Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

Financially Responsible

Here are some sentences about money that you have likely heard at some point:

"Be responsible with your money."

"Are you sure that you should be buying that?"

"Think about what else you could spend that same money on."

"You need to save more."

Here is the Venmo caption that I sent my roommate last weekend while we were celebrating one of our best friend's bachelor parties in Vegas.

"We are literally incinerating money."

Slightly different tone, no?

Everything about Las Vegas is expensive. The food is expensive. The drinks are even more expensive. Attractive servers walk around every bar and club on the strip offering bottles of Grey Goose at a 10x price mark up. Casinos themselves are covered in flashing lights and filled with cheers of lucky gamblers who hit it big on roulette and craps, and the environment is designed to fire up every dopamine receptor in your brain.

Las Vegas is an adult Disney World built to drain every last dollar from your wallet, and the house rarely loses.

Last weekend, my friends and I were no exception.

And guess what? That's okay. This isn't a post about being financially responsible, quite the opposite. This is a post about why you should occasionally be financially irresponsible.

It sounds counterintuitive, embracing irresponsible spending, but this is actually one of the most responsible things that you can do.

To understand my rationale, you need to understand that money's only purpose is to be spent. Period. End of discussion.

The question isn't, "What is the point of having money?" The questions are who spends it, what do they spend it on, and when do they spend it?

You can spend that money now, or you can spend it later. You can spend it on yourself, or you can spend it on others. You can leave it to family after you die. But money serves no purpose other than its ability to purchase things and experiences.

Narrative Violation

Before I keep going, I'm going to take a break to say this: It is important to have an emergency fund and retirement savings. You never know when you'll have an emergency (losing your job, medical issues, etc.), and you don't want to work forever. The rest of this article is about what happens after you have those covered.

Most financial advice boils down to, "Save as much money as possible so you are set for retirement." And that's great. But there are diminishing returns to saving for saving's sake, and it takes less money than you would think to prepare yourself for retirement.

If you save just $6,000 per year for 40 years, and the S&P maintains its historical 9% annual returns, you'll end up with $2.2M. $10,000 per year becomes $3.7M. And as your income increases, your invested capital per year can increase, and your portfolio at retirement can be exponentially higher.

If you have a job paying $60k+, then $6,000, or 10% of your income, isn't that much to invest every year.

But no one talks about what to do once you've saved enough, so we continue to save every extra dollar for the sake of saving. Here's a narrative violation:

If you find yourself constantly avoiding experiences because you don't want to "waste" money, you aren't being financially responsible. You are depriving your life of experiences in the name of "saving money."

It's a travesty that an all-encompassing aversion to spending money is considered the pinnacle of good financial behavior.

Here's a question for you: Are you going to get more satisfaction later in life if you skip that trip that your friends invited you on now? Obviously the money itself will be worth more down the road, but what about the value that you actually extract from it?

