No one had more fun than Donald Trump last week.

I wish, I really, really wish, I could move markets with tweets. I would be insufferable.

Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

Also, I’ll be in Tel Aviv in a few weeks. If you’re in Tel Aviv, or if you know anyone interesting in the Tel Aviv tech/startup scene, could you shoot me a note at Jack@slow.co? Thank you :)

God, it must feel so good to be Donald Trump on weeks like last week.

I imagine that he sat in the Oval Office, occasionally refreshing Twitter, watching his 103.4 million followers argue back and forth over the merits of smothering everyone from China to Vietnam to the penguins on the Heard and McDonald islands with tariffs.

His loudest online supporters, many of whom vehemently opposed him in his first two elections before flipping to support the likely winner last summer, desperately bent over backward to support these tariffs. “Wall Street isn’t Main Street!” they cried out, ignoring that input costs and consumer sentiment do, in fact, affect Main Street. “The children yearn for the factories, let them build iPhones!” “We’re getting back at Vietnam for ripping us off!” (because our trade imbalance with ‘Nam is proof of malicious actions by the southeast Asian nation, and it has nothing to do with the fact that the Vietnamese can’t afford American goods while we buy cheap clothing and materials from them hand over fist.)

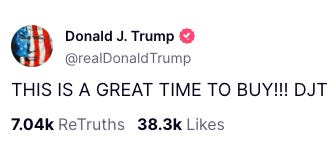

And then, with markets melting down, Trump posts, “THIS IS A GREAT TIME TO BUY!!! DJT” a few hours before announcing a 90 day pause on tariffs, sending the S&P rocketing from ~4,900 back to 5,400.

Naturally, the same folks claiming that “Wall Street isn’t Main Street” then pivoted and said that the removal of the tariffs was a 4-D chess move. Textbook Art of the Deal stuff.

Tariffs on? Good. We’re getting even. Tariffs off? Good. 4-D chess. Great negotiation. Heads, I win. Tails, I don’t lose. It’s all so exhausting.

One of my more humorous theories is that Trump knows exactly what he’s doing. He’s just out here having fun, regardless of the geopolitical ramifications.

I mean, can you imagine the rush of knowing that one tweet can create or erase trillions in market capitalization in minutes? Hitting “send tweet” and watching the QQQ jump 10% would be a dopamine injection from God himself. And, for the cherry on top, I’m sure he’s refreshing Twitter with a smug smile, watching his loudest fans try desperately to defend the president’s most recent decision, even if it means contradicting what they said just 12 hours before. If he says “jump,” they’ll reply “how high?” If I were the President, I would be eating that up like a king watching his court jesters.

Oh, and you can’t forget about all of the folks who think they can predict what will happen next, referencing The Smoot-Hawley Tariff Act or pulling up charts of the 30-year yield, despite never buying a bond in their life. Do you seriously think you can predict what’s going to happen next? Really? In a period of 72 hours we went from no tariffs to all the tariffs to “hmmm, maybe some tariffs on China.” No one knows what’s going to happen next. I don’t even know if Trump himself knows what’s going to happen next.

And even if you did know what’s going to happen next, you don’t know what’s going to happen after that. Say the tariffs are on. Do you really think we’ll run back the post-Smoot-Hawley Tariff Act economy verbatim? The world in 1930 and 2025 are night and day different. Even if you had a crystal ball that would tell you exactly what would happen with tariffs, I doubt you’d be able to make money from it.

How many billions of hours of collective brain power and attention went toward opining on or predicting the ramifications of Schrödinger's tariffs? And for what? You’re one tweet away from being wrong. The tariff debate is intellectual speculation for folks who like watching treasury yields on Sunday evenings (futures are up 0.80% by the way. Let’s see where they close tomorrow).

There was one silver lining of this tariff tantrum, however. It provided a brief, but clear, window showing who is an independent thinker, and who’s just crafting talking points that match their political preferences.

Don’t waste your time trying to predict which stocks or bonds are going to do what in the short-term, considering that the biggest catalyst is, in itself, a totally unknowable wildcard. Say there’s a 50/50 shot of heavy tariffs, and you have no idea of knowing if they’ll come to fruition. Do you really think you have an edge here? Of course not.

Tariffs off? Buy stocks. Tariffs on? Sell them..? But what if you think they’re on, so you sell, then they’re called off, and you miss the entire rally? What if the opposite happens? Bessent said he wants yields down, and yet, the 10Y is up 80 bps since September 2024. Nobody, including you, knows what’s going to happen next. Every variable, and every secondary effect if every variable, is up in the air right now.

What you should do, however, is audit your information sources. Independent thinking is in short supply these days. My $0.02? Find the folks whose opinions didn’t shift with market movements or policy 180s. Whether or not you agree with them, their opinions are probably genuine.

You can’t put a price on genuine these days.

And maybe turn on post notifications for Trump. The president of the United States of America said, “THIS IS A GREAT TIME TO BUY!!!” and you didn’t buy? Really? Come on now.

- Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

There are so many things that the president has done that feel illegal but aren’t technically simply because the lawmakers never imagined someone would employ this mix of chicanery and audacity. It’s the confidence of a child never told no.

When it comes to forecasts we are alway trying to fight the last war. This tariff situation won’t be like the past and yet may have similar results. I believe it won’t last. That we will see regression to the mean but I think the mean is lower than where we were recently and that will be enough to bring about that overdue recession that has been forecast for the last few years.

It feels like we're just pressing "shuffle" on the global economy. While I think someone needed to do that, I just really hope I don't have to listen to five years of Nickelback before something good comes on.

We are at a strategic disadvantage on the world stage due to the (preferable) reality that it is nearly impossible for the US to execute on anything longer than a 4-8 year unified strategic plan. China, on the other hand, is a communist dictatorship that has the ability to execute a 20-30 year vision with minimal internal disruptions.

In other words, if someone wants to drive true and lasting global economic impact as a US President / administration, it needs to be drastic, quick, and, unfortunately, jarring to our markets. Gradualism will just be undone by the next administration.

DISCLAIMER: Not an argument in favor or against the Trump Admin's handling of trade / tariffs, I won't pretend to be the expert on that topic. Just an interesting aside that I think gets overlooked when talking global game theory.