You Only Have to Get Rich Once.

Hitting it big in the market is electrifying, but can you hold on to what you made?

Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

Masayoshi Son, the CEO and founder of Softbank, holds a particularly desirable title: multi-billionaire. For 22 years, Masayoshi Son also held a particularly undesirable title: largest loss of personal net worth in history, $70 billion. When the Dot Com bubble popped in 2000, Son’s Softbank, which was heavily invested in tech stocks like Yahoo!, collapsed by 99%, taking almost all of Son’s wealth with it.

In the 24 years since then, Son has made and lost tens of billions more. Some of the highlights:

Softbank’s ~$54 million dollar investment in Chinese e-commerce platform Alibaba yielded a $72 billion return by the time the company exited its position in 2023.

Softbank raised $100 billion for its Vision Fund in 2017, making it the largest venture fund ever.

Softbank’s Vision Fund lost $32 billion in the financial year ending March 2023, following a $19 billion loss the year before.

Softbank lost more than $14 billion on WeWork alone in 2023 when the office-leasing company filed for bankruptcy, after doubling and tripling down on its investment.

Softbank took British chipmaker Arm public at a $54 billion valuation in 2023. Thanks in large part to the current AI boom, Arm is now worth approximately $150 billion, and Softbank’s 90% stake in Arm makes up almost half of the investing group’s total portfolio.

The ironic part about Son’s journey is that, despite the hundreds of billions of dollars that his company has gained and lost over the last 24 years, his net worth is still only $30 billion, or less than halfway back to his peak net worth. He would have been much, much richer had he exited the game in 1999 than he is now after spending 24 more years investing.

If you owned stocks (like, literally, any stocks) or crypto (like, literally any crypto) over the last couple of months, you’ve made money. If you owned the right stocks (or crypto) over the last year, you may have made a life-changing amount of money. Some one year returns:

Rocket Lab: 350%

Dogecoin: 332% (lol)

Cava: 305%

Coinbase: 220%

Palantir: 195%

Nvidia: 185%

Hims: 180%

Upstart: 166%

Even the S&P 500, a categorically “boring” index fund that averages a 9% annual return, is up approximately 25% year-to-date as of November 18, 2024.

Eye-popping returns, naturally, cause two subsequent reactions: FOMO from those who didn’t generate 195% returns, and pride from those who did. The former is the foundation of every bubble ever: you see someone made a lot of money buying a thing and, after resisting for months, you capitulate and throw some money in as well. Then someone else does. And someone else. Sending the price higher and higher. That’s FOMO. Advice for this group is straightforward: don’t chase an investment just because everyone else is, especially if you don’t fully understand why it’s going up. (This advice is easy to follow in theory, but difficult in reality.)

The latter group however, is the one I find more intriguing: What if, instead of chasing the FOMO, you were ahead of it? What if you’re the one who made “f*ck you money” on a trade gone right? Maybe you’ve been giga-long Coinbase (or, even better, MicroStrategy) since Q4 2022, or you loaded up on Cava after an excellent slop bowl of braised lamb and veggies last year. If that’s you, you’re actually in a more dangerous position than your FOMO-chasing counterparts, because money easily made is easily lost, and the only thing worse than not making life-changing money is losing the life-changing money that you just made.

Why is it so hard to hold on to the money we made? Because hitting a home run on an investment is euphoric. And beyond the dopamine rush, it strokes your ego, making you feel smart. Those good feelings cloud your judgement.

Financial returns are a seductive feedback mechanism. When something you invest in goes up by a lot, you feel like a genius, and you want to experience that rush again. And because your last bet was correct, you grow more confident, so you decide to double down on another trade. Maybe that investment works out as well, so you repeat the process again. Positive reinforcement in the form of financial compensation is one hell of a drug.

The thing is, stocks can go up for a variety of reasons, and they don’t always go up for the same reason that you made your investment.

Sometimes, that “reason” is fundamental to the company itself: such as margin expansion, a shift to profitability, or revenue acceleration that is then amplified by valuation expansion.

Other times, the reason is related to broader macro conditions: maybe interest rates were cut or some geopolitical risk subsided, and your investment benefited.

A stock could also go up simply because of its correlation to other stocks that have had a fundamental reason to go up. For example, from March 2023 to May 2024, Dell’s stock climbed from $37 to $160 thanks to “AI.” The issue with this group is that these stocks can quickly reverse course as investors realize that the correlation was in name only. In Dell’s case, the stock promptly fell from $160 to $92 over the next four months as investors realized that “AI” hadn’t translated to improved revenue or earnings.

But when you buy something that goes up, you always, always assume that your investment belongs to the first camp: the good performance is fundamental to the company itself. We all want to think that we’re the masterminds of our own riches, after all. It’s a hubris thing. If the stock went up for some non-fundamental reason, it would imply that your good fortune was due to luck, or a coincidence, rather than skill on your part.

This flywheel of “I’m so smart because I bought the thing that made me rich” is seductive. While the most compulsive gambler on a roulette table knows he’s playing a game of luck, the investor can easily convince himself that it was his own analysis that made him rich, not market/sector beta or sheer chance. And that self-proclaimed genius investor, who didn’t analyze why, exactly, his investment made money, will soon find another genius, compelling opportunity in which he will make another concentrated bet, feeling emboldened by his recent successes.

One factor that magnifies investors’ inability to analyze the “why” behind their investment results is the speed at which markets move today. Thanks to the internet, which has enabled the rapid dispersion of information, financial markets move so quickly you don’t have time to reflect on why, exactly, you made the money you did. Information and sentiment that used to trickle from market participant to market participant is now broadcast with an online megaphone 24/7.