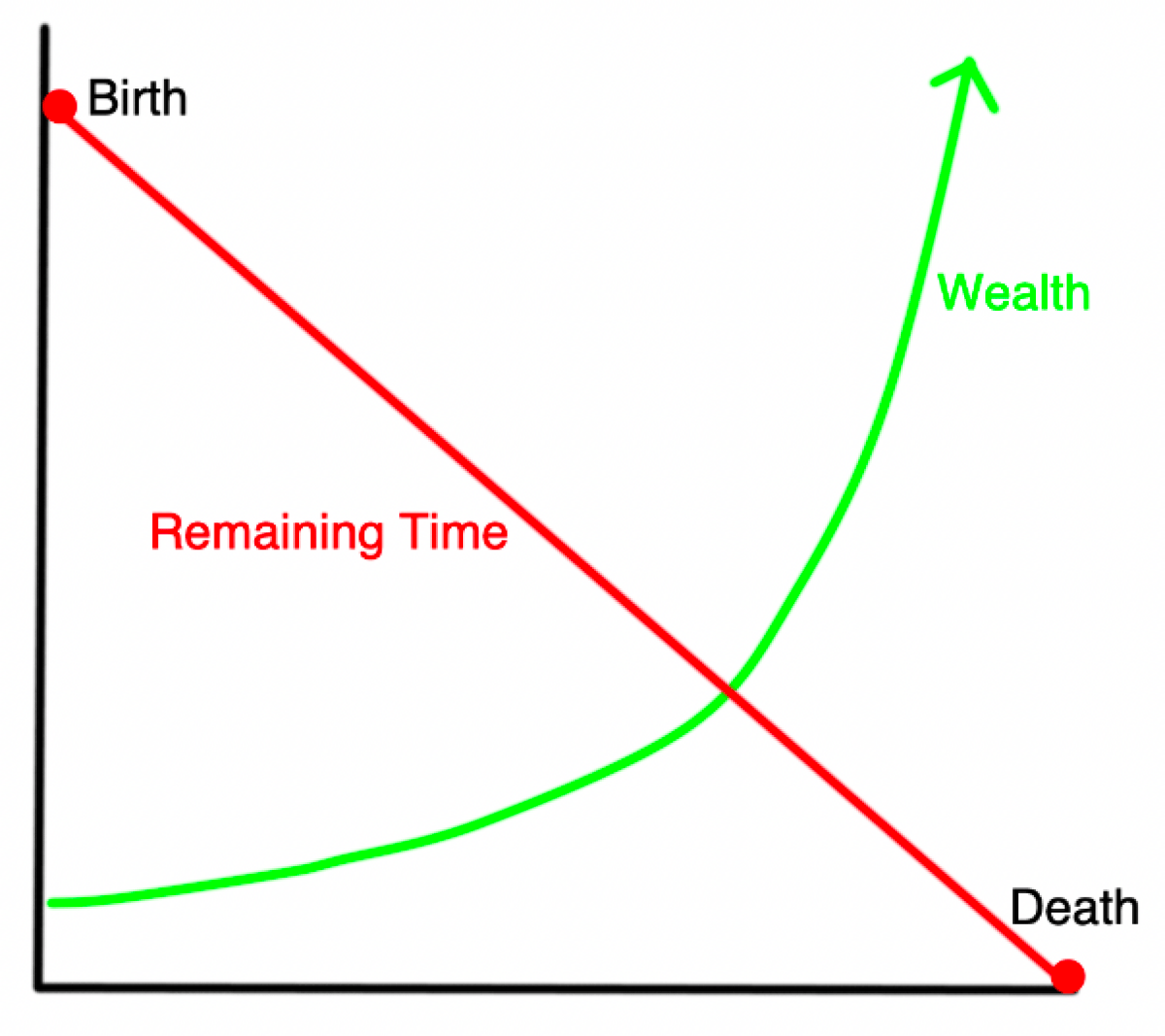

Time is a finite asset. Money is an infinite asset. As time goes on, your wealth will likely grow, but your opportunities to spend that money on rewarding experiences will decline.

There's no reward for saving the most money over the course of your life. You're a multi-millionaire when you die? Congrats. The priest isn't going to fist bump you in the coffin for having a ton of money leftover. You left chips on the table, and you'll never be able to cash them in. Hope it was worth it.

As I said earlier, it takes less money than you'd think to set yourself up for a good retirement. Over-saving beyond that point isn't financially responsible, it is experientially reckless.

Don't deprive your current life of experiences that you would enjoy to give your future self money that he doesn't need.

Just Make More Money

Balance is everything, and the key is to put yourself in a situation where your future is covered so that you can spend your excess money as you wish. This is simple in theory: Make enough money to cover your expenses and investments while still having some cash leftover.

Getting there is a bit more complicated. Traditional advice tells you to cut unnecessary costs.

"Oh, you're short on cash every month? Cut expenses." Make a strict budget, and follow it. Monitor your expenses. Watch out for lifestyle creep. Et cetera, et cetera.

Meanwhile, very little thought is given to the income side.

