Did Judas Iscariot Make the Worst Deal in History?

Judas had an all-time bag fumble, but was it the worst in history?

Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

For the 2 billion or so Christians on the planet, Easter Sunday commemorates the Bible’s most important event: Jesus Christ hitting death with an all-time pump fake and ditching the tomb.

Naturally, we celebrate this by taking pictures with grown men in bunny costumes and sending children on scavenger hunts for candy and cash-filled eggs. Holidays are weird.

As someone who grew up in the church, the resurrection story has been long-ingrained in my memory. However, I have always found the events that led to Jesus’s arrest and eventual crucifixion to be just as interesting as the resurrection itself.

For those who are unaware, in the days leading up to his death, Jesus was betrayed by one of his disciples, Judas. To quote Matthew chapter 26:

“Then one of the Twelve—the one called Judas Iscariot—went to the chief priests 15 and asked, “What are you willing to give me if I deliver him over to you?” So they counted out for him thirty pieces of silver. 16 From then on Judas watched for an opportunity to hand him over.”

30 pieces of silver for one of your “best friends” who also happens to be the Son of God. That couldn’t be a good deal, right?

So the other day, I decided to Google, “How much would 30 pieces of silver be worth today?”

It turns out that In 2021 dollars, these 30 pieces of silver would be worth between $91 and $441, depending on the purity of said coins.

This has to be one of the worst trades of all time. Like, you’ve seen this man walk on water and heal blind men. He literally brought one of his boys back from the dead. The religious leaders of Israel saw him as an existential threat. Considering that the FBI offers $100,000+ for the capture of individuals on its “10 Most Wanted” list, Jesus’s market value had to be, what, at least $300,000?

Like, if you’re going to be the guy who commits a betrayal so heinous that your name becomes synonymous with “back-stabber,” you should at least get paid appropriately for your treachery. But nope, Judas, who also happened to be the treasurer of the disciples, thought, “Hmm, yep he’s probably worth like $150! That makes sense.”

My man literally sold the Son of God for an Uber from JFK to Manhattan during rush hour traffic.

So yeah, morality and religion aside, Judas had one of the biggest bag fumbles in history. But was this the worst deal ever? Let’s see.

The Alaska Trade

The Russian Empire first laid claim to Alaska in the 1740s, and their new territory initially prospered in the fur trade. However, few Russians ever settled here, and Alexander II realized that it would be difficult to defend Alaska from the British Empire if war broke out.

In 1867, after the American Civil War had ended, US Secretary of State William Seward brokered a deal to buy the state for $7.2M, or $140M in 2021 dollars. In the US, reception was generally positive as Americans hoped that Alaska could be used to expand trade with Asia. However, some referred to the deal as “Seward’s Folly,” claiming that the US had acquired useless land.

The thing is, an industrial breakthrough was on the verge of changing the world, and Alaska would be one of its biggest beneficiaries.

In 1859, Edwin Drake created the first modern deep oil drill, and just three years after America acquired Alaska, JD Rockefeller founded Standard Oil, soon to be one of the largest companies in the world.

By the turn of the century, automobile adoption exploded, developed nations rapidly industrialized, and the wheels of progress and innovation were fueled by one thing: oil.

And in 1957, 90 years after Alaska switched hands, we discovered that it happened to be full of the world’s most valuable resource. Alaska is now the 4th highest oil-producing state in the US, producing 160M barrels in 2021.

The state would likely be worth trillions for the value of its oil reserves alone, but it was instead sold for less than $1 per barrel of oil produced last year.

Talk about poor timing by the Russians.

Jack Dorsey’s NFT

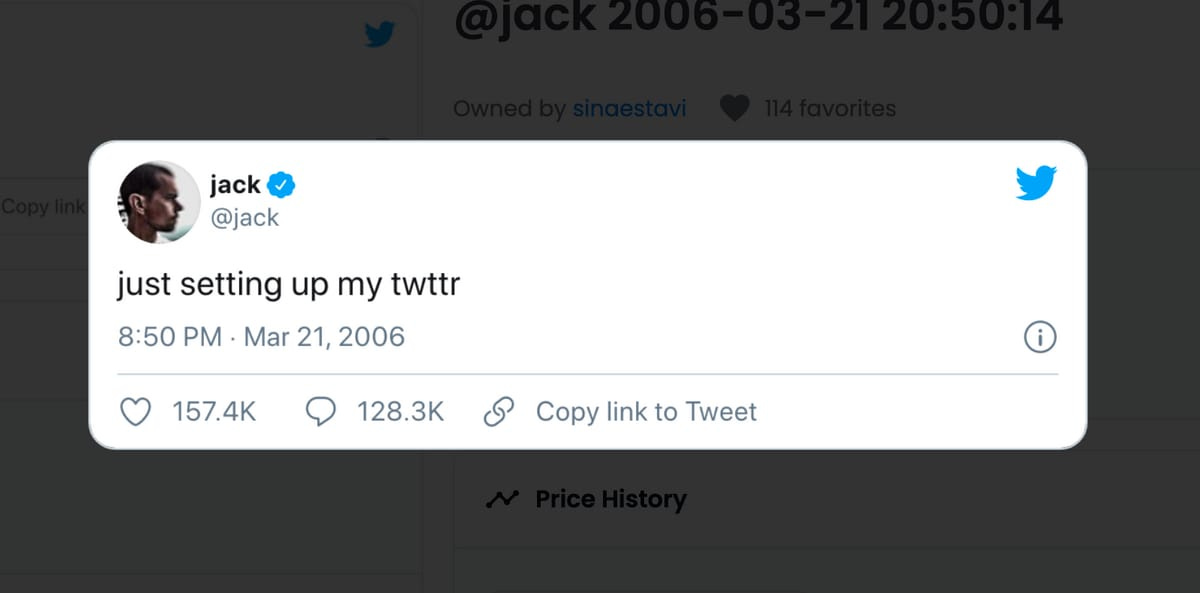

In March 2021, at the peak of the crypto / web3 hype, “crypto entrepreneur” Sina Estavi made history by purchasing an NFT of Jack Dorsey’s first tweet (seen below) for $2.9M.