The Dot Com bubble peaked in 2000, but it didn’t bottom out until two and a half years later, in October 2002. That’s a 31 month draw-down. In 2020, it took just 5 months for markets to hit all-time highs, fall 30%, and regain all-time highs again.

That’s insane.

And every moment of the collapse and recovery was documented and opined on by millions of investors across Twitter, Reddit, newsletters, and blogs. In 2024, markets move faster than we can process what happened. When prices move faster than the speed in which we can process those moves, as they are now, we’re vulnerable to making mistakes because we have the confidence of someone who made money without the understanding of why, exactly, we made that money. We get so distracted by the next thing that we can’t digest the current thing. The increasing confidence that stems from our under-analyzed profitability sets us up to get humbled on a future trade, which brings me to my next point:

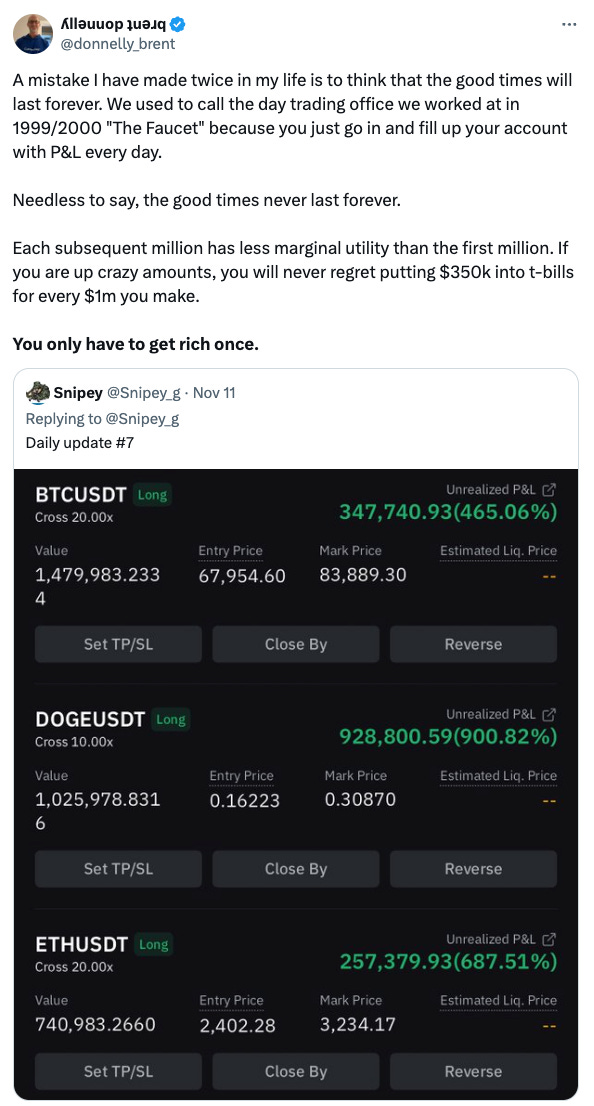

Beyond not having time to digest why our last trade did or didn’t work, we don’t have time to think through if we even need to make another trade. If you hit it big, like really big, in the recent bull market, is swinging for the fences again even worth it? Brent Donnelly had a good tweet about this:

You only have to get rich once.

Markets are cyclical, and for the last few months, it has been really, really easy to make money. And if you took outsized risk, your probably made a lot of money. But markets won’t always be really, really easy. I’m not saying that the things that have been going up won’t keep going up. Bitcoin might hit $100,000 this week, Palantir could keep climbing to $80, and, of course, Tesla is destined to be a $10 trillion company or whatever its most bullish sell-side analysts say. But if you made a life-changing amount of money on a concentrated bet, it’s worth considering whether it makes sense to risk that now-life changing sum to make an additional, no-longer-life changing, amount. Going from $200k to $2 million can legitimately change your life. Going from $2 million to $4 million would be nice, but the marginal benefit pales in comparison to the costs of losing, say, $1.5 million on a trade gone wrong.

Investment decisions shouldn’t just be viewed as “numbers on a screen.” The risk-reward dynamic changes rapidly as the value of your portfolio increases, and you should consider what those dollars represent in your life: A home, a car, an earlier retirement, more trips with your kids, or the ability to sleep well at night knowing that you have a lucrative nest egg. At some point, we all have a number where the risk no longer makes sense. If you’re already rich, and you keep swinging anyway, you might suffer a loss that, 24 years later, you still haven’t fully recovered.

You only have to get rich once.

- Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Jack's Picks

Semafor published a fun profile on Emily Sundberg and the success of her Feed Me newsletter.

I recently reread this 2021 interview between Eric Newcomer and Redpoint MD Logan Bartlett on the state and future of venture investing. For context, 2021 was peak VC in terms of fundraising, exits, and valuations, so it’s interesting to look back at it three years later.

For those who don’t know, Stripe, the payments company, has a publishing arm called Stripe Press. This Making Media interview with Tammy Winter, the head of Stripe Press, was super insightful.

As a reminder, I have a weekly podcast with Sherwood Media called “Snacks Mix,” where we cover the most important stories in business and markets each week. New episodes drop every Thursday morning, and you can check out our latest episode, which covers Spirit’s bankruptcy, retail earnings, and Chinese AI companies poaching west coast talent, here.

Great article and I needed to hear this. The last few years have been very nice. I won't seek it out but it is good to have someone way shake you back to reality and offer the advice to not take your wins for granted.

Please check in on me often and maybe a slap across the face next time to make sure I am taking this advice all in.

i wish I could easily forward this to every one of my clients - lot of them are tech professionals who won the lottery and instead of cashing out of most and being set, continue to buy more lottery tickets by holding onto the stock