Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

On October 24th, 1929, the Dow Jones Industrial Average fell 11% in a single day. We now call this infamous date Black Thursday.

Black Thursday marked an inflection point in both financial markets and the broader US economy. It was preceded by the Roaring 20s, a decade of immense wealth creation where the market appreciated 6-fold, and followed by the Great Depression, a decade of immense wealth destruction where the market crashed 89%. The Roaring 20s and Great Depression are well-researched periods of American history, and market pundits often use them as reference points for current and future market dynamics.

When studying this era, we always focus on market prices, but not market participation. In 1929, only 10% of US citizens owned stocks. In 2022, 56% of Americans own stocks.

In 1929, many investors weren't aware of Black Thursday until they saw the headlines in Friday's paper. In 2020, every second of the corona crash was discussed in real time on Twitter by millions.

In 1929, investors had to call their brokers and pay commissions to place trades. In 2022, investors can place zero-commission trades seconds after reading an Elon Musk tweet about Doge Coin.

In 1929, markets were open from 10 am to 3 pm, and financial media consisted of newspapers and the occasional radio broadcast. In 2022, crypto markets never sleep, and we are exposed to 24/7 market coverage and commentary.

More players. More information. Fewer barriers. Faster communication. These are some powerful changes, and changes have consequences. I have developed a theory recently:

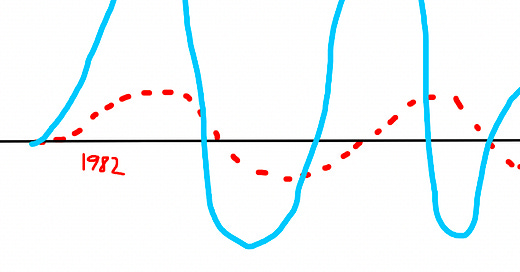

Market cycles have grown and will continue growing faster and more volatile as participants are more "plugged in" to their investments than ever before.

Let's dive in.

Everyone is a Trader

56% of Americans own stocks now. In Portugal last month, I had a colorful discussion with a Chilean about his sizable Bitcoin position. Every group chat has discussed the stock market countless times over the last two years. Your little cousin probably made $5,000 trading some alt-coin and thinks that he is the next Jordan Belfort.

We have officially democratized finance, baby.

Investing is no longer an activity reserved for the elites. Thanks to commission-free trading, mobile applications, and fast internet connections, we can trade whatever we want, whenever we want. And because we humans love accumulating $$$, it is only natural that over half of us are now participate in these markets.

More people in the market is a good thing, because everyone should have the opportunity to build wealth over time. But I need to note one point:

More participants --> more money --> bigger market moves.

Wall Street, Money Never Sleeps

Markets used to be open from 10 AM to 3 PM, and there were a few futures exchanges for commodity prices. Way before Jim Cramer was screaming "BUY BUY BUY" on Mad Money, "financial media" consisted of the front page of the paper and an occasional radio broadcast.

In 2022, the stock market is open from 9:30 AM to 4 PM. But after the regular market closes, futures markets trade all night. We don't get weekends off either. Thanks to crypto, you can now lose money on Saturdays too!

And even if you escape the vice grip of the market, you can't escape the commentary. 24/7 coverage on CNBC on your television. Your Twitter feed is full of opinions on the Federal Reserve and Tesla's earnings. Podcasts and newsletters constantly discuss the hottest investments this week.

The market has become a game that doesn't turn off, and an entertainment channel that never ends.

You. Can't. Get. Away.

Impulsive Traders

Eight seconds.

1.81 seconds faster than Usain Bolt can run 100 meters.

The length of time for a well-executed IndyCar racing pit stop.

Two thirds the length of the first Wright Brothers flight.

Eight seconds is also how long it takes for me to switch from Twitter to Robinhood, click on a stock, and press buy or sell.

Eight seconds isn't long, but it is long enough to move around millions of dollars. Enough time to buy a cryptocurrency that Elon Musk tweeted about. Enough time to purchase a tech stock that Cathie Wood bought that day. Enough time to sell everything you own in a knee-jerk reaction to the Fed Chairman's comments.

