Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

Sometimes, it pays to be dumb.

Yesterday, I was halfway done writing an article about the unrealized capital gains tax when I saw this tweet from Packy McCormick:

“Just make the 5 dumbest decisions you possibly could have financially every year.”

That tweet is probably a glaring “Market Top” sign, but Packy highlights a great point: it paid to be dumb in 2021. After writing about what makes meme stocks “meme” on Monday, I figured I might as well double down on that theme this week.

So let’s answer the question: how much money would you have made if you had invested in five really dumb ideas as soon as they started going viral?

The Rules

We start the year with $100,000.

We invest $20,000 in five incredibly dumb ideas as soon as we hear about them. Note that we won’t invest in them before any news comes out, as we can’t predict the future. No buying the bottom. Just play the hype.

Add up the returns.

That’s it. A pretty simple game.

Can’t Stop, Won’t Stop, GameStop

Imagine that you read this post on Wallstreetbets in October, 2020:

You think to yourself, “This is ridiculous. GameStop is a poorly managed video game retailer that got wrecked by the pandemic. It’s probably going to zero soon.” But you see GameStop chatter gaining steam on Reddit, so you decide to buy $20,000 worth of GME on January 4th, 2020. The first trading day of the year.

GameStop ends that day at $17.25.

Ryan Cohen, the founder of the Chewy, has now bought 13% of GameStop’s stock, and retail investors are speculating that he will try to pivot the company to an internet-first model.

Then on January 11th, GameStop announces that Ryan Cohen is joining the company’s board. Within a week, the stock has jumped from $17.25 to $40 a share. More and more investors start tracking GME’s short interest. This stock that had run up 300% in less than a month is still sporting a short interest > 100%.

One after another, Reddit posts similar to the screenshot above call for a massive short squeeze. All those shorts are going to have to buy to cover their shares. The Cohen news is big for the company. And a lot of eyes are on the video game retailer.

The stock price starts creeping up.

$45.

$60.

$76.

Suddenly on Tuesday, January 26th, GameStop goes nuts. The stock blasts past $100 a share and ends the day at $148. But you have diamond hands, so you still haven’t sold. the next day, GameStop goes parabolic. The stock breaks $300 a share, closing at $347.

You didn’t want to get greedy, so you had placed a limit sell at $300.

$17.25 → $300. Your $20,000 stake is now worth $347,826 just 22 days later.

Total portfolio value: $427,826.

Every DOGE Has His Day

During one of the early crypto bubbles in 2013, programmers Jackson Palmer and Billy Markus started Dogecoin to satirize Bitcoin by turning the viral "doge" meme into a cryptocurrency.

On April Fool’s Day 2019, the official Dogecoin Twitter account decided that the meme coin needed a CEO. It posted the following poll on Twitter:

Tesla and SpaceX CEO Elon Musk secured 54.4% of the vote, beating out Ethereum founder Vitalik Buterin, among others.

Musk took great pride in his new role, changing his Twitter bio to Dogecoin CEO. Over the next two years, he periodically tweeted about his newest “company”.

While the last tweet pumped DOGE 20%, it was still trading for less than half of a cent. However Dogecoin gained renewed attention after the GameStop incident. GME minted a group of degenerate millionaires, and the online masses wanted to pump something else. On January 27th, posts such as this exploded all over Reddit:

The thesis was simple: the GameStop squeeze was ridiculous, but it worked. What is the next stupid thing we can pump?

From January 27th to January 29th, DOGE jumped from $0.006 to $0.03 behind the internet hype. That’s a 400% increase in two days. DOGE continued its ascent til it peaked around $0.06 in February. It stays flat for two months after this.

You don’t hear about Dogecoin until February, but you decide that it is the next stupid bet. It’s already up 1000% since New Years, and it has no value. There’s no short squeeze thesis. No catalyst. It’s a digitized token of a Shiba Inu.

On April Fool’s Day 2021, the two year anniversary of Elon Musk being crowned CEO of DOGE, you purchase $20,000 at $0.06 per coin, with a limit sell at $0.69.

Coinbase’s April IPO brings attention back to the crypto sector, and DOGE starts perking up.

Then Elon begins tweeting again.

Dogecoin stops barking at the moon, and hops on a rocket to outer space.

On April 17th, DOGE his $0.27. The meme coin now sports a $40B+ market cap, bigger than Ford Automotive. It becomes a social media frenzy, and #DOGEDAY420 starts trending. “Investors” want to push the crypto to $1 on 4/20. How poetic.