After purchasing his new digital artifact, Estavi told CNBC, “By bidding on Jack Dorsey’s first tweet of history and Elon Musk’s NFT, I wanted to emphasize the importance of NFTs on the future of crypto and tech sphere.”

If you could go back and pay $2.9M for the Mona Lisa, you would do that in a heartbeat, right? Same logic applies here, I guess. Idk.

A year later, Sina listed this NFT for sale for an astonishing $48M, saying that he would donate $25M of the proceeds to charity, but the auction closed a week later with just seven bids ranging from $6 to $277.

Not $277M.

Not $277,000.

$277. Period.

Facing a 99.99999% markdown on his “investment,” Estavi told CoinDesk the same thing any of us would say if we wanted to avoid taking responsibility for making one of the most egregious financial decisions of the decade:

“The deadline I set was over, but if I get a good offer, I might accept it, I might never sell it.”

Down horrendous.

Yahoo!’s Broadcast Debacle

In 1994, Mark Cuban and his friend Todd Wagner founded AudioNet.com as a solution for sports fans who wanted to listen to out-of-town games over internet radio. Their coverage quickly extended to include presidential debates and other live events, and they rebranded as Broadcast.com before going public in 1998, at the peak of the Dot Com Bubble.

Broadcast’s stock soared 250% on its first day as a public company, taking it to a $1B+ market valuation and giving Cuban a paper net worth of $300M.

One year later, Yahoo! acquired Broadcast for $5.7B in stock. At the time, Yahoo! was the biggest search engine on the web, and thanks to inflated valuations across the internet landscape, stock-based acquisitions were in vogue.

The thing is, the price just didn’t make any sense. Broadcast.com had 570,000 users at that time, meaning that Yahoo! paid $10,000 per user to acquire an internet radio broadcasting site. Not the most frugal purchase.

Still, the Dot Com Bubble kept bubbling, and by January of 2000, Yahoo! was worth more than $125B, making it the world’s most valuable company. But Cuban knew it was too good to be true.

Mark Cuban was paid in stock, not cash, and he worked with Goldman Sachs to create a hedge that would protect his wealth if the market did indeed crash.

Of course, we all know how this story ends. The tech bubble did end up crashing, Cuban managed to preserve most of his wealth thanks to this well-timed hedge, and Yahoo! shut down its broadcast services just three years after the purchase, cementing its $5.7B Broadcast.com acquisition as one of the worst deals of all time.

The Manhattan Trade

New York City was originally called “New Amsterdam,” as the Dutch were the first to establish a colony in the New York / New Jersey / Delaware / Connecticut area.

Soon after making landfall on America’s east coast, the Dutch began bartering with the local Lenape tribe. The Lenape lived in current-day Manhattan (which was originally called Manahatta, or “the place where we get bows,” by its native residents), and the Dutch soon realized how valuable this island would be as a central port.

Peter Minuit, the third director of New Netherland, wanted to legitimize Dutch ownership of the island, and he brokered a deal with the Lenape people to purchase “Manahatta.”

Urban legend has it that the island was sold for “$24 in trinkets,” though a letter written to the East Indian Company states that it was purchased for 60 guilders, or ~$1,143 in 2020 dollars.

Of course, $1,143 isn’t enough for a mid-tier Hell’s Kitchen studio apartment, and the total land value of Manhattan is estimated to be worth at least $1.74T, with a “t.”

In hindsight, this was a terrible deal by the local populace. However, Native American tribes didn’t view property rights in the same way as Europeans, they likely had no idea that they “sold the land,” and in 1641, a bloody war ensued that killed thousands of Lenape tribesmen and European settlers.

Shout out Peter Minuit, real estate legend.

The Bitcoin Pizza Dude

There have been a lot of bad deals in history, but nobody from Judas to the Lenape tribe has made a worse deal than Laszlo Hanyecs, the man who sold his bitcoin for a couple of pizzas.

On May 22, 2010, long before “Dogecoin” and the “metaverse” had ever been mentioned, bitcoin was only known by individuals who frequented the sparsely-populated crypto forums such as “Bitcointalk.org.”

Mr. Hanyecs was one of these individuals, and on this particular day, he and his family were craving some Papa John’s pizza. The problem was that Laszlo wanted to pay in bitcoin, and Papa John’s wouldn’t accept bitcoin as a payment, so he took to the internet for help.

Laszlo eventually agreed to pay 19-year-old Jeremy Sturdivant 10,000 BTC, or $41 at the time, to deliver two large pizzas to his house.

Obviously, bitcoin has done well over the last decade, and those 10,000 bitcoins would be worth $300,000,000 today. Not a great move in hindsight. But don’t worry, Sturdivant didn’t hold onto the crypto either: he spent his pizza payday on travel expenses with his girlfriend.

So yeah, Judas’s deal was pretty bad. But at least he didn’t spend $300,000,000 on two Papa John’s pizzas.

- Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!

Jack's Picks

The New York Times did a great job of covering the real energy cost of Bitcoin miners.

I’ve been enjoying Tim Urban’s latest book, What’s Our Problem?