Eight seconds is not enough time to think through a trade. To evaluate the risk-return of your decision. To thoroughly research the security.

Eight seconds isn't enough time to make a decision. But it is more than enough time to take action. That makes eight seconds very, very dangerous. Zero-commission trading and mobile brokerage apps are awesome, because they have opened the investing process to millions.

Zero-commission trading and mobile brokerage apps are also hazardous, because they removed any barriers to save us from ourselves. When you had to call your broker and pay commission to make a trade, you thought twice about it.

"I want to buy $50,000 of Shiba Inu coin" just isn't a phrase that you want to tell the finance professional managing your account. And you will certainly hesitate to pay commission fees for these impulsive trades. But with that friction gone? You can ape into whatever you want, whenever you want. No ragrets, right fam?

When money is at stake, we humans aren't exactly rational.

FOMO

Between April and June 2020, the stock price of Nikola Motors, a startup that planned to build battery electric and hydrogen powered semi trucks, ran from $10 to $93. Nikola, a company whose only product thus far was computer-rendered image of a truck, briefly had a higher market capitalization than Ford, an auto manufacturer that produces millions of vehicles each year.

Between January and February 2020, the stock price of Churchill Capital IV, a SPAC rumored to be taking electric vehicle start up Lucid Motors public, ran from $10 to $64. The merger wasn't confirmed, the deal valuation wasn't known, and the SPAC traded at a 540% premium to its cash balance.

Between November 2020 and January 2021, the stock price of GameStop, a declining video game retailer, jumped from $10 to $400. GameStop, a likely bankruptcy prospect just months earlier, was briefly worth more than $20 billion.

Between December 2020 and May 2021, the price of Doge Coin, a cryptocurrency based on a Shiba Inu, increased from $0.003 to $0.70. Doge Coin, a meme token created to make fun of Bitcoin, was briefly worth more than Deutsche Bank, a financial institution that generates billions in revenue each year.

Why?

Because 1% of people are getting hysterically rich and 99% of people want to be the 1%. Social media has empowered people to share whatever they want whenever they want, and clout isn't cheap. No one is out here sharing humility on their timelines (unless they are humble-bragging on Linkedin).

No. They're sharing wins. And the biggest wins get the biggest stages.

Front page Reddit posts from the guy who made $30M on GameStop. CNBC stories about the Tesla investors who retired at 35. We all know a 25 year old crypto millionaire these days. And everyone wants to be the next overnight success.

The problem is we are horrible at estimating the odds of success.

We have a disproportional idea of what these success stories look like. It seems like everyone is getting rich in the NFT craze, but 5% of addresses are responsible for 80% of profits. The tales of those who lost everything are whispered in shadows. The stories of those who hit the jackpot are exclaimed from mountaintops.

The Dunning-Kruger Effect tells us that we are notorious for overestimating our own knowledge and skills.

A lot of people see a few people make a lot of money, and everyone thinks that they'll be next. Everyone thinks that they are on the right side of the bell curve, because the guys who made all of the money don't seem that smart. It can't be that hard.

When the wins are in your face everyday, the losses are nowhere to be seen, and all of your cash is only a phone screen away, you just might decide to throw some money at the next hot story.

The only cure to FOMO is a good YOLO anyways.

Ripples of Information

For about 15 months, I was an active member of a SPAC Discord. For the uninitiated, Discord is like an internet chat room on crack. Discord servers can be organized with tiered members, separate channels for different information, and a Pandora's Box of various plug-ins.

My Discord, the International SPAC Station, was (and still is) a community of 2500 SPAC traders. 30 of us met through Reddit, and we set up a server to centralize the exchange of information on all things SPAC.

Over time, our community grew larger and more efficient. We designated channels for each SPAC. We built bots to scrape SEC filings. We set up an alert chain where anyone could send push notifications to the entire server as soon as they saw merger news. We were even tracking website changes of various SPACs.

Are you familiar with an Electric vehicle maker called "Fisker Inc."?

