Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

This is the first of two blog posts covering my broad thoughts on "money". Second half is dropping Thursday, I hope you enjoy.

The Time Value of Money is a core principle of finance that shows us how much the value of an investment will change between two points in time given an expected annual return.

By using the Time Value of Money, we can calculate that $10,000 invested for 40 years at average market returns (~9% per year) would yield $314,094. Put differently, the present value of $314,094 in 40 years is $10,000 today.

How much do you need to invest *right now* if you want $1,000,000 in 40 years, assuming 9% returns? By working backwards, we see that the answer $31,837.58.

(I've been crushing my corporate finance homework, if you can't tell).

The time value of money plays a role in every branch of finance. Mortgages and car loans are amortized over time. 401k plans suggest estimated contributions needed for your portfolio to hit your retirement goals. Investors discount the future cash flows of companies to estimate their fair values, and companies discount the future cash flows of projects to determine if they are worth undertaking.

The time value of money is also the basis for most mainstream personal finance advice: spend less now to have exponentially more later.

Over time, this has led to a deluge of advice that vilifies whimsical spending and deifies stinginess.

"Don't buy your coffee from Starbucks!" screams an army of Dave Ramsey acolytes. "That $50 per month will cost you $221,575 in 40 years!"

"Pour every nonessential dollar into your index funds!" shouts the FIRE movement's loudest supports. "Every dollar spent now just pushes your retirement back further."

And over time, well-meaning advice such as "Spend less than you make" has been warped into "Never spend or else." And when you preach this long enough, people begin to believe it.

I, like most young people, grew up viewing money as this scarce asset that should be treasured and put away for safe keeping. Save every dollar, don't overspend on anything, you know the drill. Make sure everyone else in your Uber Venmo's you. Obsess over the cash in your checking account every week.

In hindsight, it was irrational for me to be worried about money. In college, I was an upper-middle class kid with a full scholarship. Realistically, I would land a relatively high paying job as a 22-year-old college graduate and be good-to-go.

But when frugality is portrayed as the sole important value in personal finance during your formative years, you tend to conform to this standard.

This mindset stuck with me after college into my first job. Better max out that 401k and watch your weekend spending! You know, the same stuff that every other 23-year-old thinks while working their first job.

Now, if you've followed me for a while, you know what happens next. It's a story that I've told a million times, but here we go again:

I MADE A BUNCH OF MONEY TRADING SPACS DURING COVID AND THEN LOST HALF OF IT BUT I STILL HAD ENOUGH MONEY TO JUST QUIT WORKING FOR A YEAR SO I LIVED OUT OF A BACKPACK IN EUROPE AND SOUTH AMERICA FOR A YEAR BECAUSE THAT SEEMED LIKE THE MOST LOGICAL DECISION FOR A 24 YEAR OLD WHO HAD ENOUGH MONEY THAT THEY DIDN'T NEED TO WORK FOR A YEAR AND NOW I'M WRITING THIS BLOG.

I've talked about this experience in several blog posts, and I have recounted the story on a dozen podcasts. Make money, lose money, travel, start writing, here we are today. What I haven't discussed is just how much this moment altered my perception of money.

As I mentioned above, we are trained to put frugality above all else from an early age, and it isn't until you reach the point where you no longer need to be frugal that you realize just how dangerous pure frugality is.

Most people don't reach this point until retirement, but thanks to my savvy ability to buy stocks that went up, I was able to briefly experience this sensation at 23. So today, I'm going to let you in on a little secret:

When you have enough money that you no longer have to be frugal, and you are staring at those numbers behind the dollar sign, you can only think one thing: now what?

Our careers are built around the idea of acquiring as much capital as possible, but it is only once you are finally done acquiring capital, and you are contemplating what to do next, that you realize an important truth:

You can't eat money, you can't breath it, and you can't have sex with it. Money, on its own, can't entertain you. It can't make you laugh, cry, or smile. Money alone can't provide you with fond memories, and it will never set your soul on fire. You can't form a relationship with money (many have tried, but money never returns the love that it receives).

Money, in and of itself, is shockingly worthless.

