Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

Richard Matheson's hit post-apocalyptic novel, I Am Legend, tells the story of Robert Neville, the last man on Earth. In this story, a vampiric plague decimated the planet, claiming the lives of Neville's wife, daughter, and neighbors, turning them into pale, blood-sucking creatures.

Fueled by a desire for both vengeance and self-preservation, Neville spent three years hunting, killing, and experimenting on these vampires. During the day, while the vampires rested in comatose, he drove stakes through their hearts, injected them with different concoctions, and took them captive for interrogation.

One afternoon, while wandering around the outskirts of town, Neville was shocked to see a living, breathing woman walking across a field. It had been years since Robert had seen one of his own, and he cautiously brought her back to his home.

The bond between Robert and this woman, Ruth, grew stronger as the two strangers became companions and lovers. Still, Robert couldn't shake the fact that Ruth might not be who she said she was. He hadn't seen another human in years, after all. What if she was simply a vampire who was resistant to daylight?

No longer able to suppress his concerns, he asked to test her blood for vampiris bacillus. She cautiously agreed, and Robert swore to help cure her if she tested positive.

As Robert leaned toward his microscope to examine the sample, she begged him not to look at the results, but it was too late.

Neville collapsed to the floor as a mallet cracked against his skull, and his vision went black as Ruth stood over him, quietly sobbing.

Neville awoke the next day with Ruth nowhere to be found, but she had left behind a note.

Ruth explained that she was part of a group of vampires who had discovered a drug that staved off the effects of the vampiris bacillus, allowing them to survive their infections. While most vampires that Neville had encountered were reanimated corpses, Ruth and the other "living" vampires retained their intelligence and emotions, and they had begun to form a new society. Ruth was sent by the group to spy on Robert, a task that she relished as Robert had killed her husband. However, Ruth later realized that Robert was only doing what he had to do to survive, no different from her group.

In order to rebuild society, this newly formed group of living vampires sought to exterminate the dead vampires and humans alike, and Ruth warned Robert to flee before they came for him.

But Robert didn't flee, and they eventually came for him by night. Robert opened fire on the intruders as they stormed through his front door, but he was wounded by return fire and taken prisoner.

Robert awoke to Ruth visiting him in a prison cell, and she informed him that their new justice council had voted to have him executed. Ruth had come to console her former lover, and she offered him a suicide pill for a painless death.

Robert had spent the last three years fighting vampires, desperately clinging to any semblance of his old life. But in this moment, as the judgement of this new society weighed on him, he realized that *he* was now the monster.

In his own mind, Robert was humanity's last hope, a hero struggling to survive in a world that had gone to hell. He rationalized his actions, no matter how cruel, as part of his fight to preserve this humanity. The ends always justified the means. But to this new world, to this new society, Robert was the evil being that hunted their husbands and wives, friends and family.

No one is a villain in their own mind, and Robert had spent years searching for a cure, attempting to cleanse the world of this vampiric disease. But to this new vampiric order, Robert was the disease that needed to be cleansed.

Sam Bankman-Fried (SBF) was crypto's golden boy. In an industry plagued by greed and fraud, SBF was the lovable nerd running one of crypto's most-trusted exchanges.

While many newly-minted crypto-millionaires led lavish lifestyles, screaming "Have fun staying poor!" at the suckers who missed out on the digital gold rush, Bankman-Fried slept on beanbags in his office, drove a used Corolla, and played League of Legends.

Unlike many of his contemporaries, Sam publicly denounced materialism and embraced a more wholesome philosophy: Effective Altruism.

Effective altruism is a research field and practical community that aims to find the best ways to help others, and put them into practice. The most efficient form of effective altruism? Make as much money as possible so you can have the largest impact possible.

Sure, if you have $100,000 you can make charitable donations and buy some Christmas presents for the less fortunate. But if you have $100,000,000,000? You can cure malaria, purify water supplies, and fight global hunger.

Sam wanted to make as much money as possible to help as many people as possible.

And he was well on his way to achieve this goal, for a while at least. SBF's Alameda Research, a quantitative trading firm, (allegedly) made millions through bitcoin arbitrage on the Asian markets. The crypto wizard followed this performance with an even more impressive second act: building a $32B crypto exchange, FTX, in just three years.

As crypto platform after crypto platform imploded over the last year, SBF came to the rescue: bailing out and acquiring company after company. The king of crypto was infallible.

And then the music stopped last week. It turns out that the crypto's golden boy was tainted: SBF had quietly transferred $10B in customer funds from FTX to Alameda to patch up the 11-digit hole in the trading group's balance sheet, and clients seeking to withdraw their capital from the exchange were shocked to find out that their money had disappeared.

In The Dark Knight, Harvey Dent told Bruce Wayne, "You either die a hero, or live long enough to see yourself become a villain."

No one ever sets out to become the bad guy, but SBF's villain arc began last week.

So how did this fall from grace happen so quickly? While I can never be certain about someone else's intentions, I have an idea.

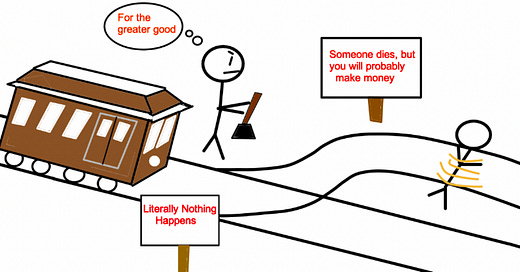

Sam would need a lot money to maximize his impact as an "effective altruist", and if Alameda went under, his net worth would crash with it, rendering his altruism ineffective. His quantitative firm had an existential hole on its balance sheet, and Sam weighed his options and decided that the best course of action was to misappropriate client funds to bail out his trading group.

He probably thought that with a cash infusion, they could generate enough profits to recapitalize Alameda and move the original funds back to FTX. No harm, no foul. And maybe this would have worked if clients didn't attempt to withdraw $6B from the exchange in 72 hours.

But we'll never know, because clients did attempt to withdraw $6B from FTX after Binance's CEO sounded the alarm, and all hell broke loose when the money wasn't there.

Secretly moving $10B of client money is, objectively, a really bad thing. And in 2021, if you had asked Sam if he would ever secretly move $10B of client money, his response would probably have been, "Of course not!"

But the human mind has a remarkable ability to rationalize in times of crisis, and previously unthinkable actions become quite thinkable when circumstances are dire. If the "effective altruist" knows that his dream will evaporate if his trading firm crashes, he will do anything to keep that firm alive, even if that means misusing customer funds. And he can convince himself that everything will be just fine because they'll move the client money back after generating enough cash to save Alameda.

In his own mind, Sam wasn't making a selfish decision. Quite the opposite! He was taking this risk in order to help as many other people as possible! This was admirable, really.

And a series of rationalizations like this can lead ordinary people to make really, really bad decisions.

No one is a villain in their own mind, and we all believe that the ends justify the means in all of our decisions. The stories that we tell ourselves can be quite seductive.

But when the outcomes of these rationalizations hurt others, no one cares about your "good intentions", "apologies", or "mistakes".

No one cared about Robert Neville's search for a cure when this search led to the deaths of their friends and family. No one cares about Sam's effective altruism when it costs them $10B.

But let's be real, "altruism" was never compatible with fraud in the first place, and neither the court of public opinion nor the court of law takes kindly to "good intentions" gone wrong.

- Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!

Jack's Picks

Finance 101 says that when interest rates go up, the net present value of future cash flows declines. Packy McCormick wrote an interesting piece on how we discount "belief" similarly, especially in long-shot investments.

Morgan Housel's recent piece on capturing "attention" is a great read for any writers out there.