DOGE doesn’t hit a dollar on 4/20, barely breaking $0.40. You keep your limit sell order and forget about it.

Then DOGE starts climbing again in May.

Then it goes parabolic.

On May 7th, Doge hits $0.72. Your coins sell at $0.69.

$0.06 → $0.69.

$20,000 to $230,000 in 36 days.

Total portfolio value: $637,826.

$MAGA

Last week, we had the most 2021 headline:

Trump Media & Technology Group and Digital World Acquisition Corp. (NASDAQ: DWAC) have entered into a definitive merger agreement…

... Trump Media & Technology Group (“TMTG”) will soon be launching a social network named “TRUTH Social.”

Donald Trump’s media group is going public through a SPAC. It makes sense that #45 would want to build his own media platform after getting banned from both Twitter and Facebook. That being said, his company isn’t exactly ready to go public.

However, here’s a list of things that TMTG does not yet have:

A functioning website

A functioning application

media content

revenue

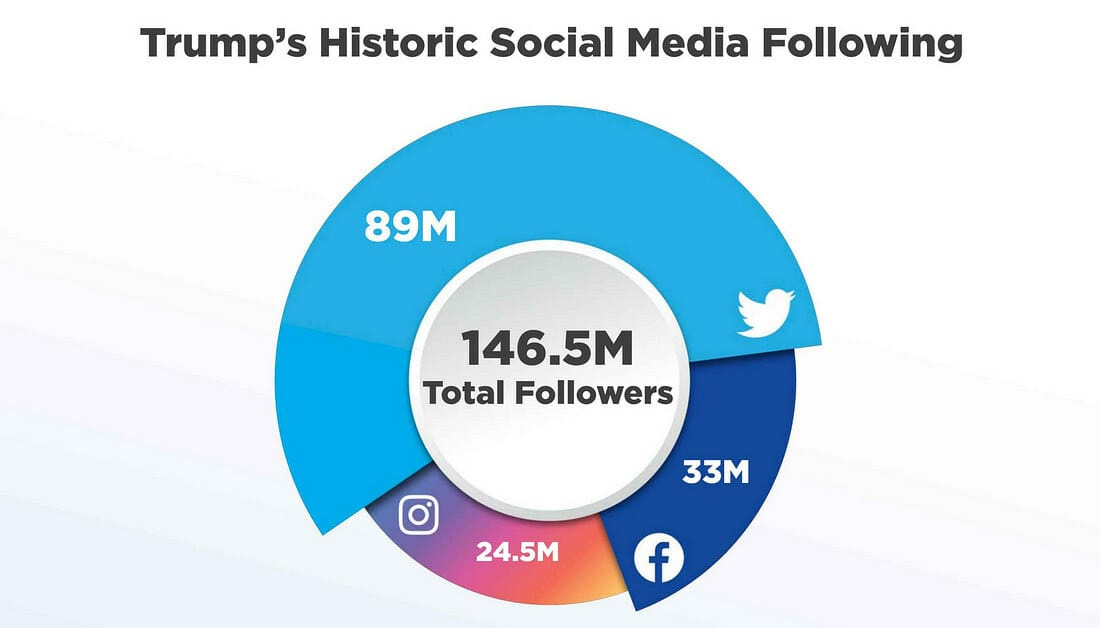

What metric did they use to value the company? Trump’s prior social media following.

What is the market opportunity? Twitter, Facebook (Meta?), Netflix, Disney+, CNN, Amazon Web Services, Stripe, Google Cloud, and Azure.

Trump’s media company, that doesn’t yet exist, claims that it will build an audience of 100M+ and compete with every social media, streaming, news, and cloud storage (???) company simultaneously? Yeah, right.

The morning after the announcement, DWAC spiked to $17 before falling to $10.32.

This is obviously the next dumb idea.

$20,000 purchase at $10.50. You set a sell order at $100, because why not? Well the volume is nuts as the market opens, and it climbs higher.

Then President 45’s SPAC blasts through $45 a share, and it keeps climbing in the after hours. The next morning, DWAC touches $175. Your shares sell at $100.

Maybe Trump supporters bought it hand over fist. Maybe investors thought Trump supporters would buy it hand over fist, so they tried to front run it. Regardless, you made bank.

$10.50 → $100.

$20,000 to $190,476 in one day.

Total portfolio value: $808,302.

The Derivative of DOGE

DOGE was made to satirize Bitcoin. SHIB was made to satirize DOGE.

