Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

A couple of months ago, I came across this tweet from Lawrence Yeo:

Lawrence is one of my favorite writers. Check out his site, More to That.

"Here's the harsh reality of any creative endeavor: in the beginning, no one cares...

This is the part that many successful creators leave out. While it's sexy to attribute your success to patience, it's not as sexy to admit that you had a financial safety net that could buffer you against failure."

As I read Lawrence's tweet, I thought about my own writing journey.

Writing has quickly grown from a side-hobby of sorts to a primary income stream for me; I currently earn more money writing online than I previously did in a finance job. More importantly, I see a viable path to make exponentially more money in the future as my writing progresses.

However, I didn't just wake up one day last summer, flip a switch, and start making money writing. In reality, it was a slow, often tedious process to get to this point.

I published my first online article on Seeking Alpha on April 16th, 2021. For those curious, I wrote a bullish piece on Corsair Gaming. The stock is down 30% since. It was a mediocre piece at best, but I made a little bit of money from it. After trying (and failing) to land a finance-focused writing job, I decided to stop writing on Seeking Alpha and start working on my own site, Young Money.

I didn't really know where this finance blog would go; I just wanted somewhere to share my thoughts with the world. Slowly but surely, the world started to listen.

Between July 9th and October 30th of last year, a period of 113 days, I gained a total of 510 new subscribers. That is just under five new readers per day. At this point, I was spending countless hours writing each week, while not making a dime for my efforts.

I then quit my full-time job in August to travel, and I spent the next four months traveling and writing with no income whatsoever. However, in December, this writing thing began to take off.

Someone paid me to cross-post an old article of mine on their newsletter. I gained 610 subscribers in 12 days, with Young Money growing 10x faster than it was just months before. My Twitter network expanded exponentially, and my opportunities quickly multiplied. I now have more than 4,300 subscribers, multiple writing-based income streams, and several seeds planted for future opportunities.

Things are going well.

Yet to get here, I had to spend eight months writing without making a dime. I had to develop my voice. I had to learn to market my content online, and I had to seek out opportunities to make money from my work.

Eight months with no income is a significant risk, and the ability to survive eight months without income is a privilege not afforded to everyone. This is about the privilege to take risks.

This privilege stems from one's time and money.

The Privilege of Time

Time plays two roles in risk-taking:

Longer time frames increase your likelihood of success

Longer time frames give you more opportunities to start over if you fail

Increased Likelihood of Success

"In the beginning, no one cares."

You won't make a dime from a new venture without an audience or customer base, but no one begins a new venture with an audience or customers. When you create a new blog, newsletter, podcast, Youtube channel, or any other form of online content, it takes time to build an audience. When you start a new business, it takes time to build a customer base.

More time gives you more opportunities to improve your content or product, which will make them more enjoyable for consumers.

More time makes it easier to build a bigger audience, because your current audience will have more opportunities to share your work with their peers.

More time gives you the chance to experiment with different marketing methods, and you will learn which approaches most effectively grow your base.

As your product improves, your audience grows, and your marketing becomes more efficient, your risk of failure decreases.

