Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

Thoughts from 30,000 Feet

I went on a ski trip in Breckenridge, CO with several of my college friends last weekend. Man, it was awesome. Three days of great powder in the Rockies with good friends. You can't ask for anything better.

Unfortunately for me, I live on the east coast while the best skiing in the US is out west. To access the best powder in the states, I needed to fly to Colorado. And I have always hated flying.

While I have grown more comfortable with flying in the last few months (this sort of had to happen considering I've been on 25 flights since August), something about being trapped in a metal tube 34,000 feet above the ground for 2.5 hours still doesn't sit well with me.

There are a lot of things that suck about flying.

Long security lines

Minimal leg room

Overpriced refreshments

But one thing stands out to me: Turbulence.

When you are seven miles above the earth's surface, it's a long way down. When the plane lurches up and down, side to side in the middle of the troposphere, you pray to God that physics don't stop working. But turbulence isn't bad or dangerous. It's just uncomfortable.

Turbulent flights actually have a lot in common with stock market declines. Let's dive in.

Expand Your View

I fly with Delta whenever possible.

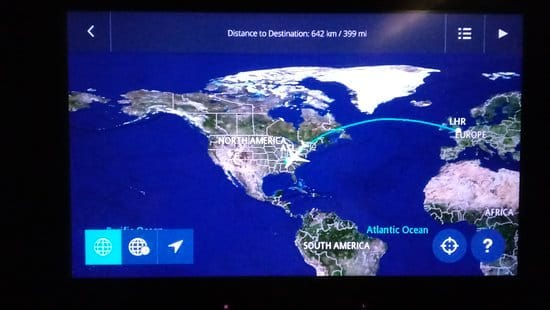

One reason that I prefer flying with Delta is the built-in entertainment system. Hundreds of movies, shows, and games are at your disposal for the duration of the flight. However, my favorite feature isn't any of these: It is the flight tracker.

I love seeing where my plane is on the map, moving the cursor around the globe, and exploring different time zones. The flight tracker also has an "information" tab that shows altitude, speed, time to destination, etc.

Back to turbulence. On my way to Colorado, we experienced a wave of stomach-dropping turbulence an hour in. My heart rate jumped as my fight-or-flight response kicked in. We must have dropped hundreds, maybe thousands of feet... right?

Wrong.

I checked the altitude tracker on my screen. We had dropped a massive 18 feet. from a cruising altitude of 34,000 feet. That's a 0.05% decline in altitude. Literally nothing.

But it didn't feel like nothing. In my state of heightened anxiety, it felt like we were moments from a death spiral. Because I was hyperaware of every bump and dip.

Investing works the same way. When we are checking stock prices everyday, constantly plugged in to the market, every minuscule decline feels pronounced. The S&P 500 is down 1.5% one day? That's thousands of dollars down the drain. Your positions have been red for a week? You wish you had sold.

When you live in this state of market hyperawareness, you feel like you need to safeguard against every little decline.

Zoom out. That 1.5% decline is nothing over the long-term. The fear, anxiety, and doubt that you feel isn't a sign of risk or danger. It's a sign that you are paying too much attention to short-term volatility, and not enough attention to long-term trajectory.

When you are overly focused on your flight's movements, those 10 foot drops feel like a death sentence. When you look at those small bumps in comparison to your altitude, you realize they are irrelevant.

When you are tracking stock prices day in and day out, those small drops feel like the world is crashing. When you look at the long-term trajectory of the stock market, you realize declines are entirely normal. A feature, not a bug.

Zoom out.

The Cost of Comfort

Turbulence sucks because it is uncomfortable. I know for a fact that I would be more comfortable taking a full day to drive out west. I would be in control. I wouldn't be at the mercy of high-altitude winds.

But this comfort comes with a cost.

It would take 20 hours to drive from Atlanta to Colorado. It only takes 2.5 hours to fly the same distance.

The cost of comfort is efficiency.

For all of the discomfort involved in flying, it is a remarkably quick way to travel from point A to point B. Is "comfort" really worth wasting a full day?

