Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

This morning, probably around the same time that you are reading this article, the government will release Q2 GDP numbers. Given that the White House is front-running the GDP numbers by establishing its own definition of a "recession," it's likely that we will see a second consecutive quarter of negative real GDP growth.

Typically we would call this a recession.

Considering that over the last six months tech stocks have crashed 80%, crypto is dead, bonuses are down, inflation is high, gas prices are higher, and layoffs have been hitting in waves, it certainly feels like a recession.

And yet here I sit in a packed coffee shop in Atlanta, Georgia, and business is booming. There are 30 people in line for lunch, and the baristas have been busy all morning. The Braves game I went to last Tuesday (TUESDAY) was sold out. No one at the party I attended Saturday night seemed overly concerned with the economy, and the Atlanta airport was packed on Monday morning.

Reality must have forgotten about the recession.

What's going on?

Two Different Worlds

Two worlds exist: the world that you read about online, and the world that you live in every single day.

The online world has never been more precarious, with risks around every corner. According to this online world, we are one misstep away from economic free fall. Every headline warns us of war, inflation, and supply chain problems. Startups are failing, financial markets are falling, and every line that used to go straight up has been falling straight down (except for your gas prices, of course.)

The world that you read about online sucks.

But the real world? The one that exists outside of our screens? It's doing pretty well. In the real world, we hired 100,000 more people than expected in June alone.

In the real world, Amex customers are spending 148% more on air travel, 90% more on lodging, and 48% more on restaurants than they were in Q2 of last year. And that's just "experience" spending. Total spending is up 31% year over year.

Recent earnings reports from Hilton and Visa confirm this same trend: consumers are spending a ton of money.

Best recession ever.

So now we are in this weird spot where everyone thinks the economy sucks, but everyone acts like the economy is booming.

