Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

A brief note before we get started: I’m out west on an RV trip for the next 8 days, and I also need to take this week to iron out the rest of my book proposal (exciting times!). No Young Money next week, but we’ll be back on schedule afterward.

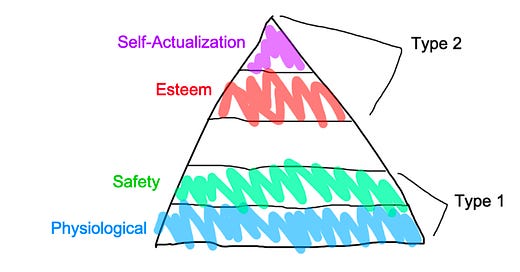

In 1943, American psychologist Abraham Maslow published his now-famous “Hierarchy of Needs.”

Maslow’s Hierarchy of Needs illustrates how human needs evolve over time: we must first satisfy our most basic needs, such as shelter, food, and water, before we can grasp higher-level needs, such as affection, self-esteem, and purpose.

The order of this hierarchy is crucial: you can’t address the needs out of order. If you offered a subway beggar career advice, he would look at you like you’re crazy. He doesn’t need a fulfilling career. He needs $10 for food. He couldn’t care less about “fulfilling careers.”

In contrast, the person who is worried about leading a fulfilling career doesn’t have to think twice about spending $10 on a bagel and coffee. It’s pocket change, a rounding error in their bank account.

We only worry about the intrinsic needs after the extrinsic stuff is accounted for.

Our financial well-being works like this too.

Connected to Maslow’s Hierarchy of Needs, there are two types of money problems: problems that can be solved by the presence of money, and problems that only exist in the presence of money.

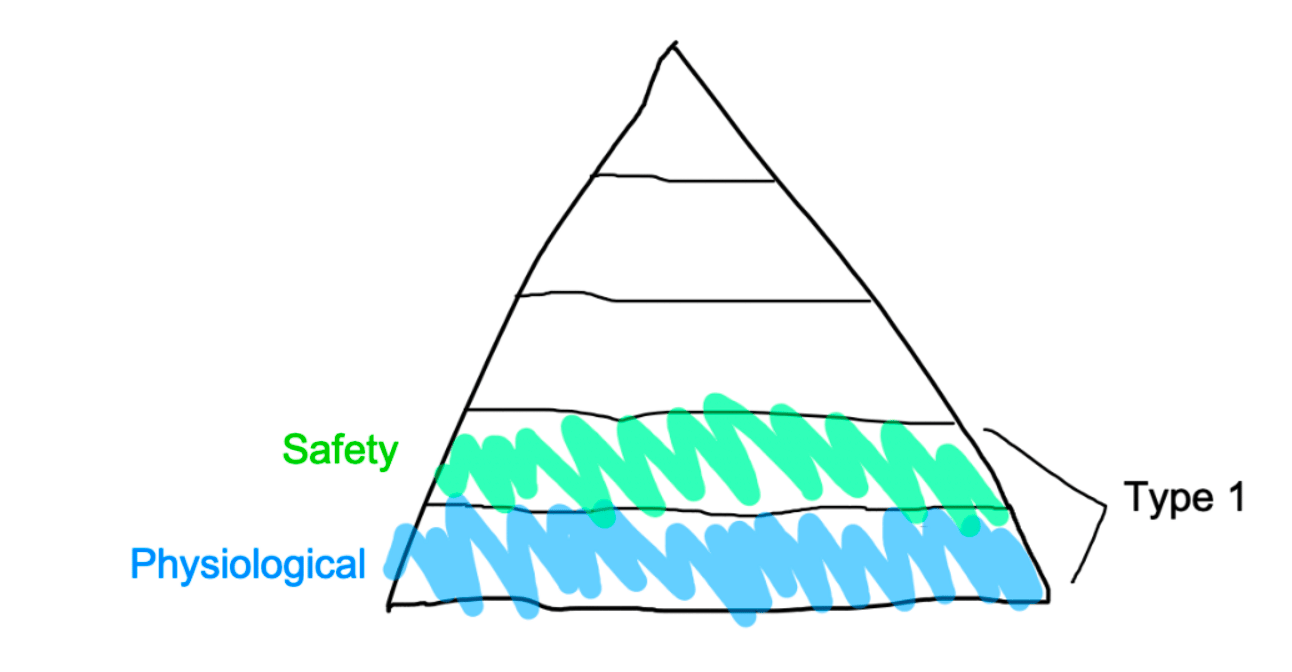

The former, which we’ll refer to as “Type 1” problems, address the lower ranges of Maslow’s Hierarchy: physiological and security needs. The latter, which we’ll refer to as “Type 2” problems, address the more nuanced parts of our psyche such as self-esteem, achievement, purpose, and reaching our potential.

We’ll focus on Type 1 first.

Type 1 problems are straightforward; think lack of water, food, shelter, and clothing. If you make enough money, those problems disappear.

Safety, at least in a financial sense, is a Type 1 problem as well, because more money in the bank gives you flexibility to meet your physiological needs regardless of life circumstances.

All Type 1 problems can be resolved with more money, but not all money problems are Type 1. If money could solve all money problems, then people with money wouldn’t suffer from financial anxiety. And yet, financial anxiety and wealth often coincide.

Take Alex Lieberman, for example. Alex sold Morning Brew, the newsletter company that he started in college, for >$75M. He openly shares his thoughts about his financial anxiety on Twitter:

He answered, “I don’t. I passed 9 figures a long time ago, and by any objective measure I’m financially secure, and I have huge financial anxiety.”

So why do people with money still have financial anxiety? Because this anxiety has little to do with material goods. It addresses the final levels of Maslow’s Hierarchy: self-actualization and esteem.

Say you’ve made enough money that you’ll never again worry about food and shelter. Cool. The bottom of your pyramid is taken care of. Now you’ve graduated to a more difficult set of questions:

Is your work fulfilling?

Are you living up to your potential?

Is everything going to come crashing down?

Can you maintain your lifestyle?

Are you underachieving in relation to your peers?

Will you lose your social status if your business fails?

Type 1 problems are static: everyone has a specific amount of money that will take care of their material needs forever. Type 2 problems are dynamic: they continue to adapt to your life circumstances.

Type 1 problems are individualistic: what do I need to survive? Type 2 problems are pluralistic: What are my peers doing better than me?

Material problems don’t just disappear once you have some level of wealth. They get replaced by intrinsic problems.

- Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!

Jack's Picks

I'm subscribed to dozens of newsletters, and my biggest problem is sorting through hundreds of emails each week to find the stuff that I want to read. Thankfully, Meco has a solution. Meco is an app designed for reading newsletters, allowing you to read your favorite content in one place, without the clutter. The process is simple: just download the Meco app, add your favorite newsletters, and start reading! If you want to clean up your inbox, get started with Meco here.

This piece by John Luttig on the risks of “indexing” your life is fantastic.

Noah Smith discussed the risks with everything that comes after Pax Americana.

During a 5-hour Wikipedia binge (big fan of the occasional Wikipedia binge, highly recommend), I stumbled upon the life of Ibn Battuta, a Maghrebi traveler and scholar who took a 30-year journey from modern-day Morocco to China, covering 4x the distance of Marco Polo. Check out his story.