Homeownership: American Dream or Financial Nightmare?

A crash course on renting, buying, and everything you should know about where you live.

Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

Disclaimer: There’s a ~20% chance that you’re going to disagree with everything that I’m about to say. That’s a good thing.

The “American Dream” was first coined by writer and historian James Truslow Adams in his best-selling 1931 book “Epic of America.” He described it as "that dream of a land in which life should be better and richer and fuller for everyone, with opportunity for each according to ability or achievement." 90 years later, it has become a cliché. We have this template for the modern American Dream:

Graduate from college

Start working for a good company

Get married

Buy a house

Have kids

Work for ~40 years

Retire and live out your golden years in a retirement community in Florida

The American Dream.

The core tenet of today’s American Dream is homeownership. This idea really took hold after World War II when millions of soldiers returned to a booming economy, and suburban life exploded. Today, Americans really want to own homes. 91% of Americans say they would like to own a home at some point in their lives, myself included. Homeownership can be a great thing, but it can also be a financial pitfall. When, why, and how should choose buying vs. renting?

Benefits of Buying a Home

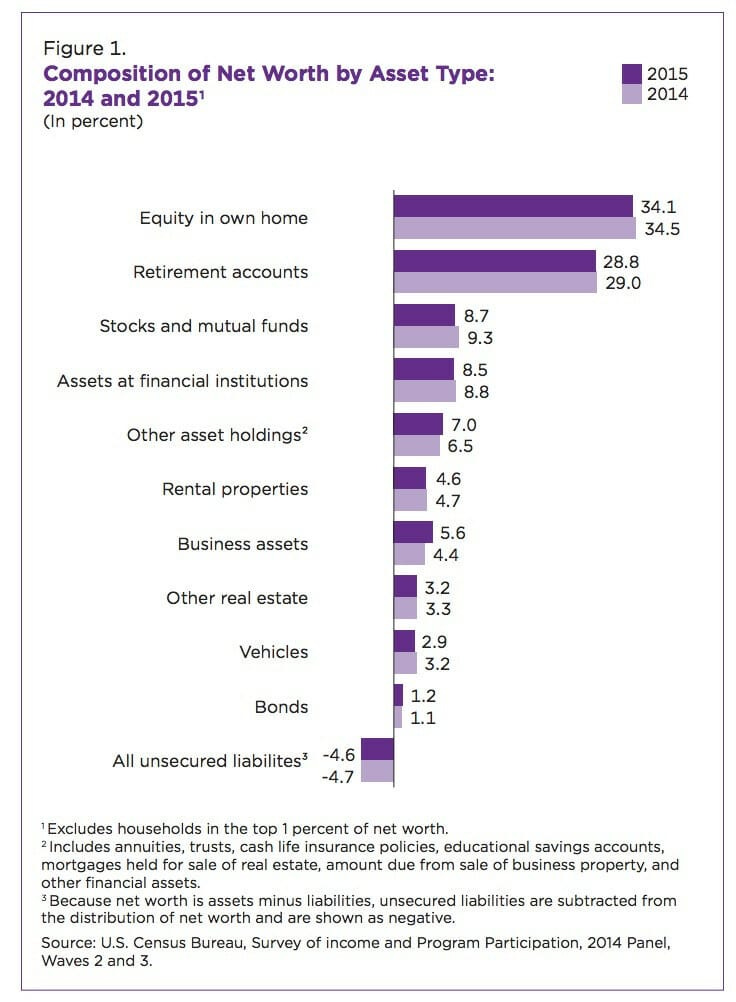

The biggest pro-homeownership argument is obvious: it makes Americans rich. Homeownership is the top contributor of household wealth in the US.

House prices have appreciated by an average of 3.7% annually since 1928, and more than one third of US household wealth is generated from homeownership. Everyday Americans creating wealth is a beautiful thing, and homeownership will likely remain the top driver for the foreseeable future. Why is homeownership so prevalent in the US?

Because it’s easy to buy a house. While houses are currently more expensive than ever…

…interest rates have never been lower.

You may pay a lot for your house over time, but your monthly payments have never been cheaper. If you have a job and you can cough up enough cash for the down payment, you can buy a house right now.

Homeownership also gives you control. A house costs a lot of money, but it is your piece of property. When you own your home you don’t have to answer to landlords, deal with unruly roommates, or worry about renewing your lease each year.

Pride matters, too. Owning a home is the ultimate status signal in America. When you buy a house, you are showing the world that you made it. All of that being said, it often makes more sense to rent.