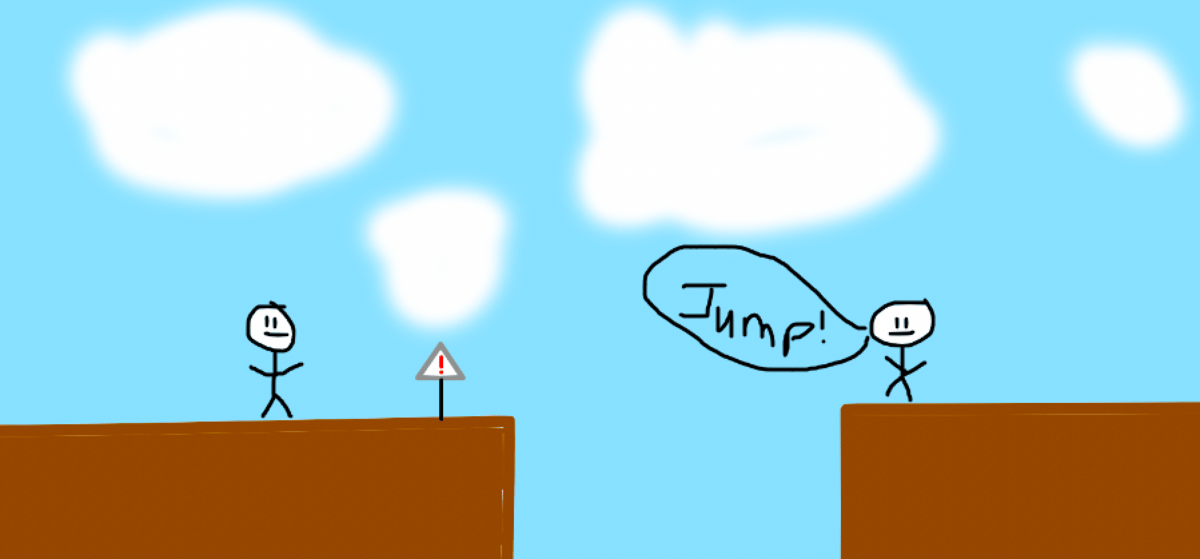

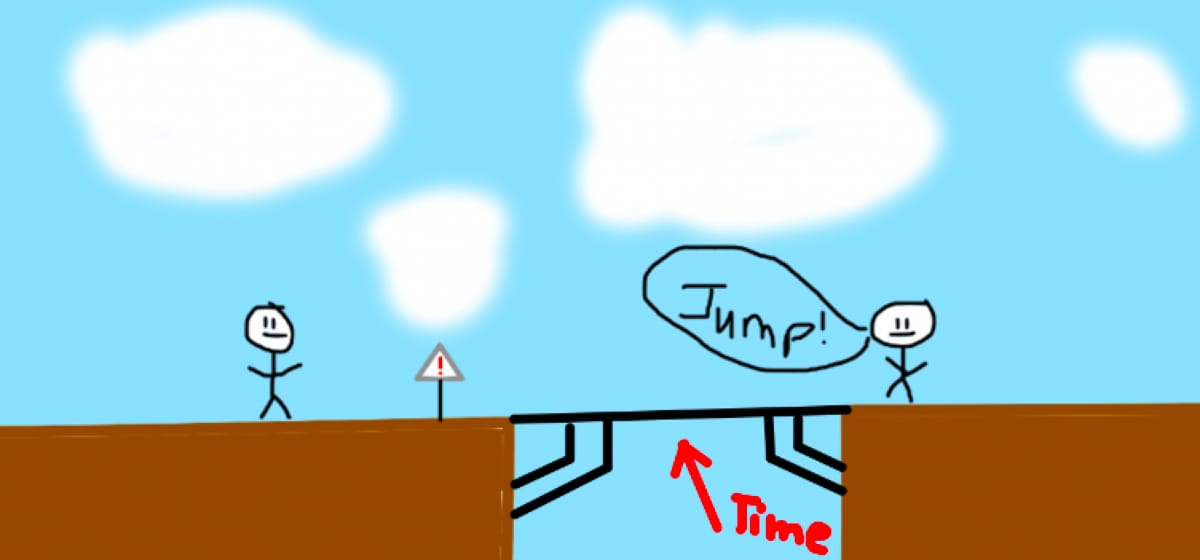

Time is the bridge that minimizes risk, because as time approaches infinity, risk approaches zero. Time bridges the leap of faith in the graphic above.

Increased Post-Failure Opportunities

The other side of the coin is that longer time horizons make it easier to start over.

Not only does a longer time horizon lower the probability of failure, it lowers its magnitude. I'm 24 years old. If this finance blog had crashed and burned, and I never earned a penny from writing, I could have easily found another corporate job and never skipped a beat. I still have 40+ years to make enough money to retire on if needed. I can afford to take a risk, because I don't need that money right now.

If I was closer to retirement, I wouldn't have the luxury to take such a gamble.

The Role of Financial Flexibility

As I mentioned earlier, you won't make a dime from a new venture without an audience or customer base, but no one begins a new venture with an audience or customers.

You can't expect to make a single dollar on day 1 of your new venture. Realistically, you can't expect to make a single dollar on day 100 of your new venture. And you probably won't be able to live solely off of income generated from your new venture within the first 365 days.

However, your expenses don't care about your new ventures, and hard work doesn't pay the bills. It takes time to reach the point of sustainable revenue generation. And you need money to cover your expenses until you get there. You need financial flexibility.

Low expenses and a large nest egg are imperative.

Here is a list of my current financial obligations:

Rent & utilities: ~$1,000 per month.

That's it. I was fortunate to attend college on academic and athletic scholarships, so I graduated debt free. I don't own a home, so I don't have any mortgage payments. I'm not married and don't have any kids or other dependents.

With my total fixed expenses being $1,000 a month, I didn't need a ton of money to cover several months' expenses.

On top of keeping my expenses low, I had a fortuitous streak on the stock market in 2020 that accelerated how quickly I could accumulate a critical mass of capital. I made 3x my salary by clicking buttons on my phone. This financial NOS boost combined with my low living expenses gave me a year+ runway where I could maintain my lifestyle with zero income without running out of cash.

Suddenly, the crazy idea to travel and write didn't seem all that crazy. To me, it was a no-brainer.

Practicality Matters

We tend to romanticize the idea of throwing caution to the wind, and going "all in" on a new venture or idea. But reality doesn't take kindly to romanticized ideas, and your expenses don't care about your dreams.