Fisker went public through a merger with Spartan Acquisition Co. (SPAQ). By the time merger news came out in Summer 2020, it was too late to profit on the announcement. But we didn't wait on the merger news. We saw it coming ahead of time. My group of SPAC bois saw that Spartan had changed its website header from oil rigs to windmills three weeks before the announcement. And we also knew that Spartan's merger deadline was quickly approaching.

Check the date: 6/29/20

We (correctly) believed that this meant Spartan had found an EV/clean energy target, and merger news was imminent. So we loaded SPAQ warrants (similar to call options) at $1. And when the merger news came out two weeks later, we made 400% returns in a day.

Check the date: 7/13/20. Two weeks after we called it.

Imagine having a Bloomberg terminal + the combined research of 2500 traders in one spot. We knew this market sector better than anyone else. We developed trading strategies for warrants and shares. We were making bank. I turned $6,000 into $400,000, and I wasn't even the biggest winner in percent or absolute returns.

It was nuts. In the world of SPACs, we were the smart money.

Sometimes, we would correctly predict mergers before they happened (this also happened when SBE changed its website before announcing its merger with ChargePoint), so we just bought and waited on the announcements.

Other times, we would share our findings with the world. The SPAC Reddit page had grown to 100k followers, and we would discuss our due diligence there. We would post detailed write ups on Twitter. More eyes would see these stocks. Then someone would write about it on Seeking Alpha. Some podcast might discuss it. And two weeks after we discovered a SPAC, Jim Cramer would mention it on Mad Money.

Since this market is driven by hype and FOMO, a mere mention by JC was worth 100x more than any fundamental metric like cash flow or profitability. I'm not kidding, Cramer pumps were gold in 2020.

Another zero revenue EV startup, Canoo, went public through a merger with HCAC. It was dead money for months. Then Cramer found out about it three months after the merger was announced.

Guess what happened after Jim Cramer said he liked the EV startup?

I have an explanation for the "Cramer Pump", and the broader movement of information throughout market participants.

Have you ever thrown a stone into a pond? Once the rock hits water, rings expand from the impact zone. Market information moves in a similar fashion. It emerges from a central point (in our case, a Discord server) before leaking out to social media platforms. With millions of new potential eyes, it is only a matter of time before this information hits the broader internet. And if momentum is strong enough, you'll eventually hear about it on television.

Each "ring" adds a bigger audience to the mix. More potential buyers. The biggest audiences are also the latest buyers.

Information always starts at some central point. Sometimes, the central point is the mainstream media. No one has the advantage of being early.

Other times, one group is way ahead of the curve. In the SPAC market, our server happened to be one of several sources for early information. We digested data quicker than most. These central points exist in every sector. SPACs. Crypto. Growth stocks. Every market has information epicenters.

If you're early, you can make a killing, because all of those outer rings will bid up your investment.

The problem is if you are located on an outer ring and don't realize it.

When you throw a stone in the pond, the ripples eventually subside.

Reality Check

Let's go over what we know so far.

Everyone is a trader. Markets never close. There are no barriers to trading. FOMO is being shoved in your face. And information constantly radiates from central points across all media channels. All of this means information is reaching bigger audiences incredibly quick, and these audiences will likely apply a lot of buying pressure.

Everything I mentioned above explains why stuff melts up so quickly, but that is only half of the cycle. What causes the swift crash that tends to follow?

The story always outruns the substance. I'm going to steal a quote from a piece I wrote in December:

When valuations are sky-high, execution has to be perfect for you to breakeven. And if growth slows down at all? Have fun staying poor.

When valuations are at rock-bottom, every little thing that goes right can make you money. Story based valuations are great, but eventually you have to generate revenue. Sales based valuations are great, but eventually you have to turn a profit.

If you’re investing in stories, you better hope J.K. Rowling is the author.

I mentioned how information spreads from a central point like ripples in a pond. As those rings of information expand, more buyers pour into an asset. While the story hasn't changed, the price increases as more investors want in. And the later buyers usually don't realize how much they are paying for this story. A story can be fairly valued at its source, and grossly overpriced by the time you hear about it.