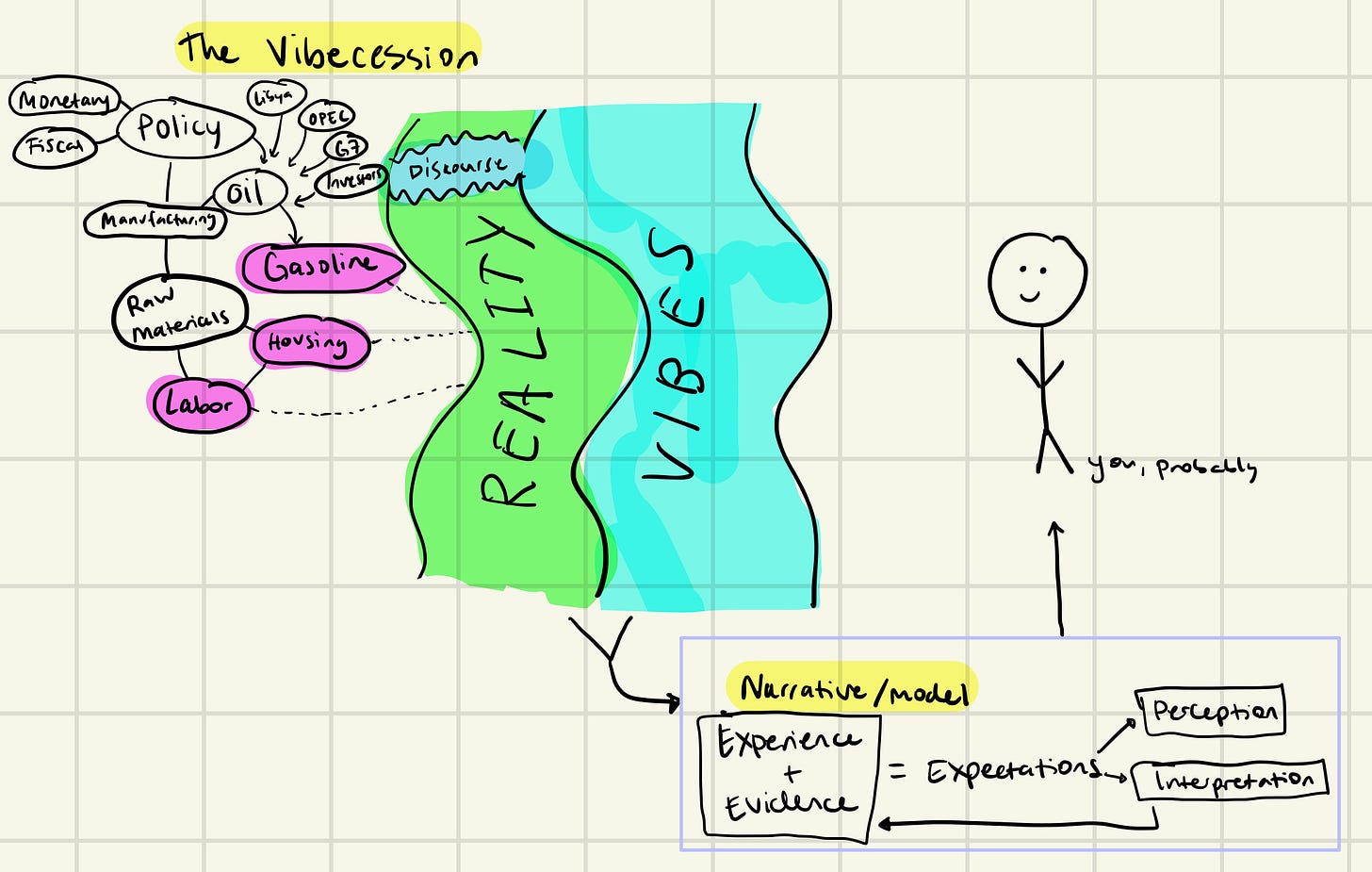

A couple of weeks ago, Kyla Scanlon asked an interesting question: Are we manifesting a recession?

The Vibecession: The Self-Fulfilling Prophecy

Are we manifesting a recession?

https://kyla.substack.com/p/the-vibecession-the-self-fulfilling

She raises a great point. The actual economic data is mixed. Jobs numbers are good and inflation is bad. But the vibes, the consumer sentiment, is awful. Everyone seems to think we're in a bad place, even if we really aren't.

This sentiment is really important because thoughts lead to actions. And the actions that people take when they think stuff is bad (because of what they read in the online world) can have implications in the real world.

Recall the early pandemic days, when everyone was so terrified of toilet paper shortages that they hoarded toilet paper, which, in turn, created a toilet paper shortage.

A "vibecession" works the same way. If people think the economy sucks, and they take actions that reflect these thoughts such as spending less, and this reduction in consumer spending spreads across the country, then yes, we could manifest a recession.

So right now, consumer actions are good, but consumer sentiment is bad. If sentiment remains bad, actions will likely become worse. Which, in turn, could cause a recession.

However, right now, consumers are still spending a ton of money. This vibecession has yet to impact consumer spending habits.

Considering that these negative vibes could have real consequences, the important question is why are the "vibes" so bad?

Mean Reversion

For both the economy and the stock market, the last ~two and a half years have been insane.

A pandemic shut down travel for a year, and offices closed everywhere as white-collar employees began working from home. The government committed to trillions in stimulus and cut interest rates to 0 to keep businesses afloat.

Meanwhile, the stock market experienced its fastest 30% decline ever, before rebounding so violently that it finished 2020 up 18%. Quantitative easing and stimulus packages sent a ton of new capital toward different assets, and we saw growth stocks trading at 50x sales, cryptocurrencies shooting up 1000%, SPACs taking half-constructed science projects public, private companies raising funding at 1000x revenue, and JPEGs trading for hundreds of thousands of dollars.

I mean come on man, people were paying $1M for pictures of rocks.

