Welcome to Young Money! If you’re new here, you can join the tens of thousands of subscribers receiving my essays each week by adding your email below.

Every three years, the Federal Reserve publishes a report that shows changes in American family finances. Earlier this week, Ben Carlson wrote an excellent blog post titled Americans Have Never Been Wealthier & No One Is Happy that highlighted some wild stats from the report.

A few snippets:

Real (adjusted for inflation) median net worth for US households was up 37% from 2019

The under-35 cohort experienced the biggest percentage increase, with their median net worth increasing by 143% over that period

Renters actually experienced a larger gain than homeowners (43% vs 34%)

The tl;dr of Ben’s article: If America is so wealthy, why does everyone feel so miserable?

As a 26-year-old who resides in the now much wealthier 35-and-under bracket, I would like to share some thoughts on this disconnect between perception and reality.

To understand why young people feel hopeless despite the “data” being optimistic, you need some context on young people’s careers.

I finished undergrad in December 2019 and started my career as a financial analyst for UPS in Atlanta, Georgia in February 2020. I was buzzing with emotions on the first day of work, and as I drove to the office, all sorts of questions bounced around in my mind:

Will I like my coworkers?

Will my coworkers like me?

Am I going to enjoy my day-to-day work?

Will I make enough money?

What will the hours actually be like?

Walking out of the office five days later, I only had one question:

Will I ever work in this office again?

As I wrapped up my first week of work, my team received an email from UPS corporate stating that we would need to work from home for a few weeks as we adjusted to the dangers posed by COVID-19. A few weeks turned into a few months, and a few months turned into a year and a half of rolling out of bed, making coffee, and logging into Microsoft Teams from the comfort of my living room.

Being a new employee is tough. You don’t know how to do anything, you make mistakes regularly, and you haven’t figured out office politics and interpersonal dynamics.

But at least when you’re in the office, you can stop by your coworkers’ cubicles to chat and ask questions. You sit in on meetings. You receive instantaneous feedback. You can grab lunch with and get to know your teammates. After a few weeks, you’ll find your groove.

You don’t get those luxuries working remotely.

You feel isolated behind the fluorescent glow of a computer monitor. How are you supposed to elicit actionable feedback from supervisors who haven’t seen you in 15 months? How are you expected to pay attention or feign excitement during your 25th “all hands” Zoom meeting of the quarter?

It’s impossible.

No one really knows how much anyone is working, so you have to appear online at all times. If you were in an office, maybe you could fill the gaps in your schedule by checking in with your director to see if they need help. But remote? You’ll just keep moving that cursor, making sure your status never says “away.”

It wasn’t a job. It was compensated purgatory.

It wasn’t my fault, or my team’s fault, or UPS’s fault that these working conditions defined my first 18 months in the “real world.” It was just unfortunate timing. But my experience wasn’t an outlier, it was the norm for anyone who started or pivoted their career between late 2019 and 2021.

So when you read that younger people are wealthier than ever, you need to recognize the cost of that wealth: two years of professional malaise.

Now back to the wealth thing.

Imagine that you graduated in 2018 and started working that August. A year and a half later, as you are starting to hit your stride in work, you’re forced to work from home indefinitely. A prisoner with a paycheck.

Then the stock market experiences its fastest crash ever. Rumors of widespread insolvencies bombard the media. Bill Ackman is crying on CNBC, proclaiming that “Hell is coming.” Is this your generation’s 2008?

Your net worth falls 30% in a month with your portfolio, and you have no idea what’s going to happen to your job and your savings.

Then the Federal Reserve kicks off an aggressive round of quantitative easing to stabilize financial markets. The government ships $4,000 stimmy checks to anyone and everyone locked in their homes. The outside world is still on pause, and there’s nowhere to spend your checks, so you dump them in the stock market, fueling the fastest rebound in history as the S&P and Nasdaq ricochet to new heights in a matter of months. And this was just the base case scenario for your average 25-year-old in 2020.

What about the outliers?

Everyone had a friend who made millions by placing heavy bets on Tesla. It seemed sooo obvious in hindsight, no? Of course, markets were going to rebound, so why didn’t you buy call options on tech stocks too?

And that guy who bet big on Bitcoin in 2018? Well, his conviction paid off when the price of Michael Saylor’s favorite cryptocurrency soared past $60,000.