CCIV/Lucid was an interesting speculative buy at $10 when the rumor news first broke. CCIV/Lucid was a screaming red flag at $52 when it hit CNBC. But CNBC's audience didn't realize that Lucid was worth $80B+ on paper at this point. They didn't realize that SPACs price their deals on a $10 per share basis. They didn't understand that buying now was overpaying by 5x. They didn't know that Lucid was worth more in January 2021 with 0 deliveries than Tesla was worth in January 2020 with 367,500 deliveries.

They heard that Lucid was the next Tesla. And they knew that buying Tesla four years ago would have made them rich.

And it only takes eight seconds to open their brokerage account and purchase $25,000 worth of Lucid. Eight seconds isn't enough time to reheat cold pizza, let alone think through the risks involved with buying a stock. So you buy it. Because it's the next Tesla.

And then the merger is confirmed. You were right! But it turns out that by investing at $60, you did pay $80 billion for an EV company that hadn't delivered any EVs yet.

See, in the course of a few weeks, two things happened.

The asset's story outgrew its value

Buyers disappeared as ripples calmed down

As the "story" of Lucid grew, more investors piled in. By the time you heard about it on CNBC, anyone else who wanted to get in was already in. Everyone knew that the merger was a done deal. There was no one new left to buy. So when the good news dropped, Lucid dropped too.

Because who would pay 6x more than what the company should be worth?

And when those ripples disappear, and that price stops increasing, look out below.

Let's Tie It All Together

Right now, everyone that you know owns stocks. But not in a "let me call my broker once a quarter and check my portfolio" type of way. In a "let me swipe up to refresh Robinhood every 3 minutes" type of way.

Not only can you refresh our stocks every 3 minutes, you can trade them whenever we want for free! In just eight seconds, you can go from a locked phone screen to a $250k trade.

Pretty cool that over half of our population can YOLO all their money on a moment's notice, right? Now let's introduce 24/7 markets. Crypto never sleeps. Anyone can trade futures. And even when the stock market closes, the commentary never stops. Your Twitter timeline. CNBC. Reddit. Your group text. Every second of every day, you are exposed to news about markets. The stock market is living rent free in your head.

The best part about this constant exposure? You see success story after success story. $GME millionaires. Guys who retired early because they went all in on Tesla. Those guys aren't smarter than you. They likely just got luckier than you.

But you believe that one day, you could be one of those winners.

What you don't see are the countless failures, blowups, and mistakes that left others broke. Because we whisper our failures and scream our victories.

Not that you would be one of the losers anyway.

So then you catch wind of a story. The next hot investment. Your big break. The one that could make you rich. Word is spreading quickly, because there are millions of investors just like you looking for their own lottery tickets.

"The next Tesla!" "Short squeeze!" It doesn't matter what the story is.

In 8 seconds, you throw all of your money behind that trade.

Whoops.

You thought you were early, but you were actually late. You thought that you were in the middle ripple, but you were actually on the outside. Because information moves fast these days. And a lot of buyers wanted in. That stock had already 10x'd in the last month, there weren't any new buyers left.

In a matter of weeks, everyone that wanted to invest had invested, and the ripples stopped expanding. Buyers stopped coming in, price started dropping, and panic set in on a million traders.

Imagine a packed movie theater catches on fire, and hundreds of people try to pour through one small exit. That's you and every other trader that bought too late. And no one is going to buy this dip anytime soon. So the price plummets as everyone looks to sell.

And this whole thing happened in a month.

Markets move fast in 2022. Generational trades play out in weeks, not years. Everyone is trading. No one can escape the markets, and we all think that we will be winners.

And FOMO is a helluva drug. After a stock 5x's in a quarter, your rational brain should think "it's overvalued." But your brain instead thinks, "I need to get in before it's too late."

And you're not alone. Unfortunately, someone will be "too late". Maybe it will be you, maybe it will be someone else. The last one in is probably going to ride this thing down to rock bottom.

And it can all happen in a month.

More investors. More markets. More exposure. More greed. More access. Are we really wondering why we have more volatile market swings?

Happy Thursday. Let's go find some generational investments that will 10x in 10 days.

- Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!