The ability to take risks is largely predicated on your capacity to finance your lifestyle while you aren't making consistent money.

You can't take risks that prohibit your ability to pay for your financial responsibilities, and those responsibilities vary from person to person. Someone with $100k in student debt needs more financial security than someone who is debt free. Someone with kids needs a larger nest egg than someone who is single and childless. Someone living in NYC needs more cash for living expenses than someone in Atlanta. The list goes on and on.

Low expenses extend your runway. A large nest egg extends your runway. You want a runway large enough to land a 747.

Maybe to minimize your personal financial risk, you need to spend a year working on your new project while keeping your regular job. Maybe between student loans, providing for your family, and living in an expensive city, you'll never have the freedom to drop everything and go all-in on a new idea. I don't know.

What I do know, is that if you're young, unburdened financially, and don't have any dependents, there has never been a better time to take a risk and bet on yourself.

The internet has leveled the playing field, and it's never been easier to find another job.

And if you do have the privilege to take a risk, you owe it to yourself to do so. Even if only to see what you can accomplish.

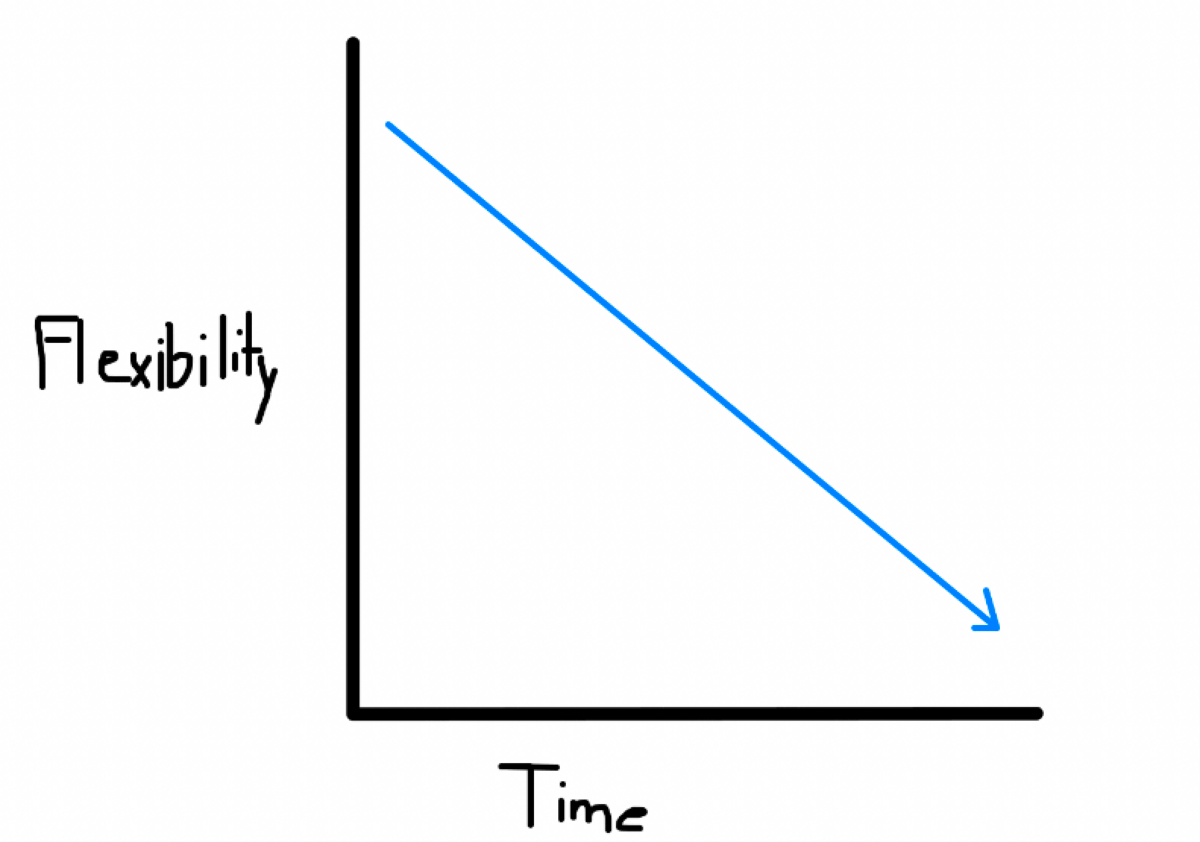

Over time, your responsibilities will only increase, while your flexibility will decrease.

Survival plays an underrated role in success, and financial solvency plays an underrated role in survival. The world's most successful entrepreneurs weren't necessarily the smartest.

Oftentimes, they were survivors. They were the ones with the privilege to take risks.

- Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!