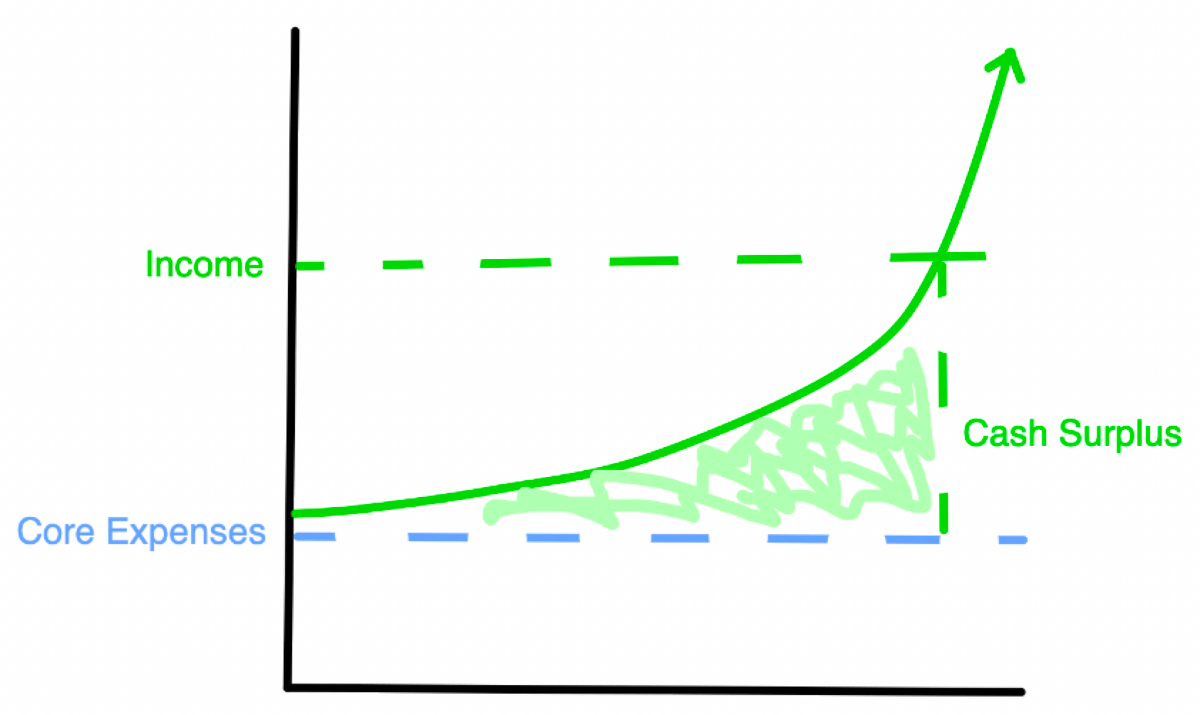

But that's entirely backwards, because there are limits to how much you can reduce your expenses. At a minimum, you will need to pay for rent/mortage, food, and transportation. If you want to have any social life whatsoever, that's going to cost you too. While the dollar amount varies from person to person, we all have core expenses that we have to pay, and you can't cut costs below your core expenses.

The real trick to expanding your dispensable cash is increasing your income. You can only cut costs by so much, but income can scale to infinity and beyond. The further your income is above your costs, the larger your cash surplus is.

Focusing on costs is a scarcity mindset. "Oh I can't go out tonight, it's too expensive." "Oh I want to go on that trip, but it costs so much!"

Flip the equation around. Instead of avoiding expensive experiences, focus on making enough money to afford them.

This isn't a message to throw caution to the wind and FOMO headfirst into every expensive invitation that you receive. But it is a message to stop thinking that it's necessary to avoid any and all expenses for the sake of being financially responsible. Expand your income, increase your dispensable cash, and do whatever you want.

Dispensable Income

Dispensable income is the goal, because it allows you to guiltlessly spend your money however you want. As the gap between your income and core expenses grows, you have the ability to spend your time and money as you wish without jeopardizing your future.

Once you reach that point, you have to give yourself the freedom to spend that cash without feeling guilty. Saving every last penny feels responsible, but you are fattening your bank account while starving your life.

In Greenlights, Matthew McConaughey said, "I’d rather lose money havin' fun than make money being bored." And that's the truth.

What are the three best experiences of your life? I doubt any of them involved you skipping out on something because you wanted to save a few dollars.

Acquire dispensable money and spend it on indispensable experiences. I can assure you that 60 years from now, I'll be glad that I spent a bit too much money on one of my best friend's bachelor parties. I certainly won't be regretting that I hadn't let it compound for 60 years at a 9% CAGR.

Light blue shirt is very engaged ❤️, I am very not-engaged 🤠

- Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!