On February 7th, as DOGE approached a $15B market capitalization, SHIBA INU’s market cap was $0. One of several thousand alt-coins, Coinbase didn’t even show a valuation because it was so small.

When DOGE went parabolic in May, SHIB ran as well, reaching an incredibly high price of $0.00003. Once DOGE calmed down, SHIB dropped back to a conservative price of $0.000006, with a market cap of $2B. Still a crazy valuation for a stupid alt-coin, but whatever.

You see a cute Shiba Inu on the street while you’re out jogging in September. Taking it as a sign from God (or Satoshi), you buy $20,000 of SHIB at $0.000006.

Nothing happens for a month. You set a sell order at $0.00008, because SHIB would be worth $40B, aka more than DOGE, at this price. There’s no way that the meme coin of a meme coin of a coin will surpass the value of the OG meme coin.

And then in October, SHIB goes nuclear. The big doge wanted to eat, and sure enough SHIB trades at a higher valuation than Deutsche Bank (boomers), Robinhood (there’s something poetic there), and finally DOGE. Your coins sell at $0.00008.

The meme coin of a meme coin of a coin is worth $44B. We live in a simulation.

$0.000006 → $0.00008.

$20,0000 to $266,667 in a month.

Total portfolio value: $1,054,969.

Buy a House or a Picture of a Rock?

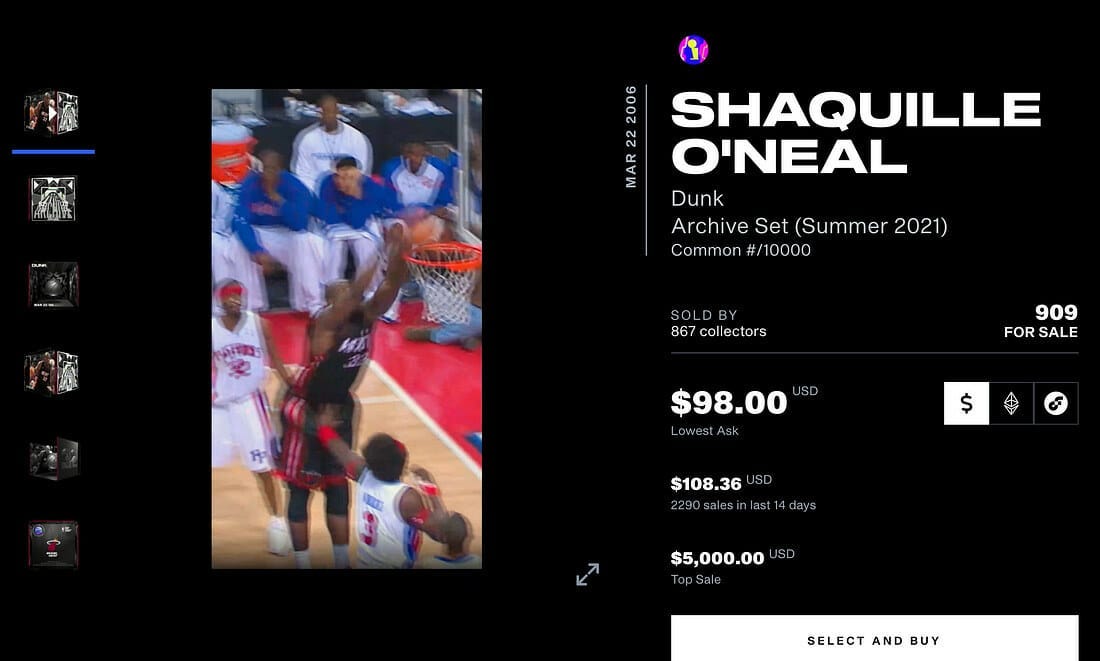

In February 2021, you hear about this new thing called “NBA Top Shot”. People are buying NBA highlights and trading them at auctions like physical trading cards.

The prices keep going up. A Lebron James dunk sells for $129,000. A Steph Curry 3 point shot sells for $84,000. You start doing your research, and see that NBA Top Shot falls under a broader asset class known as “NFTs”. NFT stands for non-fungible token. NFTs are pieces of digital media that can be owned by individuals. Ownership of these NFTs is verified on the blockchain.

Not that it matters. Who would pay money for NFTs in the first place, when you can just screenshot them? But NFTs keep growing in popularity. Then investors start throwing thousands of dollars at CryptoPunks. CryptoPunks were one of the first NFT classes minted, or created, back in 2017. Punks were an OG NFT, and owning one became a status symbol. The prices skyrocketed.