Renting vs. Buying

When you rent, lease payments are the maximum that you will pay to live. When you buy, mortgage payments are the minimum that you will pay to live. I rent a townhouse in Buckhead right now. If we have a plumbing issue, I call my landlord. Washing machine breaks? landlord. Faulty wiring? landlord. You get the idea.

Now flip it around. Say I bought the same house in Buckhead. Plumbing issues, broken washing machine, faulty wiring? I am the landlord. Mo’ home equity, mo’ problems.

When you choose to rent, you sacrifice equity for flexibility and convenience. I have 12 months left on my lease, and I pay $950 a month. When my lease is up, I can renew it or move somewhere else with no issues. If I relocate for work before my lease is up, I can sublease to someone else, negotiate an early termination with my landlord, or at worst bite the bullet and pay the rest of my lease. My maximum loss in any case is a few thousand dollars.

Now imagine I took out a 30-year mortgage on the same property. I’m locked in, baby. What happens if I get a job offer in Washington D.C.? What if I want to move to Denver? What if I want to buy a one-way ticket to Europe and travel the world for a year? I still have that $300,000 bank loan that has to be paid back. Yeah, I can sell the house and use the proceeds to pay off the mortgage, but that is a lengthy process with no guarantee of turning a profit. If you are seriously considering buying a home for your personal residence, you need to be comfortable staying in that location for a while. It’s not impossible to move, but you would save yourself a lot of trouble by renting instead.

There is a popular narrative that renting is throwing money down the drain. You’re paying someone else for a place to live, instead of building equity in the house yourself. This argument sounds good, but it’s a shallow take. You can’t treat every purchase as an investment.

Vehicles are depreciating assets, but we buy them for transportation. Food is hardly an investment, but we buy it every single day for nourishment. Hotel rooms don’t provide any return on equity, but we reserve them for vacations. Almost every purchase that we make serves some utility: it fulfills a need or want in our lives. It’s great that home owners built equity through their houses, but it’s okay for renters to choose convenience and flexibility over equity. You aren’t “throwing money away” when you buy a car, order Chipotle, rent an RV, or buy a plane ticket. You aren’t throwing money away when you rent a house either. I’m not building equity in a house right now, but I am building equity somewhere else: the stock market.

Where Else Can You Put Your Money?

There is an opportunity cost to buying a home: the stock market outperforms the housing market. Say you planned to purchase a home in 1975, and you paid a $50,000 down payment. By 2013, your home would have appreciated by four-fold, and that $50,000 down payment would be worth $250,000. However, if you had invested that same $50,000 in the S&P 500, it would be worth $800,000. Why? Because the stock market appreciates at an average of 9.5% per year vs. 3.7% annually for houses. Renting and choosing to invest the down payment would produce an additional $550,000 over time. We tend to compartmentalize our finances, but occasionally it’s a good exercise to look at all of your money holistically. If renting and buying both provide you a place to live, where can you earn the most return on your $$$?

How to Turn Your Home into an Investment

Before the pro-home buyer base jumps on me, you can turn a home into a cash flow positive investment if you play your cards right. Here are a couple of examples how:

Purchase a multi-bedroom home and let your roommates pay off the mortgage. If you’re a 20-something living in the same town as a lot of your friends, you can be your own landlord. If you put $60,000 down on a $300,000 house with a 2.85% 30 year mortgage, your monthly payments will be $1,255. Charge $1,000 a month to two roommates and you are netting $745 a month profit. You now live in a “free” house thanks to your roommates, and you are free to spend or invest the leftover cash as you wish.

Purchase a home for the sole purpose of leasing to others. Similar to the last example, you can buy a home in a city or college town and rent it to 3-4 tenants each year. However, this time you won’t live in the house yourself. Using the last house as an example, you can charge 3 tenants $1,000 each and turn a $1,745 profit each month on your rental property. That’s nuts.

If you go into homeownership with an investor mindset, you can generate quality returns on your capital.

Closing Thoughts

Outside of marriage and kids, buying a home is one of the biggest decisions that most people make in their lives. Deciding to purchase a house ties up your capital, your time, and your ability to relocate. That being said, owning a piece of property comes with its own perks. My advice: don’t buy a house unless you are confident with where you want to live and what you want to do. If you insist on buying a home in your 20s, turn it into an investment.

Homeownership is great, but there’s nothing wrong with choosing convenience over equity and letting your landlord handle everything else.

- Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!