy and satisfied as you hope to be in retirement…What may be missing is a sense of purpose and some meaning to your life. Put another way, you will want to keep growing as an individual instead of remaining stagnant.”

We humans need something to work towards. Something to build or create. Some struggle to overcome. If your end goal is to escape work, you’ll find the latter half of your life pretty dull.

Take this blog from writer “livingafi” as an example of this phenomenon. He retired early in 2015. After two years of “living the dream”, early retirement started losing its luster. His friends were making more money as their careers progressed, and he had less and less in common with his peers. They were spending more and more on houses, cars, and lavish vacations, while he was strapped to continue living off of his retirement withdrawals. His relationships deteriorated, and he found himself facing massive voids in his life.

If you don’t take the time to think about the post-FIRE life, you might find yourself bored and lost. What’s going to be your drive once the money has been made?

Opportunity Cost

A dollar today is worth more than a dollar tomorrow. An additional $1,000 invested at age 24 is the equivalent of $31,400 at age 64 (assuming a 9% average rate of return for 40 years). Spending that $1,000 at 24 would be incredibly short-sighted, right? That depends.

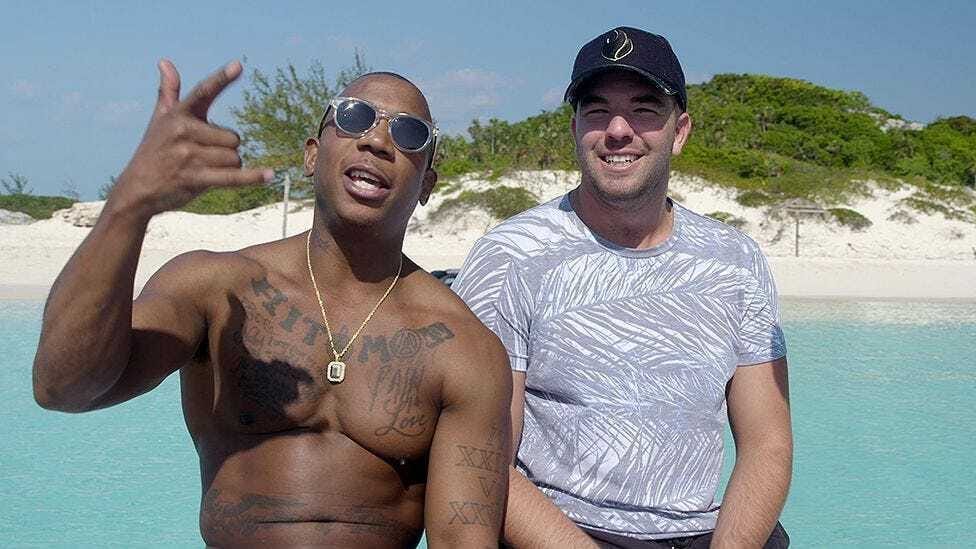

It’s true, every $1,000 invested now is over $30,000 in forty years. But don’t let that stop you from making memories now. If that $1,000 could be spent on a ski trip with friends, do you really want to miss out on that? A road trip out west? Countless concerts, sporting events, and nights out with people you care about?

Don’t be like this guy who was so focused on building his net worth that he forgot to live a little. Here’s the deal: it’s okay to spend money. The amount that you want to invest is up to you. The ideal retirement date is up to you. You do need to save for retirement. That being said, the idea that every single extra dollar should go towards retirement is toxic. Don’t miss out on the present because you’re stuck staring at the future.

So What Do We Do?

Save your money, and allocate what you are comfortable with for retirement. If you start early, a little money can go a long way.

Instead of looking at work as some activity that you need to escape permanently, take a more holistic approach. Maybe your job isn’t engaging or your hours suck. Inquire about new projects, or take something new altogether. If you’re unhappy and lack purpose now, these struggles won’t magically disappear once you quit your job.

If you are determined to retire early, figure out your why and what. Why do you want to leave the workforce? What are you going to do afterwards? If you don’t plan that out, you will likely face the boredom and identity crisis that strikes other early retirees. If you can find new venues to channel your creative and productive abilities, you’ll be alright.

Yes, This Post Is Ironic

I just wrote 1300 words about why FIRE is overrated and work isn’t that bad, even though I literally quit my job to move to Europe lol. I don’t mind working, I just wanted to get out and see the world before grad school next year. I think it’s important to find satisfying work, and I imagine I’ll be ready to get back at it soon enough.

That’s all for today, enjoy the (almost) weekend amigos.

Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!