The result? We had millions of people working from their living rooms, casually throwing money at anything and everything. And everyone was getting rich. We were all stock trading wizards. We all had that buddy who made a killing in crypto. Stimulus checks became lottery tickets, and no one was actually "working" from home.

Dozens of things that had never happened before all happened at the same time.

After 18 months, we normalized this new environment. Of course, this was far from normal. Like, really, really far from normal.

The S&P 500, which historically averages 8-10% annual returns, increased by 31% in 2019, 18% in 2020 (and that's after a 30% decline in a month), and 31% in 2021. That's not normal.

The Invesco QQQ ETF, which tracks the tech-heavy NASDAQ, returned 39% in 2019, 49% (!!!) in 2020, and 27% in 2021. That's not normal.

Two years is a small blip in the history of markets and economies, but two years feels like an eternity in our "everything everywhere all at once" world today. 24/7 coverage of financial markets and economic news has us living through every moment in a hyper-exaggerated state of "right now."

When you live in a perpetual right now, it's difficult to remember what life was like before "right now." So "right now" becomes our baseline idea of normal.

And if you graduated college right before the pandemic began, or you first became interested in the stock market because you were bored while working from home, the last three years are the only "normal" that you have ever experienced.

This new normal was rocket ship emojis, NFTs, and cheap capital-subsidized billion-dollar companies that literally couldn't make money.

But this new normal wasn't actually normal. This new normal was just the normalization of euphoria.

Stocks can't go up 30% every year. Companies unable to generate cash flow can't keep hiring thousands of new employees. Speculative assets with no real value can't maintain insane valuations. Interest rates can't remain at 0% forever.

That was never going to be sustainable.

But if you were seduced by recent market conditions, it felt sustainable. Or at least you wanted it to be sustainable. Everyone loves making money, after all.

But thinking something is normal doesn't mean it actually is. And now, with interest rates rising, cash-burning companies going bust, and speculative assets crashing, we are returning to the real "normal."

But this isn't a recession. It certainly isn't a 2008 scenario. It's a mean reversion.

Mean reversions are tough, especially when you fall in love with the euphoria. With the boom cycle. When you are making money hand over fist for months, and then you suddenly start losing money hand over fist, of course you will have a negative view of the economy.

When cheap money subsidized a massive hiring spree for your unprofitable employer, and then your employer cuts jobs to focus on profitability when the free money dries up, of course you will think the labor market is crashing.

When you could have secured a 30-year mortgage at a 3% interest rate, and now it's a 5.50% interest rate, of course you will think the economy is faltering.

And when every single piece of financial information online highlights how far we have fallen from the peak euphoria of everything, while ignoring how crazy the peak euphoria was in the first place, of course it will feel like the world is crashing.

Right now, everything feels like this.

But if you expand your time horizon, it looks more like this.

Widespread, lucrative market speculation isn't normal. Companies burning cash into perpetuity isn't normal. What you are experiencing right now is a mean reversion to normalcy.

The extent to which you believe our economy is cratering has more to do with your perception of reality than reality itself. The more that you normalized the euphoria of the last few years, the stronger your negative feelings will be.

Sure, there are risks out there. There will always be risks out there. But when unemployment and interest rates are near historic lows, consumer spending is high, and companies that actually make money are continuing to make money, I think we'll be alright.

Air travel is booming, sports events are packed, restaurants are lively, and dive bar cover bands are back in business. Take some time away from the screens and check out the world around you. Real life is having one hell of a bull market right now.

- Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!

Jack's Picks

I am sick and tired of engagement farming on Twitter (and social media as a whole). Nick deWilde wrote a piece that summarizes exactly how I feel about this recent trend.

As some of you know, I am a huge fan of learning foreign languages. For any of you that may be learning Chinese, the Slow Chinese audio newsletter is a fantastic resource for honing your skills.

Lastly, I'm linking two of my favorite recent "recession" pieces: Kyla's Vibecession article and Katie's thoughts about this not really being a recession.