Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

"What Should I Invest in?"

I have gotten this question more times than I can count over the last year or so. It makes sense, considering I write a blog about finance.

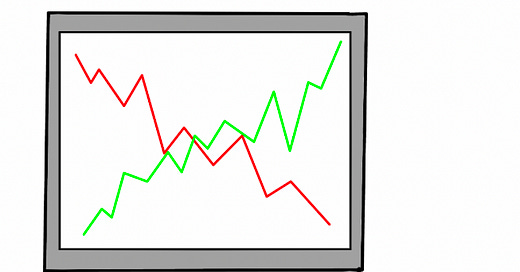

My answer has changed over time. Two years ago, I would have given you a detailed explanation of what SPAC I was throwing my money at and why. Two months ago, I would have said to invest in index funds, because it's almost impossible to outperform the market.

While I still agree with my latter answer (the majority of my money is invested in index funds, after all), I have since realized that this response was incomplete. Yes, I believe that in most instances, you should invest in index funds. The market is unpredictable, especially in the short-term, making active trading a difficult activity. However, there's more to index funds than simply "you probably can't beat the market."

We often get the goal of investing confused. The goal isn't to achieve the best percentage return. The goal is to make money over time. The method(s) by which you do that is irrelevant. This sounds counterintuitive, but stick with me.

This thread by James Camp was a lightbulb moment for me.

As James pointed out, great returns with small amounts of capital doesn't move the needle at all. Outsized real returns only occur when you have a lot of capital. Sure, making 100% returns on your $10,000 portfolio is cool. But it isn't going to change your life. I would take a 10% return on $1M over a 100% return on $10k every single time.

We give a lot of attention to percentage returns, but absolute returns are what really matter. Percentage return on your investments is just part of the equation. The question is, how do we maximize these absolute returns?

Opportunity Costs

Imagine you have $25,000 of expendable cash. Let's go through two scenarios.

Scenario A

You want to trade. You think you can outperform the market. So over the next year, you spend thousands of hours studying the market, honing your strategy, and putting your ideas to work. You actively and aggressively trade your $25,000 over the next year.

Trading has a binary outcome. You will either outperform the market, or you won't. While the outcome is binary, the odds are not evenly distributed. Most people won't outperform.

But let's say that you are in the minority who does outperform the broader market. Actually, let's go a step further. You absolutely crush the market, generating 100% returns. Okay. Can you do it again? And again? And again? If so, fantastic. Read no further.

The thing is, you *probably* can't. And there's no way to know if you can until those years come and go.

Scenario B

You want to invest, but you don't want to trade day-in and day-out. You invest your $25,000 in the S&P 500, and you set out to develop another skill. Coding, writing, a foreign language, Excel, sales, public speaking. Maybe you start a podcast or blog. It's up to you.

After a year, you won't outperform the market. You'll match it exactly. But you will develop a skill that can be leveraged to make more money. Maybe you earn a promotion, start a side hustle, land a new job, or something else entirely. Your worst outcome in scenario B is that you earn market returns and develop a new skill. Your best case is that your new skill makes you a lot more money. And guess what? You can invest this extra capital right back in the market.

In both scenarios, you invest the same amount of time honing a skill, but the potential outcomes vary widely.

Investing is one of the few fields where an inexperienced novice often has an advantage over an "expert". You can spend 1,000 hours honing your skill, studying markets, and backtesting your strategies. Then market conditions change, and you underperform anyway. Your 1,000 hours of knowledge may even be a disadvantage, if your trading strategy was reliant on a specific asset class or market environment.

Meanwhile, if you spend a year learning French, the language won't change overnight. If you become proficient in Python, you won't wake up one day unable to code. If you write a blog, you won't suddenly become illiterate.

You can quickly tell if your French, Python, or writing is improving. With trading? Maybe you're good, maybe you're lucky. It's hard to tell, and you won't know for a long time.

Nick Maggiulli hit the nail on a head in a piece last April.

But, what about stock picking? How long would it take to determine if someone is a good stock picker?

An hour? A week? A year?

Try multiple years, and even then you still may not know for sure. The issue is that causality is harder to determine with stock picking than with other domains. When you shoot a basketball or write a computer program, the result comes immediately after the action. The ball goes in the hoop or it doesn’t. The program runs correctly or it doesn’t. But, with stock picking, you make a decision now and have to wait for it to pay off. The feedback loop can take years.

Nick Maggiulli

Which brings me to the opportunity cost of trading. You can spend time learning to trade, or you can spend time developing another skill. But we have a finite amount of time, so you need to choose wisely. The hours you spend trading are, by default, hours not spent developing something else.

The goal is to make more money, remember. By focusing on trading, you are forcing yourself to outperform the indexes. If you can't consistently out-earn market returns, you are both wasting time and missing the chance to work on another skill.

If the market was exclusive to traders, and if there was no method for passive investing, I would feel differently. But the reality is anyone can benefit from the market by default. The engineer, writer, professor, doctor, and musician can all take advantage of that 9% annual return (the market's historic average), while generating income somewhere else.

The trader has to make money from the market and market alone.

Trading exposes you to the risk of underperformance (or even losses), with no guarantee of outperformance. Passive investing guarantees that you will match the market (for better or worse), while giving you the opportunity to make more money and develop a new skill away from the market.

The opportunity cost of trading is, quite literally, the development of any other skill that could help you make more money.

What Is Alpha?

In the investing world, we focus heavily on outperformance, or alpha. Investors who can outperform broader indexes such as the S&P 500 are considered the best of the best. 15-20% annualized returns over a long timeframe are legendary. But we view investing alpha in its own bubble, where we only compare financial returns of an investor to the S&P 500.

When chasing alpha, we ask, "What investment strategy generates the highest returns?" When we should be asking, "What overall strategy generates the most money?"

Your investment process should be a cog in your broader financial process, but it shouldn't be your financial process.

If the market returned 10% and you made 20%, you generated significant alpha when looking at the percentages. But how many hours did you invest for that extra 10%? How much money did you actually make?

If you made 20% on a $50,000 investment, you turned a $10,000 profit. Say you spent 500 hours studying the market to achieve this result.

Could you have made more than $10,000 by investing the 500 hours that you spent trading on developing some other skill? How about working on a business?

This is where "alpha" gets lost. True alpha isn't outperforming the S&P's percent return. True alpha requires you to generate more money by actively trading than you would have otherwise made by spending the equivalent time working on another venture. If you can't outperform the market AND your hypothetical profits from another activity, you took a loss, regardless of what your "percent return" was.

That's the hidden cost of actively trading. A great percent return that underperforms other opportunities is a loss too.

My $0.02? Unless you are Jim Simons, find something, anything, that you can make a lot of money doing, and invest your excess income in the market. No one cares if you made 5%, 15%, or 50%. I promise you the guy who made $1M through his business and made 10% on his investments is more impressive than the one who made 25% on a $100k portfolio.

In the search for alpha, opportunity costs outweigh monetary costs. Is your investment outperformance actually alpha if the opportunity cost is your life?

- Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!