Oh, and you have another friend or two who took advantage of this remote work wave by taking on several jobs at once. Software engineers at different companies all do the same thing, so why not work for Apple, Microsoft, and Google at the same time for a couple of years? If they’re all willing to hire you, why not make $500k from your living room?

And your buddy with the half-baked startup idea? He just raised $20M from Sequoia, because with interest rates hitting their lowest level ever, VCs were spraying and praying capital at anything and everything.

Oh, and while everyone kept getting richer, flights were 90% off, apartment rents were cut in half, gas was $2.00 a gallon (and oil futures briefly went negative), and you could fill your grocery cart for $50. Our purchasing power was through the roof.

We were rich. But we didn’t feel richer. Our new “wealth” felt like an aberration.

We were pressing buttons on screens and watching numbers go up, but we couldn’t do anything with our “wealth.” The world was shut down. This “wealth” was just a side-effect of Hail Mary government policy designed to keep our economy afloat as we survived a pandemic. And we all quietly knew it was fake. It couldn’t last forever.

And it didn’t.

Interest rates started climbing. Stock prices leveled out. Crypto tanked. High-growth, unprofitable startups shut down. Mortgage rates soared while home prices refused to come down. Equity compensation fell off a cliff. Venture funding dried up. The era of 7 remote jobs ended as companies called employees back to the office. Our rents doubled as gas and groceries skyrocketed.

Maybe if that “143% increase in median net worth” was due to a steady stock market and regular promotions, we would be feeling pretty good right now. But there was nothing steady about it.

If you’re cruising at 30,000 feet from New York to San Francisco, and suddenly your plane starts oscillating up and down by thousands of feet every few minutes before settling at 40,000 feet, you aren’t thinking, “Cool, we’re above that patch of turbulence.”

You are terrified that the plane will fall out of the sky.

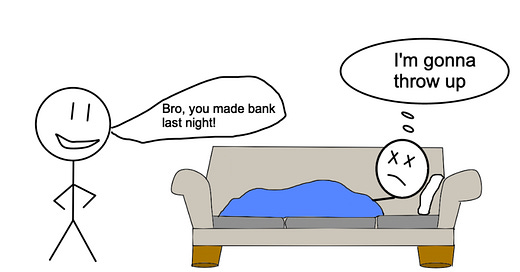

We experienced a three-year bender where we parlayed stimulus checks into tech stocks and shitcoins, masqueraded behind seven jobs, and incinerated capital through equity compensation while the world was going to hell, and now we’re dealing with a crippling hangover.

Everyone who exploited the system to make bank over the last three years knows that their window has closed forever, and everyone else who missed out on this life-changing financial opportunity won’t get a second chance.

Is our “median net worth” higher now than it was in 2019? Sure. But what was the cost?

We made money that we couldn’t spend during two years of lockdowns, we had zero opportunities for mentorship or professional growth, then we were welcomed back to the real world with 8% inflation, heavy layoffs, and 30% rent hikes. Are we really supposed to feel good about that extra $15,000 in our savings accounts?

No wonder everyone is miserable.

- Jack

I appreciate reader feedback, so if you enjoyed today’s piece, let me know with a like or comment at the bottom of this page!

Young Money is now an ad-free, reader-supported publication. This structure has created a better experience for both the reader and the writer, and it allows me to focus on producing good work instead of managing ad placements. In addition to helping support my newsletter, paid subscribers get access to additional content, including Q&As, book reviews, and more. If you’re a long-time reader who would like to further support Young Money, you can do so by clicking below. Thanks!

Jack's Picks

Lykeion is a new type of financial media – weekly newsletters, monthly research reports, and podcasts navigating the intersection of business, finance, and geopolitics. Founded by a team of former analysts, researchers, and portfolio strategists, they’re bringing investment grade insights, communicated simply and without hyperbole. Check it out for free here.

Today’s piece was largely inspired by Ben Carlson’s recent blog: Americans Have Never Been Wealthier and No One Is Happy.

Kyla Scanlon wrote about why we should rethink the 9-5.

Katie Gatti Tassin discussed whether or we we should reconsider putting home ownership on a pedestal above all of our other financial goals, especially when homes are less affordable than ever.

Part of the misery is letting go of that lifestyle and sense of limitless possibility. To be thrust back into the real world after years of "leisure" (miserable in its own way) is a jarring experience.