Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

Allow me to explain how the stock market works.

Companies are entities that (typically) sell things to make money. Tesla sells cars (and occasionally carbon credits), Apple sells iPhones, McDonald's sells burgers, and Amazon sells everything. All of these companies that sell things are owned by someone, and sometimes these ownership stakes change hands:

Smaller companies are bought and sold in private transactions, similar to you or me buying a house or car.

Really big companies, on the other hand, have tons of owners who want to buy and sell their stakes at different times, so we needed a more efficient medium of exchange.

Enter: public markets.

Thanks to the stock market, buyers and sellers of companies' shares can transact in real-time. Maybe I think Amazon is overvalued, while you think it is undervalued. Through the stock market, I can instantly sell my stake in Amazon to you for $127 a share.

Of course, some would say, "Wait, those 'stocks' are worthless unless they issue dividends!" After all, without dividends, the stock is not providing me with any money. And when the only way to make money is by selling to someone else, aren't stocks just an example of Greater Fool Theory?

Not really, because your stock does actually represent the ownership of a real business.

An example: Let’s wind back the clock to July 2022, when Twitter, a company that generates billions in advertising revenue, was worth $28B and trading for ~$37 per share, and let’s say I own some shares in Twitter. Around this time, Elon Musk decided that he wanted to (read: was forced to after attempting to renege on his offer) pay $43B, or $54.20 per share, to acquire the entire company.

Because I own some stock in this company, Musk has to pay me $54.20 for each of my shares in order to purchase this company, and he is now the sole owner of this platform and its profits (or lack thereof).

We can argue back and forth over whether Twitter was worth $43B, just like we can debate the value of real estate or the price of a vehicle, but you can’t say that Twitter has 0 intrinsic value. It’s worth something because it either A) makes money or B) has the potential to do so.

The stock market is a multi-trillion-dollar marvel of financial engineering built on top of the real economy to allow the transfer of ownership, and transactions that previously took days can now be completed in seconds. Pretty cool, right?

Sometimes, investors are willing to pay really high prices for stocks! Other times, investors are not willing to pay very much for stocks. While prices fluctuate, the key is that these stock prices reflect what investors are willing to pay for an ownership stake in a real asset.

Now, let's imagine that we have another financial market that is very similar to the stock market. We can trade all sorts of assets with all sorts of tickers on this market, and these assets appear to be very similar to stocks! Sometimes, investors are collectively willing to pay high prices for these other assets, and other times, investors are not willing to pay very much for these assets.

We'll call this market the crypto market.

The crypto market has all sorts of interesting assets, from "blue chips" like Bitcoin and Ethereum, to meme coins like Doge and Shiba Inu (which is, of course, a derivative of Doge), to scalable tokens like Avax and Solana.

Bitcoin is the OG cryptocurrency, and it was created in response to the poor central banking practices that caused the Great Financial Crisis. While the government has printed trillions and the dollar continues to devalue, Bitcoin's fixed supply makes it anti-inflationary, and the cryptocurrency can't be manipulated.

After Bitcoin hit the scene, crypto's second-biggest player, Ethereum, was created. Ethereum is programmable money, a network that can execute the smart contracts that power decentralized finance. After Ethereum's launch, other scalable networks meant to be faster or more effective, such as Solana and Avalanche, were developed. And then other solutions were built on top of these preexisting networks, such as Polygon, a Layer 2 network built on top of Ethereum.

We also have "stablecoins", which are cryptocurrencies pegged to real currencies such as the US Dollar. These stablecoins use algorithms to remain pegged to their respective currencies, and they allow investors to exchange 1 stablecoin for $1 of their related cryptocurrency. 85 TerraUSD, for example, could have been exchanged for $85 in Luna, and Luna could be "burned" for 85 TerraUSD.

Some companies, such as Binance and FTX (Rest in pieces), issued their own tokens (BNB and FTT, respectively), that gave holders all sorts of benefits like discounted trading fees. Of course, these tokens didn’t actually represent ownership or equity stakes in the exchanges.

Think of them more like "membership" tokens.

Collectively, all of these various cryptocurrencies are worth ~ one trillion dollars, kinda like a smaller stock market! However, there is one small difference between the crypto market and the stock market.