However, money can be exchanged for something infinitely valuable: experiences.

If investing was simply a quantitative game of compounding dollars and lines going up, and if the end goal was simply having the largest number, then obviously every extra penny should be dumped into the stock market. $221,575 is a ton of money; of course you should choose that over $50 of coffee every month.

But investing isn't just a quantitative game of compounding dollars and lines going up. Investing is simply one piece of our chaotic, confusing, irrational lives.

The Time Value of Money states that delaying your spending will increase the value of your portfolio over time. And if we had unlimited time on this earth, then the story would stop here. Defer all spending as long as possible to have as much money as possible at some indefinite time in the future.

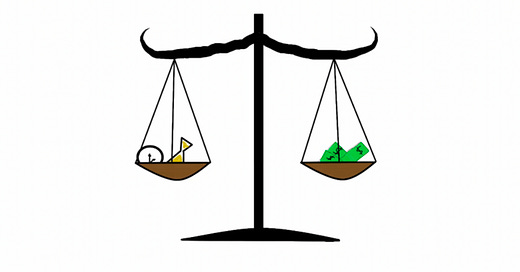

But we don't have unlimited time. To get the full picture of the relationship between money and time, you need to flip the equation around. The Time Value of Money may show us how much the value of an investment will change between two points in time given an expected annual return, but the Money Value of Time shows us how much time we have left to exchange that money for an experience. While money tends to increase over time in the former, time tends to decrease over money in the latter.

Money, therefore, serves a singular purpose: to be exchanged for experiences. The difference is whether you intend to exchange those dollars for experiences now or later. While the value of your money may grow over time, your ability to exchange that same money for experiences decreases over the same period.

And that's why extreme frugality is so dangerous: it leads you to sacrifice countless experiences early in your life just so you can try to cram them in your twilight years.

The opportunities presented to you are not homogenous across time. The experiences available to you at 25 won't be available to you at 55, and even if they are, you won't derive the same enjoyment from them. If you worry too much about "investing for retirement" in your 20s, you will miss out on life-changing experiences that you can't get back.

And that's what people often miss when they are thinking about money and planning for retirement and making all sorts of life decisions in general. We take solace in the idea that we can "do it later," whatever "it" is. We echo what we were taught about the importance of investing as much as possible and not being too risky with our money.

But depriving yourself of present adventures by throwing every penny into index funds is just as dangerous as blowing every last dollar on cheap, frivolous thrills. You can spend your entire life abstaining from the fun stuff just to realize, far too late, that you have more money than you need, and you missed some of your best opportunities to spend it.

I came to understand this inequality of time as a 23-year-old, and it caused me some serious anxiety. I was overcome by a near-omnipresent sensation of "Shit, I seriously need to start doing the fun stuff now, or I'll never get around to it."

And my mental woes manifested themselves in the most cliche of ways: guy in his mid-20s with some extra cash throws caution to the wind and goes on an adventure in Europe. And you know what, it was cliche. But it was also logical.

I realized that at 35, I wouldn't want to hop from hostel to hostel as I took trains all over Europe. Sharing bedrooms with strangers and living this vagabonding lifestyle would be miserable. But at 24? It was the world's greatest adventure. Miss a flight? Who cares. Get invited to Prague with some guys you met the night before in Barcelona? May as well tag along. Sleep on overnight trains? Why not.

The cheapness didn't detract from the experience, it was the experience. But this same cheap, rugged "fun" would be a living hell if I tried it 25 years later.

Funny enough, I'm not the only person who views money, time, and opportunity costs in this way.

Bill Perkins is a hedge fund manager, businessman, film producer, and professional poker player: a modern-day renaissance man.

Perkins also wrote one of the most thoughtful finance books of the last decade: Die with Zero.

The book's thesis is simple: you should spend your money on the experiences that you most enjoy over the course of your life so you can, as the title suggests, "die with zero." To do this effectively, you have to accept that different experiences will provide different value to you at different points in your life.

