Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

I’m going to tell you two stories about two different celebrities.

Two days after his 20th birthday, Johnny Manziel was on top of the world. In 2012, as a freshman quarterback still a year away from the legal drinking age, he set multiple conference records, knocked #1 Alabama off its pedestal, and ultimately won college football’s crown jewel: The Heisman Trophy.

While many critics predicted that Manziel would have a sophomore slump, he proceeded to finish the 2013 season as a Heisman finalist with 4,114 passing yards, and the Texas A&M legend declared for the NFL Draft.

Despite questionable scouting reports, the Cleveland Browns traded up to take Manziel with the 22nd pick after he texted then-quarterbacks coach Dowell Loggains that he wanted to “wreck the league” in Cleveland.

Illustrious collegiate career. Heisman Trophy winner. First-round draft pick. Likely franchise quarterback. 21-year-old Johnny Manziel made it. He won the game.

And that was as good as it got.

In his first preseason with the Cleveland Browns, Johnny was fined $12,000 by the NFL for flipping the bird at the Washington Redskins. He then lost the quarterback battle to teammate Brian Hoyer, who was named the starter for Week 1. Manziel only managed to start one game in his rookie season, where he threw 0 touchdowns in a 30-0 loss to the Cincinnati Bengals.

Going into Manziel’s second season, dozens of sources within the Browns organization questioned his work ethic, with an anonymous teammate referring to his rookie season as a “100% joke.” The second-year quarterback missed most of the preseason with an elbow injury and barely touched the field in the regular season, but an injury to the starter in November gave him one last opportunity… and he appeared to seize it. After throwing for 372 yards against the Steelers, Manziel was named the starter for the rest of the season.

Then he blew it.

Manziel was demoted to 3rd string just a week later after videos surfaced of him partying in Texas over the bye week. The quarterback then missed the final game of the season after suffering a concussion, before skipping mandatory team activities that Friday when he flew Vegas for a weekend.

The bad news kept coming for Manziel in February 2016 when he was investigated for a domestic violence incident involving his girlfriend. One month later, at just 23 years of age, he was gone from the league for good.

Unlike Johnny Manziel, who took over the football world as a 19-year-old, George Clooney didn’t find fame until his early 30s.

Clooney landed his first acting role when he was 17, playing an extra in the mini-series Centennial in 1978. He then spent the next 16 years bouncing between supporting roles and one-off appearances on shows such as The Facts of Life, Roseanne, and Baby Talk. It wasn’t until 1994, at ~33 years of age, that Clooney landed his big break playing Dr. Doug Ross in NBC medical drama ER.

Clooney spent six years as ER’s protagonist, and he never looked back. In the 20+ years since, he has won two Academy Awards and four Golden Globes, dominated the box office with hit films like his Oceans series, starred in, directed, and produced his own television series Catch-22, befriended President Barack Obama, co-founded and sold a $700M tequila brand, and, finally, married and started a family.

At different times in recent years, Clooney has credited the longevity of his Hollywood success to his lack of success in his youth.

In a Guardian piece from 2019, Clooney said, “I was 33, 34 when ER took off, so I was older, right… So, I’m lucky enough to understand how little the fame side has to do with me.”

And in a Times piece from 2021 covering his nearly-fatal motorcycle accident, Clooney once again echoed this idea, saying that he was “lucky I got famous when I was 33, not 23. I’d have been shooting crack into my forehead if I had been 23 and given money and success,” and “You need to have failed a sh*tload - if you have, you never trust success.”

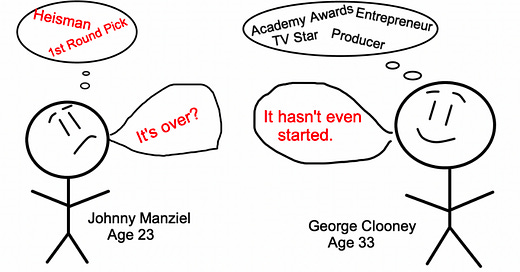

Johnny Manziel, the most dynamic player in football for two years, was out of the NFL by 23, while George Clooney, the most well-known face in Hollywood, didn’t really get started until he was 33.

It’s an interesting contrast, but it makes sense.

We see this “young superstar burns out and or goes broke after a few years” all the time, especially in sports, media, and music. The reason why resides in the final sentence of Clooney’s second quote: You need to have failed a sh*tload - if you have, you never trust success.

Success and failure are interesting because they can’t be fully explained by some third party. They have to be experienced to be understood.

This is especially true with money.

You can’t teach someone what it feels like to lose money. I mean, sure, you can show someone that markets have declined by 30, 40, or 50% in the past. You can share stories of home flippers who made and lost millions in the Great Financial Crisis and day traders whose paper fortunes evaporated when the Dot Com Bubble popped.

But no one understands risk and loss until they live through it.

And that’s why it’s so important to experience failure early. When you’re just getting started, the stakes are low. Your financial losses are minimal, the fallout is contained, and most importantly, you have time to learn from the experiences and try again with renewed understanding.

But if you only know success from an early age? Risk isn’t real to you. It’s an abstract concept. Imagine a pair of day traders who got caught up in the market madness of 2020 and 2021. They both began with $10,000 in their portfolios, and the first, after reading about a hot stock on Wall Street Bets, decided to purchase some call options. But the stock doesn’t go “to the moon,” he loses $6,000, and he decides to stop trading. “The risk isn’t worth it,” he thinks.

But the other day trader parlayed his $10,000 into $20,000. Then $50,000. Then $100,000. Then $250,000. Next thing he knows, he’s sitting on nearly $500,000. He’s a genius. Every market move is predictable. $1,000,000 is coming up soon, he’s sure of it.

Risk? I mean, sure, he could have a bad trade here or there, but it won’t be anything serious. He has this game all figured out.

But the thing about risk is that when it happens, it happens fast. And the magnitude of that first loss will be directly proportional to the length of time it takes for that first loss to occur.

One day, after the second “investor” has been trading for a couple of years, market conditions change. He thinks it’s a brief aberration. A blip. He doubles down, but the market doesn’t recover. $500,000 turns to $400,000 turns to $100,000, but he doesn’t know how to handle risk because he experienced two years of non-stop wins. And then that $100,000 goes back to $10,000, right where it started.

Meanwhile, the first investor, the one who lost $6,000 on his first trade, has spent the last two years quietly building his portfolio, oblivious to the chaos experienced by his counterpart.

We read countless stories about “retail traders” who hit it big on GameStop, Tesla, or AMC, just to squander thousands, and sometimes millions, because they refused to cash out.

They didn’t understand risk.

The athlete who goes bankrupt at 28, the childhood actor who spirals as they enter adulthood, and the day trader who blows generational wealth are different examples of the same phenomenon: misunderstanding risk.

Taking L’s early gives you a healthy respect for risk. You’re more likely to avoid it, or at least acknowledge it, as you progress financially and professionally. But starting off with nothing but success? Well, that can be catastrophic.

- Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!

Jack's Picks

I'm subscribed to around a dozen newsletters, but my inbox was getting ridiculously cluttered. I’ve started using Meco to organize and read my favorite content in one place, without the inbox clutter. Check out Meco here.

I enjoyed Katie Gatti Tassin’s recent piece discussing individualism s a policy position and whether or not “Everything’s a Pyramid Scheme.”

Nick Maggiulli wrote a good piece on the appropriate amount of lifestyle creep.

Here is the Linkedin post that will probably lead to a call with Goldman PR.