Maybe, if comfort were correlated with safety. But that isn't true. In fact, the opposite is.

What are the odds of dying in a motor vehicle crash? 1 in 103. What are the odds of dying in a plane crash? 1 in 9,821. For those keeping score back home, you are 95x more likely to die in a car crash than a plane crash.

Comfort =/= safety. And discomfort =/= risk.

Driving feels safer. It certainly feels more comfortable. But driving takes 10x longer to get from point A to point B, and it increases your risk of a fatal accident by almost 100x when compared to flying.

In this case, the more comfortable option is both more dangerous and less efficient. Hardly worth the tradeoff for comfort.

The same is true with markets.

Stock market declines suck. If you had $100,000 invested in the S&P 500 in January 2020, you lost more than $30,000 in just two months. However, by January 2022 you would be up more than $70,000 from the lows.

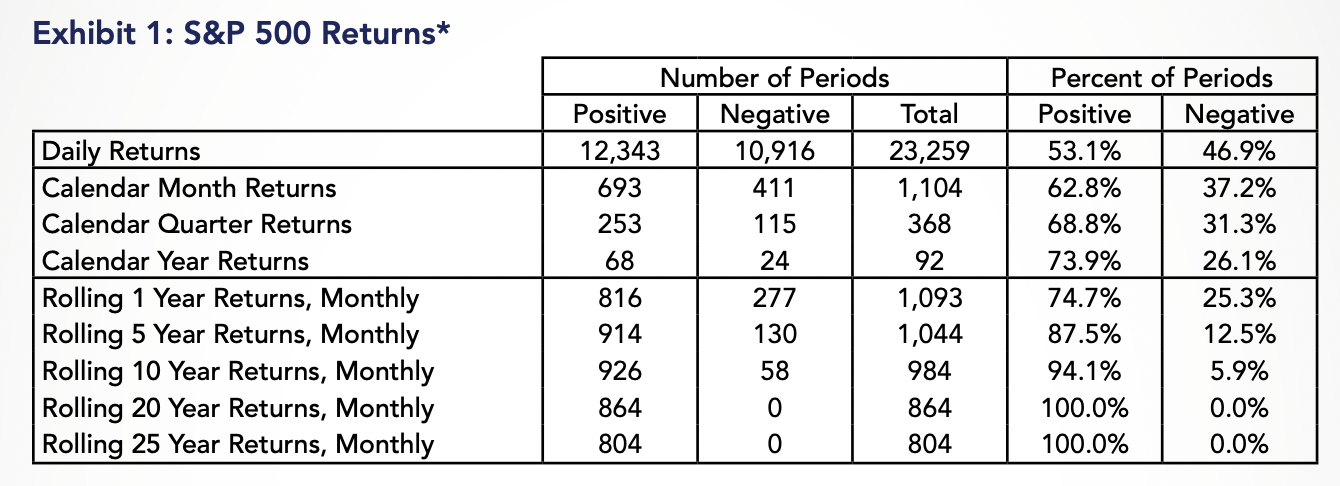

Staying in cash "feels" safer. It is more comfortable. But it is also more dangerous. As your time horizon increases, your odds of positive returns from the stock market approach 100%.

Meanwhile, staying in cash all but guarantees that your savings will depreciate over time thanks to inflation. Market declines suck. Losing money sucks. But declines shouldn't scare you off. In fact, you should welcome declines. Because they offer you cheaper prices to purchase stocks.

Turbulence is the cost of efficient transportation. Market declines are the cost of outsized returns.

Comfort =/= safety. And discomfort =/= risk.

Closing Thoughts

Turbulence sucks. But it isn't dangerous. It isn't risky. It is just uncomfortable.

Stock market declines suck. But they aren't dangerous. They aren't risky. They are just uncomfortable.

The market provides the best opportunity for average investors to create wealth over time. The journey isn't always comfortable, but volatility isn't risk. It isn't danger. It is the cost of wealth creation over time.

Cash might be comfortable, but like driving long distances, it is guaranteed to set you back over time. Ignore the turbulence, and focus on the long game.

- Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!