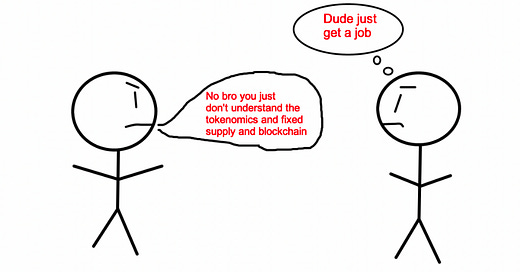

Stocks represent ownership of real assets. Cryptocurrencies? Not so much. In fact, the crypto world isn't really attached to the "real" economy at all.

So what determines the value of these assets? Stories, vibes, and ideas of what could be.

Inflation sucks thanks to the Fed, but Bitcoin is supposed to be a hedge! Let's buy $10,000 worth.

Ethereum is used to buy NFTs, and people are building all sorts of tools and protocols on the Ethereum blockchain. Since everyone is using Ethereum, might as well buy some Eth!

Oh, you can make 20% APY by "staking" your Luna? This is a much better return than simply depositing your cash in a savings account! Let's buy as much as possible.

The 20-something founder of a Bahamian crypto exchange sleeps on beanbags, loves gaming, refuses to shower, and might be on the spectrum? He must be a genius, let’s give him billions.

Different narratives such as these have followed all sorts of cryptocurrencies, tokens, NFTs, and DeFi protocols. And investors who believed these narratives poured money into these assets, and the prices climbed as a result.

The end result? We have countless different “assets” worth billions of dollars.

Now what?

Well, we should be able to use these digital assets as collateral against loans so we can buy and trade even more digital assets, right? If a house can be collateral for a mortgage, why can't a cryptocurrency be collateral for buying more cryptocurrencies?

So the narratives keep growing, the money keeps flowing, the prices keep rising, and the party keeps roaring. Let the good times roll.

Now let's take a step back.

Remember, the stock market was created because we needed a more effective way to buy and sell ownership stakes in companies. There was a problem, public markets were the solution.

Crypto, on the other hand, is a collection of "solutions" still looking for problems. A trillion-dollar industry that is trying to find its "use cases".

Amazon is worth around a trillion dollars as well, could you imagine if we were trying to figure out its "use cases"? Or what about Tesla? Microsoft? Apple? You get the idea.

"But cryptocurrencies shouldn't be compared to companies!" you might say. Very true, perhaps we could compare them to commodities? What is the use case of copper, oil, or wheat? Ah, yes, we use those to power our electronics, vehicles, and bodies.

Sure, several "use cases" have certainly been proposed:

Bitcoin could be an inflation hedge, or maybe even a new currency. How about NFTs as exclusive tickets to events? Perhaps yield farming is a better alternative to a savings account, because the interest rates are much higher.

But so far bitcoin has neither hedged for inflation nor proven to be a viable currency, NFTs are basically dead because you could just, you know, buy a ticket on your phone (??), and it turns out that "yield farming" only works when more money is coming in than going out, because someone has to be the yield!

So basically, the only "use cases" have been tools and exchanges that allow you to trade, lend against, and build on top of other cryptocurrencies that are looking for use cases. So of course, we now have multiple billion-dollar exchanges that allow you to trade these assets, crypto-lenders that promise outsized returns, and a dozen tools that were created on top of Ethereum and other blockchains.

Cool.

Over the last decade, crypto became a trillion-dollar asset class despite never finding a real "use case" (though I suppose you could buy drugs on the Silk Road for a while, and FTX single-handedly bankrolled half of the US’s professional sports leagues for a year). The prices went up as new money poured in, and people confused "price going up" for "value being created".

Engineers continued to build new assets and tools and protocols on top of these preexisting assets and tools and protocols. In the pursuit of ever-increasing yield, no one stopped to think "What is the endgame with this whole thing?" Why would they? The line goes up, it must be valuable.

And this whole thing works pretty well when prices are going up and interest rates are going down.

But stacking layer-upon-layer won't work forever when the foundational layer is powered by little more than FOMO, and when interest rates go up and prices go down, the whole system begins to collapse.

20% yields weren't sustainable, stablecoins weren't stable, and taking out loans against assets that weren't worth anything other than hopes, dreams, and FOMO was ill-advised.

It's like crypto is having its own '08 housing crisis, except the mortgaged homes were built in Minecraft instead of Miami.