Early in his book, Perkins discusses when his roommate made the impulsive decision to take three months off of work to backpack Europe (sounds familiar):

When I was in my early twenties, my roommate at the time, Jason Ruffo, decided to take about three months off from work to go on a backpacking trip to Europe. This is the same friend with whom I was splitting the rent on a pizza-oven-size apartment in Manhattan: We were both screen clerks making about $18,000 a year.

To make a trip like that a reality, Jason would have to put his job on hold—and he’d have to borrow about ten grand from the only person who would lend him that much money: a loan shark.

I said to Jason, “Are you crazy? Borrowing money from a loan shark? You’ll get your legs broken!” I wasn’t worried only about Jason’s physical safety. Going off to Europe meant that Jason would also miss out on opportunities for advancement in his job. To me, the idea of doing something like that was as foreign as going to the moon. No way was I going to go with him.

But Jason was determined, so off he flew to London, both nervous and excited about traveling alone with a Eurail pass and no set schedule. When he came back a few months later, there was no discernible difference between his income and mine—but the pictures and stories of his experiences showed that he was infinitely richer for having gone.

As he met locals and young travelers from all over, he learned more about himself and other people and cultures and felt his world opening up. His stories of the interesting cultures he’d seen and the connections he had made were so amazing, I felt pretty envious—and regretful that I hadn’t gone.

As time passed, that feeling of regret only grew. When I finally went to Europe, at age 30, it was too late: I was already a tad too old and too bougie to stay in youth hostels and hang out with a bunch of 24-year-olds. Plus, by the time I was 30, I had many more responsibilities than I’d had in my early twenties, which made it that much harder to take months off for travel.

I finally, unfortunately, had to conclude that I should have just gone earlier. Like me, Jason knows he timed that European trip exactly right. “I wouldn’t enjoy sleeping in a youth hostel with 20 guys on a shitty bunk bed now, and I wouldn’t enjoy carrying a 60-pound backpack around on trains and through the streets.” But unlike me, he actually took the trip, so he doesn’t have to live with second thoughts. In fact, despite the high-interest loan, he has the opposite of regret about the expense. “Whatever I paid, I feel it was a bargain because of the life experiences I gained,” he tells me.

Bill Perkins: Die with Zero

"As time passed, that feeling of regret only grew. When I finally went to Europe, at age 30, it was too late: I was already a tad too old and too bougie to stay in youth hostels and hang out with a bunch of 24-year-olds. Plus, by the time I was 30, I had many more responsibilities than I’d had in my early twenties, which made it that much harder to take months off for travel."

It's uncomfortable to think about aging out of certain opportunities, but the window for us to enjoy most experiences is shorter than we think. We need to act accordingly.

The writer continues:

Our ability to enjoy different kinds of experiences changes throughout our lifetimes.

Think about it: If your parents took you along on a tour of Italy when you were a toddler, how much did you get out of that expensive vacation, besides maybe a lifelong love of gelato? Or consider the other extreme: How much do you think you’ll enjoy climbing Rome’s Spanish Steps when you’re in your nineties—assuming you’ll still be alive and able to climb them at all by then?

As the title of one economics journal article put it, “What Good Is Wealth Without Health?” In other words, to get the most out of your time and money, timing matters. So to increase your overall lifetime fulfillment, it’s important to have each experience at the right age.

Bill Perkins: Die with Zero

I don't expect everyone's dream experience to be a backpacking trip in Europe. Frankly, that would be a living hell for some folks, regardless of age. But I do believe everyone has dream experiences, whether they be traveling abroad, living somewhere new in the US, experimenting with a different career path, or starting one's own company, that get delayed indefinitely because "the timing isn't right." Because you "can't afford to take that risk right now."

The truth is, the timing will never be right to make a sudden change. You either decide to make that leap, or you don't. But if you delay that dream too long, you will find that the opportunity passes you by.

The real risk isn't that you run out of money or fail. The real risk is that you miss countless experiences over the course of your life because "the risk was too high." And let's be real, if you did hit rock bottom and "ran out of money" would it really be all that hard to start over?

(But more on that Thursday).

Money's sole purpose is to be exchanged for experiences. As Perkins says, "To get the most out of your time and money, timing matters. So to increase your overall lifetime fulfillment, it’s important to have each experience at the right age."

-Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!