Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

In 1962, Yale economics student Fred Smith wrote an undergraduate research paper about the automation of society and the transportation of goods. Nine years later, after a stint in the Marine Corps, Smith took the ideas first outlined in this research paper to found Federal Express.

Initially funded by a $4M inheritance and $80M in debt and equity investments, FedEx quickly grew from an eight-plane operation to a logistics network spanning the continental US.

While business was booming, the company struggled to keep pace with rising fuel costs. Suffocating in debt, FedEx resorted to extreme measures such as pilots using personal credit cards for fuel and uncashed paychecks to stay afloat.

It didn't matter, nothing could stop the bleeding. In 1973, FedEx had just $5,000 left in the bank. Fred Smith pitched one of their investors, General Dynamics, for additional funding, but his appeal was rejected. FedEx wasn't going to have enough cash to fuel their planes for another week, and the business would soon shut down.

What does one do when they need to create thousands of dollars out of thin air?

Take a trip to Sin City and roll the dice.

Instead of flying home after his meeting with General Dynamics, Smith withdrew the company's remaining cash and headed to Las Vegas for a night.

His game of choice?

Blackjack.

Fortune favors the bold, and Smith had a hot hand that night. 24 hours and $27,000 later, Fred wired all of the funds back to FedEx's bank account, and they were able to keep the lights on for another week.

After his Vegas detour, Smith successfully raised $11M in additional capital, and they turned profitable in 1976.

In the aftermath of this Vegas trip, Roger Frock, a former senior vice president of operations at FedEx, asked Smith, "You mean you took our last $5,000 — how could you do that?"

Smith simply replied, "What difference does it make? Without the funds for the fuel companies, we couldn't have flown anyway."

44 years after his infamous trip to Sin City, Smith didn't regret a thing.

In an essay published by Forbes, Smith wrote, "No business school graduate would recommend gambling as a financial strategy, but sometimes it pays to be a little crazy early in your career."

Sources for the story can be found here and here.

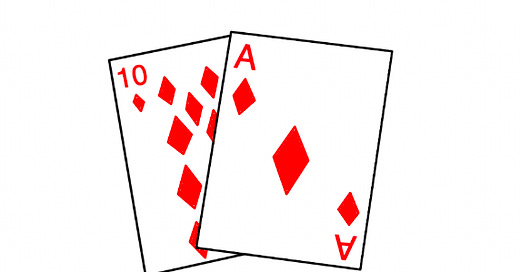

FedEx, a $60B global logistics behemoth, only exists today because 50 years ago, with his company's last $5,000 on the table, Fred Smith was dealt an Ace - 10.

Obviously, management execution played an outsized role in FedEx's success, but none of that execution would have mattered had Smith instead been dealt a 10 - 17.

Shocking, isn't it? That one small event, a single card drawn by a Las Vegas dealer, could be worth $60B 40 years later.

But this shocking anecdote is more common than you would think. The truth is, every massive success story is one lucky (or unlucky) draw away from failure.

Tesla, now the world's most valuable automaker, was a month away from bankruptcy while trying to mass-produce the Model 3 before they raised $2B in 2019.

In 1997, with Apple in deep financial trouble, Steve Jobs struck a deal with Bill Gates for Microsoft to invest $150M in its competitor. Gates likely only made this investment to appease the Department of Justice's antitrust inquiries about his company.

In early 2000, just one month before the Dot Com crash, Amazon sold $672M in convertible bonds on the European markets. Then-CFO Warren Jenson wanted a stronger cash position to hedge against suppliers requesting quicker payments. Had the e-commerce giant waited just two weeks later, it would likely be remembered as another Pets.com.

One hiccup in Tesla's production, a bit of pettiness from Bill Gates, or a week's hesitation by Warren Jenson, and we could live in a world with no Teslas, no iPhones, and no Amazon Prime. Instead, these three companies are worth trillions of dollars.

A lot of credit is given to Jobs, Musk, and Bezos, and that credit is well-deserved. But all three of their companies were one roll of the dice away from failure. From companies to individuals, luck and skill both play roles in success and failure. The problem is that we cannot weigh the importance of either trait.

The unknown importance of luck is overlooked when we study and emulate winners. Case studies on Amazon focus on Bezos's bias towards experimenting with different ideas. The former CEO called Amazon "the best place in the world to fail," as he believed that failures like the Fire Phone were an inevitable ingredient when you are swinging for home runs like Amazon Web Services.

And Bezos is correct, but none of those home runs would have been possible without a timely capital raise in 2000.

For the last 20 years, Tiger Global was championed as the king of venture capital, and Tiger earned that title. After all, they earned their investors a record-setting $10.4B in 2020. They were early investors in Alibaba, Facebook, Coinbase, Linkedin, and Spotify, among other tech giants.

Tiger Global's hedge fund also suffered a 52% decline in the first half of 2022 alone, after a lackluster 2021. Obviously, Chase Coleman and company are phenomenal investors; how else would they have done so well over the past two decades?

But Tiger's tech-heavy bets also coincided with a decade-long period of valuation expansion coupled with the mass global adoption of internet technologies. How much of their success was investor prowess? How much of it was a favorable market? Maybe their investor prowess allowed them to foresee the coming bull run in technology companies, but it didn't help them avoid the 2022 downturn.

On the opposite end of the spectrum, we have Benjamin Graham. The "father of value investing," Graham took a strict, value-heavy approach to investing. No position would be greater than 5% of his portfolio, and no position would be held once it outgrew his threshold for "value investments."

Graham broke this rule one time when an insurance company called "GEICO" became a 20% holding in his portfolio. And he held for a long time.

GEICO generated greater returns than the rest of his investments combined.

If the NASDAQ's average PE ratio doesn't climb from 9 in 2011 to 29 in 2022, how does Tiger Global perform? If Graham didn't hold an outsized position in GEICO, would we still be talking about him today?

Luck vs. skill. It's impossible to weigh the two.

Not every failure is one roll of the dice away from being a success, but every single success was, at one time, a single roll of the dice away from being a failure. When evaluating "winners," it is important to study what they did well just as much as what they luckily avoided.

The thing is, it's pretty hard to study what didn't happen, isn't it?

- Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!