Crypto came with a lot of promises.

It was supposed to eliminate the need for middlemen like banks.

It was supposed to hedge against inflation.

It was supposed to do a lot of things.

Instead, it failed at pretty much everything except enriching those who bought in early and sold near the top.

There are a lot of talented people working really hard to build something, anything, that does "work" in crypto. To find that use case that has some real staying power. But I think it's important to ask if we should even be trying to make this whole crypto thing work in the first place. Just because you "can" do something doesn't mean you "should".

Crypto is supposed to fix and improve an archaic, broken system. But does the system really need to be fixed?

The reality is that right now, you can pay next-to-nothing to invest your savings in a stock market that has historically averaged ~9% annualized returns. Is there a better example of democratized assets than Vanguard's index funds? If you want to swing for the fences, you can concentrate your investments in a few individual companies.

You can get a 5% risk-free return on treasury bills, where you don't have to worry about a 17-year-old from St. Petersburg stealing your savings if you click a spam link on Whatsapp.

If your FDIC-insured bank goes insolvent, your $250,000 is protected.

You can start a company that makes real money and sell it for real money, or you can work for a company that pays you real money to help it make real money.

And all of the "problems" with traditional finance? Those are features, not bugs.

The argument that "the dollar's value has collapsed by 99% over the last _____ years" completely misses how currencies are supposed to work in the first place. Nick Maggiulli explains it best:

Money is meant to be spent or invested, not held into perpetuity. It is a medium of exchange, not a store of value. You shouldn't be rewarded financially for holding a currency that doesn't do anything.

Of course, the idea that the dollar has collapsed by 99% isn't really all-that-true either, because your money would be just fine if you had bought T-Bills.

Yeah, there are some bad actors in "traditional" finance. Always have been, always will be. But we have FDIC insurance, heavily regulated financial markets, and a judicial system that prosecutes bad actors.

Crypto is the only sector that openly admits "Of course, 99% of our industry is grift and spam, but we aren't." Can you imagine if every single investor, consumer, and bank customer had to do their own due diligence about their checking and savings accounts to ensure that they wouldn't get rugpulled?

Crypto, in theory, works. In a perfect world, perhaps we could remove the middlemen, "own" our money, and ditch the government. But theory ignores reality. And reality is messy.

Byrne Hobart had a fantastic quote in a recent article:

"It's useful to distinguish between cryptocurrencies as a technology and the companies that use them. On the other hand, it's important not to draw that distinction too finely, since it amounts to distinguishing between crypto in theory and crypto in practice. It's like putting more weight on what Marx said a communist system would do than what Stalin or Mao actually did. In other words, technologies have to be evaluated in terms of what they do, not just what they promise."

Much like the Marxists in denial of the realities of communism, crypto's biggest supporters are quick to denounce every single NFT rugpull, stablecoin collapse, and exchange liquidity crisis by saying, "Well that isn't the real crypto!"

Well, what is the real crypto? How much longer is this going to take?

NASA was created in 1958, and we put a human being on the moon 11 years later. Bitcoin began circulating in 2009, and we can now do what? Buy a picture of a monkey for $500,000?

Are we really still "early"? Because crypto is almost old enough to get its driver's license, and so far, the “use cases” don’t look so hot.

The real world is pretty simple: build useful stuff that makes money. So far, crypto has been a series of increasingly more elaborate ways to move the same money between different people, with no new value actually being created. It’s a trillion-dollar zero-sum game.

Perhaps instead of trying to force a square peg in a round hole and recreate the greater financial system, we could simply embrace the functional one that we already have.

Or we could gamble on some dog coins.

- Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!

Jack's Picks

My man (and fellow newsletter writer) Olly Richards wrote a free 117-page case study about how he grew a $10M course business from scratch- Essential reading for my entrepreneurs out there, especially if you’re an educator, creator, or coach. Check it out here.

Matthew Ball wrote an excellent article explaining what it took for Big Tech companies to become the monsters they are today. Some of the highlights, such as how much Google pays Apple to be the default browser on iPhones, are wild.

Podcasts might be as smart as we think, according to Janan Ganesh.

Trung Phan explained how Spirit Halloween operates $650M business every October. Yes, they make over half-a-billion dollars in around a month.