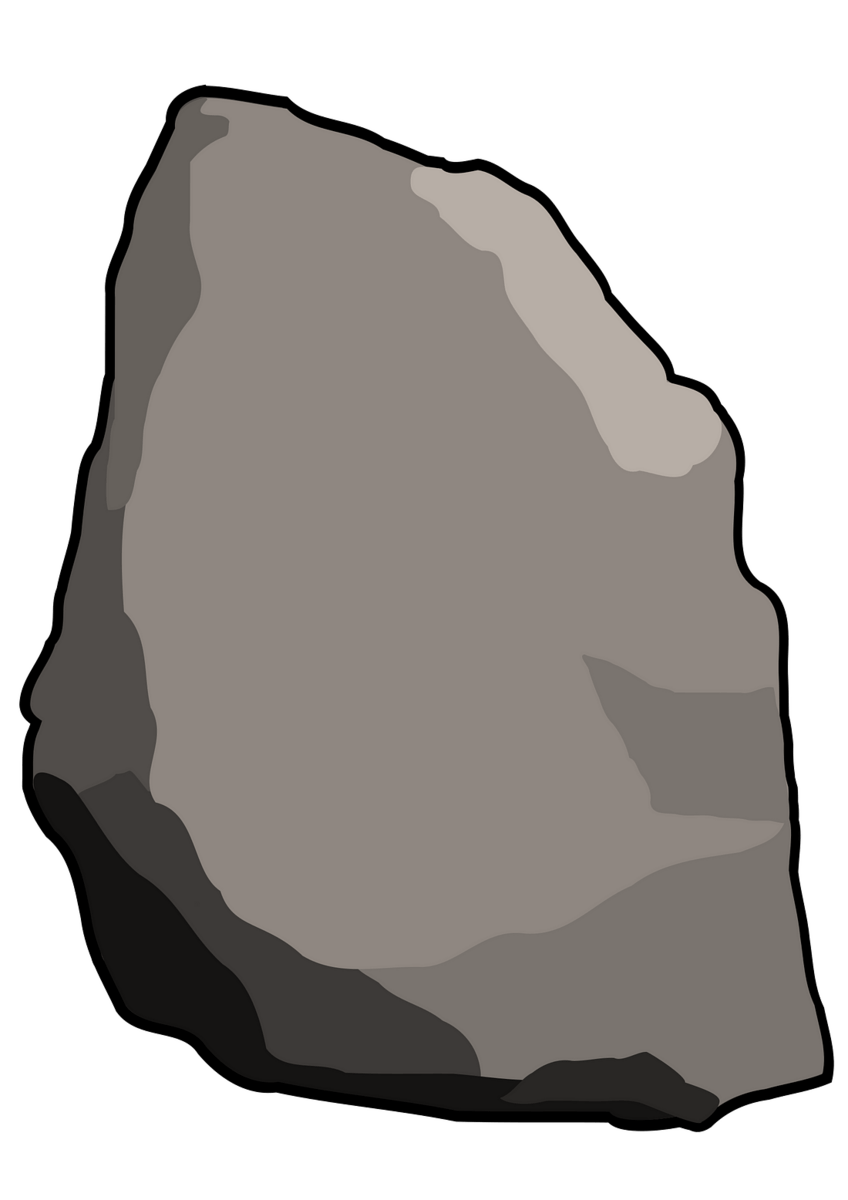

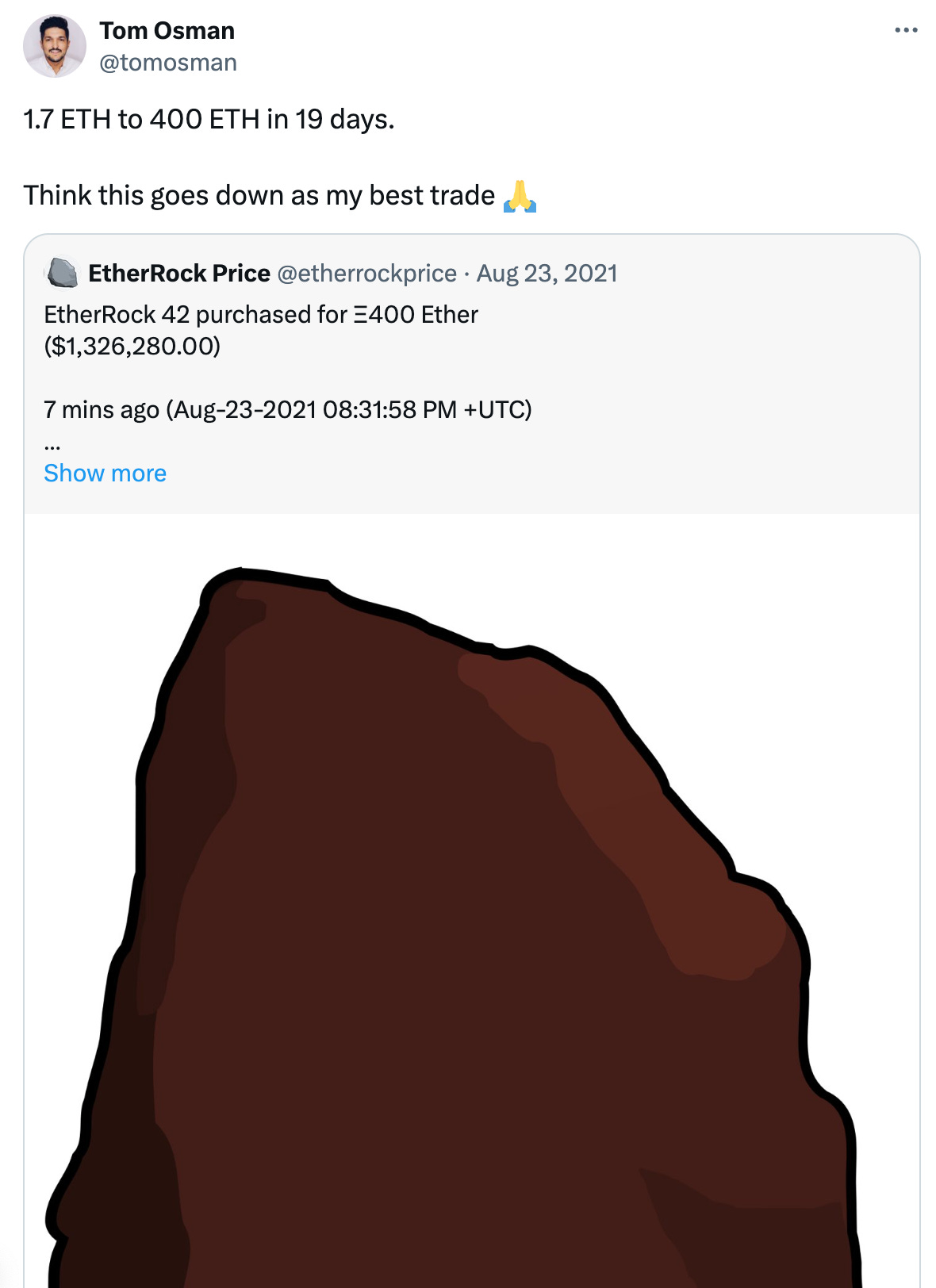

Then digital artist Beeple sells an NFT art piece for $69M, and CryptoPunks go to the moon. $100k each. $1M each. You decide to play the NFT game, and you see some Twitter accounts talking about another old NFT group: Ether Rocks. 100 animated rocks from 2017, and only 30 had been minted.

On August 4th, the EtherRock Twitter accounts tweets that 70 rocks have yet to be minted, and the post goes viral. People are paying $5k. $10k.

EtherRock becomes the ultimate stupid play. On August 4th, you may $20k for this:

This is the one.

This is unequivocally the dumbest thing that you could spend $20k on. What are these rocks worth three weeks later?

Millions. You sell yours for $1.2M.

$20,000 to $1,200,000 in a month.

Total portfolio value: $2,234,969.

Recap

A dead video game retailer. A digital dog currency. Trump’s SPAC for his nonexistent company. A meme coin of a meme coin. A picture of a rock.

$100,000 to $2.2M. You didn’t buy the bottom. You just bought when you read about them online. The S&P is up an incredible 40% in the last year. These five investments would have produced a 2234% return.

Efficient markets are dead.

So should you just throw your money into your five dumbest ideas next year? Lol no. For everyone one of these successes, there are dozens of fortunes lost and bagholders created. Still, it’s pretty wild to consider how much money was made in these wild trades.

When everyone wants to get rich quick, certain assets can produce some wild moves. That being said, parabolic up is always followed by parabolic down.

You won’t be able to identify the next SHIB before it happens. If it was easy, it would never happen in the first place. However, if you have to try for one of these home runs, keep it small. If you’re right, small is all you need. If you’re wrong, small is all you want. If you get lucky, maybe your trade can make the list for 2022.

Have a Happy Halloween, go get spooky this weekend.

Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!